Understanding Market Crashes: Navigating Global Stock Market Volatility

Introduction to the Global Stock Market

The global stock market serves as the backbone of the world economy, facilitating the exchange of securities and capital among investors worldwide. Its stability is paramount for fostering economic growth and financial well-being.

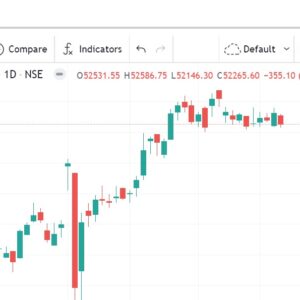

What is a Market Crash?

A market crash occurs when stock prices sharply decline over a short period, often leading to widespread panic selling and significant economic turmoil. These events are usually triggered by various factors, including economic downturns, geopolitical tensions, or unforeseen events.

Impact of Market Crashes

Market crashes have far-reaching consequences, affecting not only investors but also businesses, governments, and the general populace. Economic downturns, job losses, and decreased consumer spending are some of the immediate repercussions, while long-term effects can include recession and financial instability.

Factors Contributing to Market Crashes

Several factors can contribute to market crashes, including weak economic indicators, political instability, and advancements in technology that disrupt traditional market dynamics.

Preventive Measures

To mitigate the risk of market crashes, regulatory frameworks must be robust, and investors should employ risk management strategies such as diversification and asset allocation.

The Role of Speculation

Speculative bubbles fueled by irrational exuberance can exacerbate market volatility and increase the likelihood of crashes, underscoring the importance of prudent investing practices.

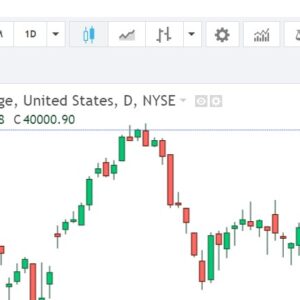

Case Study: The 2008 Financial Crisis

The 2008 financial crisis serves as a stark reminder of the devastating effects of unchecked speculation and regulatory failures, prompting reforms aimed at preventing similar crises in the future.

Globalization and Market Vulnerability

In an increasingly interconnected world, market shocks can spread rapidly across borders, highlighting the need for international cooperation and coordinated responses to mitigate systemic risks.

Mitigation Strategies

Governments and central banks play a crucial role in stabilizing markets during crises through fiscal stimulus measures and monetary interventions.

Investor Behavior During Market Crashes

Understanding investor psychology is essential for navigating market volatility, as emotions often drive irrational decision-making during turbulent times.

Technological Solutions

Advancements in technology, such as algorithmic trading and artificial intelligence, have revolutionized market analysis and trading strategies, but they also pose new challenges in managing systemic risks.

Adapting to Market Volatility

Investors must adopt adaptive investment strategies that prioritize long-term growth objectives while remaining agile in response to changing market conditions.

Government Intervention

Timely and decisive government intervention can help stabilize markets and restore investor confidence during times of crisis, but excessive interventionism may distort market dynamics.

The Role of Media

Media plays a significant role in shaping market sentiment, and responsible reporting practices are essential for maintaining stability and fostering informed decision-making among investors.

Conclusion

Market crashes are an inevitable part of the global stock market landscape, but proactive measures can help mitigate their impact and promote resilience. By understanding the underlying causes and implementing preventive strategies, investors can navigate volatility with confidence and seize opportunities for long-term growth.

Unique FAQs

- What triggers a market crash?

- Market crashes can be triggered by various factors, including economic downturns, geopolitical tensions, and speculative bubbles.

- How can investors protect themselves during a market crash?

- Diversifying investments, maintaining a long-term perspective, and staying informed about market trends are key strategies for mitigating the impact of market crashes.

- What role does government intervention play during a market crash?

- Governments and central banks often intervene during market crashes to stabilize financial markets and restore investor confidence through fiscal stimulus measures and monetary policy adjustments.

- Is market volatility the same as a market crash?

- While market volatility refers to fluctuations in stock prices, a market crash typically involves a sudden and severe decline in prices over a short period, often leading to widespread panic selling.

- How do market crashes affect the economy?

- Market crashes can have profound effects on the economy, including job losses, decreased consumer spending, and financial instability, potentially leading to recessionary conditions.