United Cotfab Limited IPO Full Details

Joined Cotfab Initial public offering is a decent value issue of Rs 36.29 crores. The issue is totally a new issue of 51.84 lakh shares.

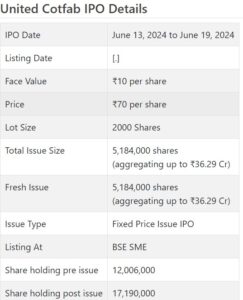

Joined Cotfab Initial public offering opens for membership on June 13, 2024 and closes on June 19, 2024. The assignment for the Unified Cotfab Initial public offering is supposed to be settled on Thursday, June 20, 2024. Joined Cotfab Initial public offering will list on BSE SME with provisional posting date fixed as Monday, June 24, 2024.

Joined Cotfab Initial public offering cost is ₹70 per share. The base part size for an application is 2000 Offers. The base measure of speculation expected by retail financial backers is ₹140,000. The base part size venture for HNI is 2 parcels (4,000 offers) adding up to ₹280,000.

• UCL, a merchant in materials has wandered into assembling of cotton yarn since April 2023.

• Helped top and main concern for one entire year of FY24 cause a stir and worry over supportability of edges.

• The organization is working in a profoundly cutthroat and section fragment.

• In view of FY24 super profit, the issue shows up completely estimated.

• All around informed/cash overflow financial backers might stop moderate assets as long as possible.

ABOUT Organization:

Joined Cotfab Ltd. (UCL) is taken part in the assembling of great open end yarn taking special care of the material business. Its assembling cycle sticks to rigid quality principles and is supported by cutting edge innovation and hardware. UCL follows a precise methodology that incorporates unrefined substance determination, mixing (whenever required), turning, winding, and quality control.

During the Monetary Year 2020-23, the organization was in the process securing of land admeasuring area of 7264 sq mtrs situated at Town Timba, Taluka Daskroi, Ahmedabad, for setting up Assembling office having an introduced limit of approx. 9125 (MT) per annum. Its assembling office is near the rich cotton developing areas of Saurashtra locale of Gujarat and Maharashtra. It started the development of cotton yarn in April 2023. Its assembling office is furnished with current and programmed plant and hardware. The degree of progression decides the efficiency of machines and work, which thus, decides the creation and productivity of the Organization. Innovation is a critical part of the cotton yarn industry.

UCL is focused on reasonable assembling rehearses and natural obligation. Its cycles are intended to limit squander, save energy and lessen the ecological effect. The organization has serious areas of strength for fabricated with a different scope of clients, including material producers, piece of clothing exporters and wholesalers. During FY 2022-23, the organization was taken part occupied with exchanging of cotton yarn. In April 2023, it started the assembling of unconditional cotton yarn. Cotton yarn is a sort of yarn that is produced using cotton filaments. Cotton yarn comes in different thicknesses, known as yarn loads, which decide its reasonableness for various items. Normal yarn loads incorporate ribbon, fingering, game, worsted, and cumbersome, each with its own qualities and suggested utilizes. It is generally utilized in the material business for different applications, including sewing, winding around, and stitching. Cotton yarn is known for its delicateness, breathability, and flexibility, pursuing it a famous decision for dress, home materials, and other texture based items. As of Walk 31, 2024, it had 118 representatives on its finance.

ISSUE Subtleties/CAPITAL HISTORY:

The organization is emerging with its lady Initial public offering of 5184000 value portions of Rs. 10 each at a decent cost of Rs. 70 for each offer to activate Rs. 36.29 cr. The issue opens for membership on June 13, 2024, and will close on June 19, 2024. The base application to be made is for 2000 offers and in products subsequently, from that point. Post assignment, offers will be recorded on BSE SME. The issue is 30.16% of the post-Initial public offering settled up capital of the organization. The organization is spending Rs. 2.73 cr. for this Initial public offering process, and from the net returns, it will use Rs. 24.70 cr. for working capital, and Rs. 8.86 cr. for general corporate purposes.

The issue is exclusively lead overseen by Direct route Capital Guides Pvt. Ltd., and Purva Sharegistry (India) Pvt. Ltd., is the enlistment center to the issue. Direct path Gathering’s Spread X Protections Pvt. Ltd. is the market creator for the organization.

The organization has given starting value capital at standard and further value shares at a decent cost of Rs. 70 for each offer in November 2023. It has additionally given extra offers in the proportion of 149 for 25 in December 2023. The typical expense of obtaining of offers by the advertisers is Rs. 10.01 per share.

Post-Initial public offering, organization’s ongoing settled up value capital of Rs. 12.01 cr. will stand upgraded to Rs. 17.19 cr. In view of the upper Initial public offering cost band, the organization is searching for a market cap of Rs. 120.33 cr.

Monetary Execution:

On the monetary execution front, for the last three fiscals, the organization has posted an all out pay/net benefit of Rs. 0.02 cr. /Rs. 0.02 cr. (FY22), Rs. 0.64 cr. /Rs. 0.14 cr. (FY23), and Rs. 115.53 cr. /Rs. 8.67 cr. (FY24). The unexpected lift in its top and primary concerns in pre-Initial public offering year for example FY24 causes a stir and worry over the manageability of edges proceeding, as it is working in an exceptionally serious and divided section.

Wild variance in the great natural substance cost, for example cotton, assumes a significant part in organizations like this. It is exceptionally subject to the public authority strategies also.

For the last three fiscals, it has detailed a normal EPS of Rs. 2.71, and a typical RoNW of 32.45%. The issue is estimated at a P/BV of 6.20 in view of its NAV of Rs. 11.30 as of Walk 31, 2024, and at a P/BV of 2.41 in light of its post-Initial public offering NAV of Rs. 29.00 per share.

On the off chance that we characteristic annualized FY24 super income to its post-Initial public offering completely weakened settled up capital, then the asking cost is at a P/E of 13.89. Hence the issue is completely estimated limiting all close to term up-sides.

For the detailed periods, the organization has posted PAT edges of NIL% (FY21), NIL% (FY22), 31.51% (FY23), 7.52% (FY24), and RoCE edges of – (0.11) %, – (0.04) %, 0.04%, 26.95% individually for the alluded periods.

Profit Strategy:

The organization has not announced any profits since joining. It will take on a reasonable profit strategy in light of its monetary presentation and future possibilities.

Correlation WITH Recorded Companions:

According to the deal archive, the organization has shown Lagnam Spintex, PBM Poly, and Vippy Spinpro as their recorded companions. They are exchanging at a P/E of 16.5, NA, and 23.1 (as of June 07, 2024). Nonetheless, they are not similar on an apple-to-apple premise.

Vendor BANKER’S History:

This is the 41st order from Straight shot Capital in the last three fiscals (counting the continuous one), out of the last 10 postings, all opened at a charges going from 5.88% to 386.67% on the date of posting.

End/Speculation Methodology

The organization that was essentially a broker in textures went on stream for assembling cotton yarn in April 2023, and hence has only one entire year execution. The year stamped supported top and primary concerns that cause a stir, yet in addition worry over its manageability, being an exceptionally serious and divided portion. In light of FY24 super profit, the issue shows up completely valued. All around informed/cash overflow financial backers might stop moderate assets as long as possible.

Survey By Dilip Davda on June 9, 2024