Stock Market Expectation One Week from now (15-19 Jan 2024)

Indian financial exchanges accomplished their most memorable week by week gains of 2024, with both Sensex and Nifty arriving at another record high. The expansion readings from the US and India stay centered.

On the sectoral front, IT acquired the most in spite of the muffled Infy and TCS quarterly profit. The additions were chiefly because of the assumption for early financing cost cuts in the US, which is probably going to further develop the IT areas. Be that as it may, the potential gain stayed covered as FIIs turned net merchants in the Indian value cash fragments.

In the approaching week, quarterly profit will be in center. WPI expansion numbers, worldwide prompts, and FIIs/FPI action will direct the pattern in the business sectors. On the worldwide front, Gross domestic product information, Modern creation and Retail deals information from China, and Expansion information from Japan, the UK, and Europe will affect the worldwide business sectors.

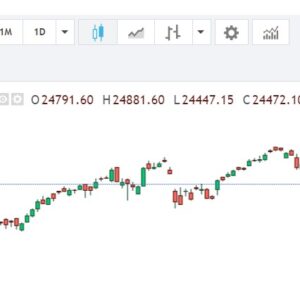

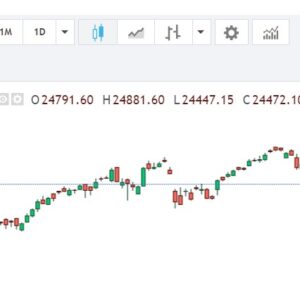

Nifty & Bank Nifty Weekly Prediction

On Friday, the Nifty file opened on areas of strength for a with a hole up and kept on acquiring as the meeting advanced on the rear of major areas of strength for a from IT monsters Infosys and TCS to scale over the 21900 zone making another record high by and by.

The Nifty file has further potential gain capability of 22300 levels with inclination and opinion staying solid alongside cutting edge stocks taking part showing strength and picking up speed. In the week, Clever could exchange the scope of 21500 to 22300 level.

Bank Nifty likewise seen a few positive maneuvers with ICICI Bank, SBI, and Kotak Bank supporting the file, however HDFC Bank neglected to partake in the convention on Friday and limited the record to end close to the 47700 zone with an increase of 270 places.

The Bank Nifty file would require a conclusive break over the 48400 zone to affirm a breakout and anticipate a further new up-move till the 49800 level. In the week, Bank Nifty record would exchange a scope of 46600-49000 levels

Domestic Macroeconomic Data

On Friday, the Service of Measurements and Program Execution (MoSPI) showed that India’s retail expansion flooded to a four-month high at 5.69% in December yearly. This is as against 5.55% expansion in November and the assumption was 5.87% according to the Reuters survey. Albeit the expansion perusing was accounted for higher in December it came according to assumption and inside the RBI resistance band of 2-6%.

Separate information delivered on Friday post-market hours showed that the country’s Modern creation developed by 2.4% in November yearly. This is when contrasted with the 11.7% kept in October.

In the forthcoming week, markets will have WPI expansion information and product and import information on Monday during market hours. Indian business sectors are probably going to overlook the marginally higher expansion information as it came in accordance with the assumption.

Global Stock Market Prediction Next Week

Worldwide securities exchange records generally finished higher in the second seven day stretch of 2024. Financial backers fundamentally centered around monetary information and raw petroleum costs during the week. The significant financial exchange files in the US shut higher, while Europe and Asian lists shut blended during the week. In the US Nasdaq record beat different benchmarks because of a meeting in innovation stocks drove by Meta stages and Nvidia.

In Europe, the UK declined while DAX and CAC shut higher. China’s Shanghai record declined as deflationary strain endured, while Japan’s Nikkei contacted its 34-year high last week, as shortcoming in Yen against the US dollar supported exporter’s feelings. Hang Seng and Kospi fell while Australia’s S&P ASX 200 file acquired.

In the approaching week, the worldwide business sectors will stay zeroed in on the financial information and quarterly profit. The US financial exchanges will be shut on Monday by virtue of Martin Luther Ruler, Jr. Day.

In the US, dealers will zero in on Retail deals information, Michigan Customer Feelings, and Lodging begins information. In the mean time, merchants will get additional profit declarations from huge monetary foundations including Morgan Stanley, Goldman Sachs, PNC Monetary Administrations, and US Bancorp.

One week from now in Europe, the emphasis will stay on expansion, as UK and Eurozone expansion information for December will be delivered one week from now. In Asia, China will deliver the Gross domestic product development rate for Q4, house cost list, retail deals, and Joblessness information in the approaching while Japan’s expansion information will remain checked.

Moreover, the Center East strain can present some unpredictability in the worldwide business sectors, as US and English militaries send off huge retaliatory negative marks against Iranian-moved Houthis in Yemen.

Crude Oil Prices

Raw petroleum costs rose around 1% on Friday as the greater part of the oil big haulers redirected the Red Ocean course following for the time being air strikes by the US and England on Houthi focuses in Yemen. The unrefined petroleum costs fell pointedly toward the start of the week because of sharp cost cuts by top exporter Saudi Arabia for Asian clients and an unexpected form in U.S. rough reserves prodded supply stresses.

In the week, London-based Brent raw petroleum was down 0.5% and US-based WTI unrefined petroleum fell 1.1%. Up until this point supplies have not yet been affected due the Red Ocean emergency, however the redirections of oil big haulers will push up the expense and season of transportation. Nonetheless, the further acceleration of the Center East emergency could hose financial exchange feelings and increment unrefined petroleum costs. Brokers ought to watch out for oil costs and the ongoing circumstance.

FII & DIIs flow

Unfamiliar Institutional Financial backers (FIIs/FPIs) transformed into net venders, they offloaded shares worth Rs 3901.27 crore in the Indian value cash portion this week. In the mean time, Homegrown Institutional Financial backers (DIIs) transformed into net purchasers, procuring shares worth Rs 6,858.47 crore during the week, which is 80% more than whatever FIIs sold.