Sonalis Consumer Products IPO June 07 To June 09

Consolidated in 2022, Sonalis Buyer Items Restricted isparticipatingd in the circulation of nutritious bars and sound tidbits. The organization has assimilated the business line and conveyance organization of Craving Food. Since Hunger Food has previously been in dynamic business for around three years, it gives an optimal stage to the Organization to develop/grow its business in the locale.

Sonalis Buyer Items Restricted’s item arrangement of solid bites/food incorporates Granola Bar, Sound Laddu and Puffs, Cheeseling, Chakli, Diet Bhel, and Sev.

During the period finished on December 31, 2022, the organization dispersed the items across 3 states Maharashtra, Gujarat, and Goa amassing INR 420.47 Lakhs.

Craving Food varieties was maintaining its business since Walk 5, 2020, which was taken over by Somalis Customer Items Restricted (counting all its portable resources, current resources, and liabilities) at an all-out thought of ₹ 12.87 Lakhs as far as Business Move Understanding dated May 15, 2022.

Every one of the items is fabricated in-house at the organization’s assembling offices situated in Vasai.

Sonalis Purchaser Items Restricted has fostered a powerful plan of action with severe command over processes, including crude fixing acquisition, fabricating tasks, stock administration across our huge scope of items and SKUs, the board of circulation coordinated operations across India, as well as overseeing considered trade deals.

• SCPL is occupied with various Craving Food varieties and exchanging agro items.

• After drowsy execution under the association firm, it stamped super execution for 9M FY23.

• In light of the FY23 super profit, the issue seems beneficially estimated.

• It works in an exceptionally cutthroat and divided section.

• There is no mischief in avoiding this “High Gamble/No Return” bet.

Prelude:

It is exceptionally amazing that consistently, we have an Initial public offering for BSE SME posting from an organization that just began in 2020 and revealed a working of simply xx months up until this point. The monetary information is with window dressing to make ready for extravagant estimating. Indeed, even the advertisers have given/changed over shares at a similar value, which is only an eyewash. What is amazing, is that this organization documented its most memorable draft outline in January 2023, refiled it in Walk 2023, and presented a new draft plan in April 2023. Presently at last it is opening up to the world however till June 04.06.23, up to 08.25 hrs., a last plan was not made accessible either on the trade site or on the site of the Lead Chief as well as on the site of the organization (www.appetitefood.in). This is truly amazing and raises worry as the organization distributed its Initial public offering opening promotion on June 01, 2023. My solicitation mail stayed unanswered till xx hrs. of June 04, 2023. Indeed, even a solicitation ready to come in case of an emergency to the Lead Supervisor for offer records however guaranteed prompt sharing didn’t occur till this time.

Such sorts of archive endorsements are generally occurring on BSE SMEs, who are maybe after amount against the nature of the issues. Passage of May 31, 2023, under the DRHP page of SME Initial public offerings, Sonalis transferred the April 23 draft plan just yet informed that it is the last one and shockingly this record didn’t have the dateline of the Initial public offering. In any case, the last outline could be followed around the early afternoon on June 05, 2023, on BSE Site. Reaction to my email likewise got this eve with a duplicate of the last plan.

ABOUT Organization:

Sonalis Customer Items Ltd. (SCPL) is integrated on Walk 15, 2022, and its prior history is as an organization firm under the name and style “Craving Food” and the items were sold under the branch name of “Hunger Food”. The broadened item arrangement of SCPL incorporates Granola Bar, Laddu, Chakli, Chivda, Sev, and so on.

SCPL fabricates a scope of items under the private naming game plan and agreement fabricating game plans with its clients and exchanges Agro items. As of the date of recording this proposition report, it had 9 workers on its finance.

ISSUE Subtleties/CAPITAL HISTORY:

