Title: Understanding Stock Market Holidays: A Comprehensive Guide

Introduction:

Stock market holidays play a crucial role in the financial world, affecting traders, investors, and the overall functioning of the market. While these holidays may seem like minor disruptions, they can significantly impact trading activities and investment strategies. In this guide, we’ll delve into what stock market holidays are, why they matter, and how they influence the financial landscape.

What are Stock Market Holidays?

Stock market holidays are days when the stock exchanges remain closed, halting regular trading activities. These holidays typically include national holidays, religious observances, and special occasions recognized by the respective countries’ financial authorities. During these times, traders cannot buy or sell securities, and no new price data is generated.

Why Do Stock Market Holidays Matter?

Stock market holidays are essential for several reasons:

1. Market Stability: Holidays provide periods of rest for market participants, allowing them to recharge and reassess their strategies. This pause in trading can help prevent irrational or panicked decisions that may arise during continuous trading sessions.

2. Global Coordination: Stock market holidays are often synchronized with banking holidays and other financial institutions’ closures worldwide. This coordination ensures smooth global financial operations and minimizes disruptions in international transactions.

3. Regulatory Compliance: Stock exchanges adhere to regulations set by governing bodies, which mandate closures on specific holidays. Compliance with these regulations ensures fair and orderly markets, fostering investor confidence.

4. Economic Significance: Some holidays coincide with important economic events or announcements. For example, markets may close on days of national significance, such as Independence Day in the United States or Lunar New Year in Asian countries, reflecting cultural and social values.

Impact of Stock Market Holidays:

Stock market holidays can have several implications for traders and investors:

1. Trading Volume: With exchanges closed, trading volume typically decreases on holiday days. Lower trading activity may lead to reduced liquidity and increased price volatility when markets reopen.

2. Market Sentiment: Market sentiment often shifts before and after holidays, influenced by factors such as economic data releases, geopolitical events, and investor expectations. Traders may adjust their positions based on these sentiments, leading to price fluctuations.

3. Portfolio Management: Investors may use holiday periods to review their portfolios, reassess risk tolerance, and rebalance their asset allocations. This strategic planning can help optimize long-term investment objectives.

4. Trading Strategies: Some traders employ specific strategies tailored to exploit holiday-related patterns, such as the “Santa Claus Rally” observed during the year-end holiday season. Understanding these seasonal trends can inform trading decisions.

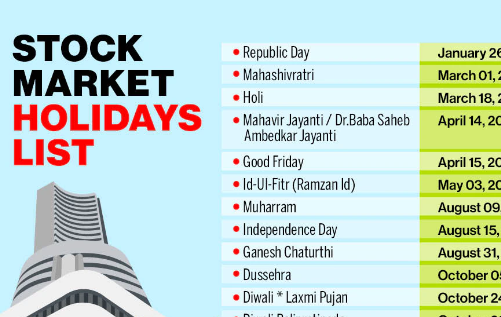

Key Stock Market Holidays:

While stock market holidays vary by country and exchange, some common holidays observed by major exchanges include:

1. New Year’s Day: January 1st

2. Martin Luther King Jr. Day: Third Monday in January (United States)

3. Good Friday: Friday before Easter Sunday (varies by year)

4. Independence Day: July 4th (United States)

5. Christmas Day: December 25th

6. Boxing Day: December 26th (Some countries, including the United Kingdom)

It’s important for traders and investors to be aware of these holidays and their respective market closures to plan their activities effectively.

Conclusion:

Stock market holidays are integral components of the financial calendar, influencing trading dynamics and investment strategies. Understanding the significance of these holidays and their impact on market behavior can help market participants navigate the complexities of the financial landscape more effectively. By recognizing the importance of stock market holidays and planning accordingly, traders and investors can position themselves for success in the dynamic world of finance.