Investment Alert: Why Polysil Irrigation Systems Limited’s IPO is a Gamechanger

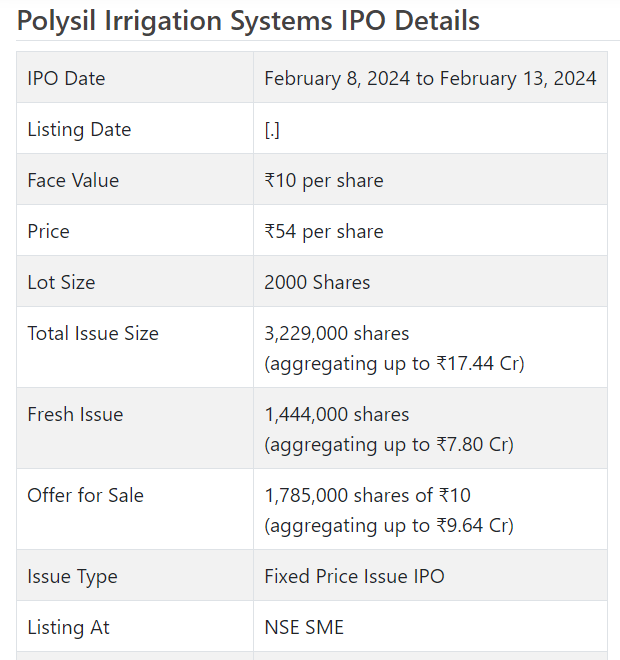

Polysil Water system Frameworks Initial public offering is a proper value issue of Rs 17.44 crores. The issue is a blend of new issue of 14.44 lakh shares collecting to Rs 7.80 crores and make available for purchase of 17.85 lakh shares conglomerating to Rs 9.64 crores.

Polysil Water system Frameworks Initial public offering opened for membership on February 8, 2024 and will close on February 13, 2024. The apportioning for the Polysil Water system Frameworks Initial public offering is supposed to be finished on Wednesday, February 14, 2024. Polysil Water system Frameworks Initial public offering will list on NSE SME with provisional posting date fixed as Friday, February 16, 2024.

Polysil Water system Frameworks Initial public offering cost is ₹54 per share. The base part size for an application is 2000 Offers. The base measure of speculation expected by retail financial backers is ₹108,000. The base part size speculation for HNI is 2 parcels (4,000 offers) adding up to ₹216,000.

• PISL is a coordinated player in dribble water system/sprinkler and so on.

• It stamped fluctuating top and main concerns for the detailed periods.

• Super benefits for 4.5M of FY24 causes a commotion and worry over its manageability.

• In view of FY24 annualized profit, the issue shows up forcefully valued.

• There is no mischief in avoiding this expensive bet.

ABOUT Organization:

Polysil Water system Frameworks Ltd. (PISL) is a completely coordinated player inside the dribble water system and sprinkler water system areas, with presence in miniature water system industry. Its items are figured to fulfill top notch guidelines and brand is related with offering some incentive based water system answers for its end clients and are dependent upon BIS norms.

The Organization is participated in assembling and offer of HDPE lines, fittings and miniature water system frameworks, like dribble water system framework and sprinkler water system framework, its parts, extras and associated items. As a maker and dealer of dribble and sprinkler water system framework its item range incorporates HDPE Lines, pipe fittings and water system gear’s, including plate channels, screen channels, hydro-tornado channels, sand channels (rock), pressure fittings, valves (electrical and mechanicals), manure tanks, Computerized Regulators, Tension Checks, and so on. PISL sells these items under the brand “Polysil”.

The organization sells items through foundation markets and open market deal. Under the open market deal, it sells items through merchants and vendors, who then exchange the items to clients for example ranchers. As of August 15, 2023, it sold items through 9 merchants and around 434 sellers in India. Its end clients are qualified to get government sponsorship, the cycle for disbursal of such appropriation is overseen by merchant/sellers and additionally clients. The organization works in the territory of Gujarat, Tamil Nadu, Maharashtra, Andhra Pradesh, Karnataka, Madhya Pradesh, Uttar Pradesh, Rajasthan and Haryana. It works in the Territory of Maharashtra, Madhya Pradesh and Rajasthan through its seller/merchant organization and in the Province of Andhra Pradesh, Gujarat, Tamil Nadu, Haryana and Uttar Pradesh under institutional model. As of December 31, 2023, it had 52 representatives on its finance and furthermore sends provisional laborers as and when required.