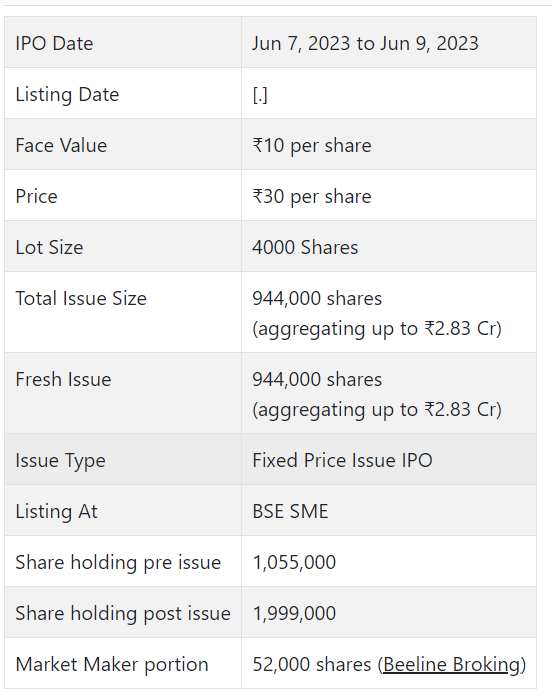

The organization is emerging with a lady Initial public offering of 944000 value portions of Rs. 10 each at a proper cost of Rs. 30 for each offer to prepare Rs. 2.83 cr. The issue opens for membership on June 07, 2023, and will close on June 09, 2023. The base application to be made is for 4000 offers and in products consequently, from that point. Post portion, offers will be recorded on BSE SME. The issue comprises 47.22% of the post-Initial public offering settled up capital of the organization. SCPL is spending Rs. 0.38 cr. for this Initial public offering process, and from the net returns, it will use Rs. 1.80 cr. for working capital and Rs. 0.65 cr. for general corporate purposes.

Master Worldwide Experts Pvt. Ltd. is the sole lead chief and Purva Sharegistry (India) Pvt. Ltd. is the enlistment center of the issue. Shortcut Broking Ltd. is the market producer for the organization.

Having given beginning value shares at standard, it gave/changed over additional value shares for Rs. 30 for every divide between July 2022 and September 2022. This transformation/issue at a premium is only an eyewash to win financial backers’ certainty. The typical expense of obtaining of offers by the advertisers is Rs. 25.42 per share.

Post Initial public offering SCPL’s ongoing settled up value capital of Rs. 1.06 cr. will stand improved to Rs. 2.00 cr. In light of the Initial public offering estimate, the organization is searching for a market cap of Rs. 6.00 cr.

Monetary Execution:

On the monetary execution front, according to repeated monetary information, for the last two fiscals, SRPL has posted a turnover/net benefit of Rs. Rs. 0.06 cr. /Rs. 0.004 cr. (FY21), Rs. 0.93 cr. /Rs.0.008 cr. (FY22), and for 9M of FY23, it procured a net benefit of Rs. 0.68 cr. on a turnover of Rs. 4.20 cr. (this large number of information connect with Craving Food – a division of SCPL). Its EBITDA edges were 11.96% (FY21), 1.44% (FY22), and 22.06% (9M-FY23), while its PAT edges were 7.14% (FY21), 0.88% (FY22), and 16.28% (9M-FY23). Along these lines, it checked high unpredictability and irregularity in its edge information.

Notwithstanding, according to offer archives, it has shown its EPS and RoNW information given its 9M FY3 execution with an EPS of Rs. 10.08 and a normal RoNW of 19.60%. The issue is evaluated at a P/BV of 0.91 given its NAV of Rs. 33.10 as of December 31, 2022, and at a P/BV of 0.95 given a post-Initial public offering NAV of Rs. 31.64 per share.

If we annualize its super income of 9M – FY23 and quality it to a post-Initial public offering, completely weakened settled up value capital, then the asking cost is at a P/E of 6.56. Subsequently, however, it seems beneficially evaluated, the maintainability of such edges amid rising contest from numerous large FMCGs as well as the section is divided, this issue can be named as a “High Gamble/No Return” bet.

Profit Strategy:

The organization has not announced any profits since joining. It will embrace a reasonable profit strategy post-posting, given its monetary presentation and future possibilities.

Correlation WITH Recorded Companions:

According to the deal record, the organization has shockingly shown DFM Food varieties, Nakoda Gathering, Prataap Tidbits, and Annapurna Swadisht as their recorded friends. They are as of now exchanging at a P/E of NA, 83.35, 93.21, and 57.01 (as of June 05, 2023). Be that as it may, they are not practically identical on an apple-to-apple premise. These enticing companions’ examination is only an eyewash.

Trader BANKER’S History:

This is the third command from Master Worldwide in the last two fiscals (counting the continuous one). Out of the last 2 postings, 1 opened at a markdown and 1 with a premium of 10.47% on the date of posting.

End/Speculation Methodology

The organization works in an exceptionally serious and divided section with numerous huge players around. The unexpected lift in its main concern for 9M FY23 causes a commotion and worry over supportability going ahead. In light of such super profit, the issue seems beneficially estimated, while given its history, it shows up forcefully evaluated. Little value capital post-Initial public offering shows a longer growth period for movement to the mainboard. There is no mischief in avoiding this “HIGH Gamble/LOW RETURN” issue