Ztech India Limited IPO Full Details

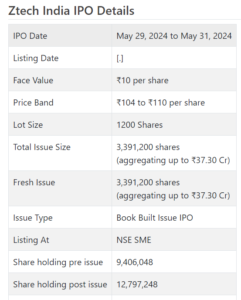

Ztech India Initial public offering is a book constructed issue of Rs 37.30 crores. The issue is totally a new issue of 33.91 lakh shares.

Ztech India Initial public offering opens for membership on May 29, 2024 and closes on May 31, 2024. The assignment for the Ztech India Initial public offering is supposed to be finished on Monday, June 3, 2024. Ztech India Initial public offering will list on NSE SME with conditional posting date fixed as Tuesday, June 4, 2024.

Ztech India Initial public offering cost band is set at ₹104 to ₹110 per share. The base parcel size for an application is 1200 Offers. The base measure of speculation expected by retail financial backers is ₹132,000. The base part size speculation for HNI is 2 parcels (2,400 offers) adding up to ₹264,000.

• The organization is participated in maintainable amusement park improvement, modern water treatment and geo specialized specific arrangements and has made a specialty place.

• It at present has significant pushed for reasonable amusement park improvement, which is a high edge class and has more than 60% commitment in its top line.

• Significant work in amusement park section has brought about supporting its top and main concern for FY24.

• It has progressing projects worth Rs. 168+ cr. furthermore, a lot more in pipeline.

• In light of FY24 profit, the issue shows up completely evaluated.

• Financial backers might lap it up for the medium to long haul rewards.

ABOUT Organization:

Z-Tech (India) Ltd. (ZIL) initially plans structural designing items and administrations with state‐of‐the‐art specialty in Geo‐ Specialized Particular Arrangements in the field of framework and common development undertakings to India. It incorporates a scope of strategies, philosophies, and advances pointed toward upgrading the exhibition and steadiness of designs based on or in the ground. Likewise, it is effectively participated in the waste administration area, where its center includes making amusement parks through the use of reused piece materials.

All the while, the organization is committed to executing creative waste water the board answers for modern units, utilizing the state of the art GEIST innovation. This double responsibility highlights its comprehensive way to deal with maintainable works on, changing disposed of materials into sporting spaces while proficiently overseeing modern wastewater through cutting edge innovation. ZIL is participated in giving creative, safe and eco-accommodating designing answers for its clients. These arrangements incorporate three significant classifications: a) Supportable Amusement Park Improvement

b) Modern Waste Water The executives, and c) Geo Specialized Particular Arrangements.

As of May 10, 2024, it had 72 representatives on is finance. The organization has continuous undertakings worth Rs. 168.98 cr. The organization has many offers in the pipeline showing splendid possibilities ahead. The deal report has some mistake on its HR count (allude Page 165).

ISSUE Subtleties/CAPITAL HISTORY:

The organization is emerging with its lady book building course Initial public offering of 3391200 value portions of Rs. 10 each to prepare Rs. 37.30 cr. at the upper cap. It has declared a value band of Rs. 104 – Rs. 110 for each offer. The issue opens for membership on May 29, 2024, and will close on May 31, 2024. The base application to be made is for 1200 offers and in products subsequently, from there on. Post apportioning, offers will be recorded on NSE SME Arise. The issue comprises 26.50% of the post-Initial public offering settled up capital of the organization. From the net returns of the Initial public offering, it will use Rs. 23.76 cr. for working capital, and the rest for general corporate purposes.

The issue is exclusively lead overseen by Narnolia Monetary Administrations Ltd.., and Maashitla Protections Pvt. Ltd. is the enlistment center to the issue. NVS Financier Pvt. Ltd., is the market creator for the organization.

Having given beginning value capital at standard, the organization gave further value shares at a decent cost of Rs. 489 in November 2023, and has additionally given extra offers in the proportion of 7 for 1 in the long stretch of November 2023. The typical expense of securing of offers by the advertisers is Rs. 1.45, and Rs. 15.39 per share.

Post-Initial public offering, organization’s ongoing settled up value capital of Rs. 9.41 cr. will stand upgraded to Rs. 12.80 cr. In view of the upper Initial public offering cost band, the organization is searching for a market cap of Rs. 140.77 cr.

Monetary Execution:

On the monetary execution front, for the last four fiscals, the organization has (on a merged premise) posted a complete pay/net benefit of Rs. 23.96 cr. /Rs. 0.70 cr. (FY21), Rs. 30.84 cr. /Rs. 0.07 cr. (FY22), Rs. 25.88 cr. /Rs. 1.96 cr. (FY23), and Rs. 67.37 cr. /Rs. 7.79 cr. (FY24).

For the last four fiscals, it has revealed a normal EPS of Rs. 4.22, and a typical RoNW of 19.75%. The issue is evaluated at a P/BV of 4.52 in view of its NAV of Rs. 24.32 as of Walk 31, 2024, and at a P/BV of 2.38 in view of its post-Initial public offering NAV of Rs. 46.26 per share (at the upper cap). In any case, Initial public offering cost band promotion is feeling the loss of its post-Initial public offering NAV information.

On the off chance that we trait annualized FY24 income to its post-Initial public offering completely weakened settled up capital, then, at that point, the asking cost is at a P/E of 18.06. In this way the issue shows up completely estimated.

For the revealed periods, the organization has posted PAT edges of 2.63% (FY21), 0.31% (FY22), 7.70% (FY23), 12% (FY24) on independent premise, and RoCE edges of 11.10%, 1.79%, 25.30%, 45.73% (on combined premise) individually for the alluded periods.

Profit Strategy:

The organization has not pronounced any profits for any monetary year up to this point. It will take on a reasonable profit strategy in view of its monetary exhibition and future possibilities.

Examination WITH Recorded Friends:

According to the proposition report, the organization has shown Particle Trade, Felix Ind., Wonderla Occasions, H G Infra, Nicco Parks, and NCC Ltd., as their recorded friends. They are exchanging at a P/E of 38.0, 379.0, 30.6, 19.0, 28.5, and 24.2 (as of May 24, 2024). Nonetheless, they are not similar on an apple-to-apple premise.

Vendor BANKER’S History:

This is the tenth order from Narnolia Monetary in the last two fiscals (counting the continuous one), out of the last 9 postings, all recorded at charges going from 4.35% to 110.36 % on the date of posting.

End/Speculation Procedure

The organization has three classifications of its plan of action and having significant pushed on its high edge business of supportable amusement stops that contributes around 60% it its top lines for last two fiscals. In view of FY24 profit, the issue shows up completely estimated. Taking into account its continuous tasks worth Rs. 168+ cr. furthermore, a lot more in pipeline, it is ready for splendid possibilities ahead. Financial backers might lap it up for the medium to long haul rewards.