Tesla Stock Full Analysis

Introduction

Tesla, Inc. (NASDAQ: TSLA) has emerged as a global leader in electric vehicles (EVs) and sustainable energy solutions. As one of the most prominent companies in the automotive and technology sectors, Tesla’s stock performance is closely monitored by investors worldwide. In this comprehensive analysis, we delve into the various factors influencing Tesla’s stock, providing valuable insights for investors and traders.

Company Overview

Founded in 2003 by Elon Musk, Tesla has revolutionized the automotive industry with its innovative approach to electric vehicles and renewable energy. The company’s product lineup includes electric cars, solar energy products, and energy storage solutions. Tesla’s relentless focus on innovation, coupled with its ambitious goals for sustainability, has garnered significant attention from consumers, investors, and policymakers alike.

Financial Performance

Tesla’s financial performance has been a subject of both admiration and scrutiny in recent years. Despite occasional volatility, the company has demonstrated impressive revenue growth and market expansion. Key financial metrics, including revenue, gross margin, and net income, reflect Tesla’s strong position within the EV market and its ability to deliver value to shareholders.

Market Share and Competition

In the increasingly competitive landscape of electric vehicles, Tesla maintains a dominant market position, outpacing traditional automakers and emerging rivals. The company’s brand recognition, technological prowess, and expansive Supercharger network contribute to its competitive advantage. However, Tesla faces growing competition from established automakers and new entrants aiming to capture a share of the burgeoning EV market.

Innovation and Technological Advancements

Central to Tesla’s success is its commitment to innovation and technological advancements. The company continuously pushes the boundaries of EV technology, with initiatives such as autonomous driving capabilities, battery innovation, and energy-efficient solutions. Tesla’s ongoing investments in research and development underscore its long-term vision for sustainable transportation and energy systems.

Regulatory Environment and Policy Impact

Tesla’s operations are subject to various regulatory frameworks and government policies, which can impact its business prospects and stock performance. Factors such as emissions regulations, tax incentives for EVs, and geopolitical tensions may influence Tesla’s market dynamics and strategic decisions. Additionally, changes in environmental policies and consumer preferences towards sustainability can shape the demand for Tesla’s products.

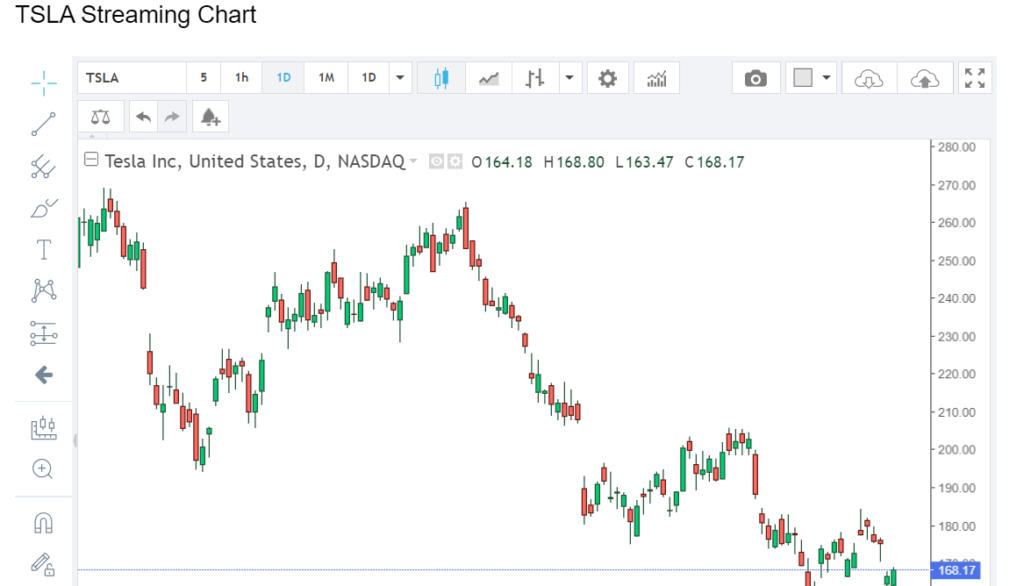

Investor Sentiment and Stock Performance

Tesla’s stock performance often reflects investor sentiment towards the company’s growth prospects, financial health, and market positioning. Despite occasional volatility and skepticism from some quarters, Tesla has attracted a loyal investor base, driven by optimism surrounding its disruptive technologies and long-term vision. The stock’s performance is influenced by a myriad of factors, including quarterly earnings reports, production milestones, and macroeconomic trends.

Conclusion

In conclusion, Tesla’s stock remains a focal point for investors seeking exposure to the future of transportation and sustainable energy. As the company continues to innovate and expand its product offerings, its stock performance is likely to be shaped by a combination of financial metrics, market dynamics, regulatory developments, and investor sentiment. For investors considering Tesla as a potential investment opportunity, thorough analysis of these factors is essential for informed decision-making.