ISSUE Subtleties/CAPITAL HISTORY:

The organization is emerging with its lady combo Initial public offering of 3228000 value portions of Rs. 10 each at a proper cost of Rs. 54 for every offer to assemble Rs 17.43 cr. The issue comprises new value issue worth Rs. cr. 7.80 cr. (1444000 value shares) and a Proposal available to be purchased L (OFS) of Rs. 9.63 cr. (1784000 offers).

The issue has previously opened for membership on February 08, 2024, and will close on February 13, 2024. The base application to be made is for 2000 offers and in products consequently, from that point. Post apportioning, offers will be recorded on NSE SME Arise. The issue is 28.46% of the post-Initial public offering settled up capital of the organization. The organization is spending Rs. 1.74 cr. for this Initial public offering process (new value issue) and from the net returns of the new value issue, it will use Rs. 5.00 cr. for working capital, and Rs. 1.06 cr. for general corporate purposes. There seems, by all accounts, to be some jumble as the plan shows weakening of 24.59%, which is off-base.

The issue is exclusively lead overseen by Fedex Protections Pvt. Ltd., and Bigshare Administrations Pvt. Ltd. is the recorder of the issue. Market-Center point Stock Broking Pvt. Ltd. is the market creator for the organization. While Fedex Protections has guaranteed 15.06% of the issue, 84.96% is endorsed by Unadulterated Broking Pvt. Ltd.

Subsequent to having given starting value capital at standard, it gave further value capital in the value scope of Rs. 307.50 – Rs. 317.40 per share (in light of Rs. 10 assumed worth) between Walk 2021 and October 2022. It has likewise given extra offers in the proportion of 20 for 1 in February 2023. The typical expense of obtaining of offers by the advertisers/selling partners is Rs. 13.92, and Rs. 14.51 per share

Post-Initial public offering, organization’s ongoing settled up value capital of Rs. 9.90 cr. will stand upgraded to Rs. 11.34 cr. With the Initial public offering evaluating, the organization is searching for a market cap of Rs. 61.24 cr.

Monetary Execution:

On the monetary execution front, for the last three fiscals, the organization has posted an all out income/net benefit of Rs. 54.72 cr. /Rs. 0.65 cr. (FY21), Rs. 37.67 cr. /Rs. 0.34 cr. (FY22), and Rs. 43.93 cr. /Rs. 1.14 cr. (FY23). For 4.5M of FY24 finished on August 15, 2023, it procures a net benefit of Rs. 1.10 cr. on a complete pay of Rs. 10.20 cr. Toward the finish of first day, it got simply 0.87 times membership.

In this way its top and primary concerns posted irregularity and helped benefits for 4.5M of FY24 seems, by all accounts, to be a window dressing to match the asking cost.

For the last three fiscals, it has revealed a normal EPS of Rs. 0.80, and a typical RONW of 5.32%. The issue is estimated at a P/BV of 3.24 in view of its NAV of Rs. 16.65 as of August 15, 2023, and at a P/BV of 2.53based on its post-Initial public offering NAV of Rs. 21.32 per share.

On the off chance that we quality annualized FY24 super income to its post-Initial public offering completely weakened paid-p capital, then, at that point, the asking cost is at a P/E of 20.85. In view of FY23 profit, the issue is at a P/E of 54. Consequently the issue shows up forcefully estimated.

For the revealed periods, the organization has posted unpredictable PAT edges of 1.19% (FY21), 0.90% (FY22), 2.59% (FY23), 6.70% (4.5M-FY24) and ROCE edges of 8.59%, 6.02%, 12.81%, 7.16% separately, for the detailed periods.

Profit Strategy:

The organization has not proclaimed any profits since fuse. It will take on a judicious profit strategy in light of its monetary presentation and future possibilities.

Correlation WITH Recorded Friends:

According to the deal report, the organization has shown Skipper Poly, RM Dribble, Texmo Lines, and Jain Water system as their recorded companions. They are exchanging at a P/E of 20.03, 32.10, NA, and NA (as of February 08, 2024). Be that as it may, they are not tantamount on an apple-to-apple premise.

Dealer BANKER’S History:

This is the 27th order from Fedex Protections in the last four fiscals, out of the last 10 postings, 2 opened at markdown and the rest with expenses going from 6.49% to 76.19% on the date of posting.

End/Venture Procedure

The organization is working in a profoundly cutthroat and divided portion. It stamped flighty top and main concerns for the detailed periods. Super profit for 4.5M of FY24 cause a stir, yet in addition main pressing issue over its supportability going ahead. In view of FY24 annualized profit, the issue shows up forcefully estimated. There is no mischief in avoiding this expensive bet.