Signatureglobal (India) Limited IPOSeptember 20, 2023 to September 22, 2023

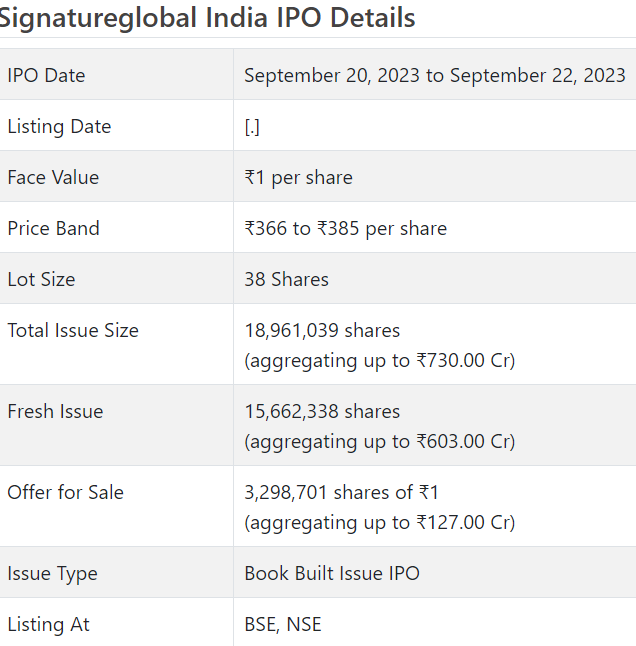

Signatureglobal India Initial public offering is a book constructed issue of Rs 730.00 crores. The issue is a blend of new issue of 1.57 crore shares collecting to Rs 603.00 crores and make available for purchase of 0.33 crore shares conglomerating to Rs 127.00 crores.

Signatureglobal India Initial public offering opens for membership on September 20, 2023 and closes on September 22, 2023. The portion for the Signatureglobal India Initial public offering is supposed to be settled on Wednesday, September 27, 2023. Signatureglobal India Initial public offering will list on BSE, NSE with speculative posting date fixed as Wednesday, October 4, 2023.

Signatureglobal India Initial public offering cost band is set at ₹366 to ₹385 per share. The base part size for an application is 38 Offers. The base measure of speculation expected by retail financial backers is ₹14,630. The base part size venture for sNII is 14 parcels (532 offers), adding up to ₹204,820, and for bNII, it is 69 parcels (2,622 offers), adding up to ₹1,009,470.

• SGIL is the biggest land designer in Delhi NCR locale in the reasonable lodging.

• However the organization posted development in its working, it actually keeps on posting misfortunes.

• It has accomplished 20% pieces of the pie inside its locale of activity in a limited capacity to focus.

• Because of negative income for the revealed periods, the issue is at a negative P/E.

• With the tasks close by, it is probably going to turn the table in the closer term.

• Very much educated/cash excess/risk searchers might stop moderate assets for long haul rewards, others can skip.

ABOUT Organization:

Signatureglobal (India) Ltd. (SGIL) cases to be the biggest land advancement organization in the Public Capital Locale of Delhi (“Delhi NCR”) in the reasonable and lower mid fragment lodging as far as units provided (in the underneath Rs. 8 million cost classification) among 2020 and the three months finished Walk 31, 2023, with a portion of the overall industry of 19%. (Source: Anarock Report).

It started tasks in 2014 through its Auxiliary, Mark Developers Private Restricted, with the send off of Solera project on 6.13 sections of land of land in Gurugram, Haryana. As of Walk 31, 2023, it had sold 27,965 private and business units, all inside the Delhi NCR locale, with a total Saleable Area of 18.90 million square feet. SGIL’s Business (net of undoing) have developed at an accumulated yearly development rate (“CAGR”) of 42.46%, from Rs. 1690.27 cr. in Financial 2021 to Rs. 3430.58 cr. in Financial 2023. As of Walk 31, 2023, the organization has sold 25,089 private units with a typical selling cost of Rs. 0.36 cr. per unit.

SGIL has decisively centered around the Reasonable Lodging (“AH”) portion (beneath Rs. 0.40 cr. cost classification) and the Center Pay Lodging (“MH”) portion (between Rs. 0.40 cr. to Rs. 0.25 cr.) through GoI and state government arrangements. The state legislature of Haryana under its different arrangements permits advancement of AH and MH. Likewise, going ahead it will likewise foster a portion of its Impending Tasks under the Haryana Gathering Lodging Strategy (“HGHP”) and New Coordinated Permitting Strategy (“NILP”) consolidating them with the arrangements of Travel Situated Improvement Strategy (“TODP”) and Move of Improvement Privileges Strategy (“TDRP”), which will empower the organization to accomplish higher FAR, thus higher developable region as well as higher thickness to focus on the MH fragment. The TODP expects to empower advancement around metro passages for which extra FAR and higher thickness has been permitted. (Source: Anarock Report)

The majority of SGIL’s Finished Ventures, Progressing Activities and Approaching Tasks are situated in Gurugram and Sohna in Haryana, with 88.49% of Saleable Region situated around here as of Walk 31, 2023, and practically its activities have been all, or are being, embraced under the AHP or the DDJAY – APHP. As far as deals in Gurugram, the organization had a piece of the pie of 31% in the reasonable and lower mid section, and a portion of the overall industry of 24% in all spending plan classes, in the period from 2020 to the three months finished Walk 31, 2023. (Source: Anarock Report) The AHP licenses for more prominent thickness, which is the quantity of people per section of land, that empowers it to fabricate more modest unit sizes prompting further developed saleability. Furthermore, lower administrative expenses with waiver of permit expense and infrastructural improvement accuses for designers coupled of higher floor region proportion (“FAR”) for private turn of events and business advancement are a portion of different advantages accessible under the AHP. Under the DDJAY – APHP too, higher thickness, more modest plot sizes and higher FAR contrasted with that for a private plotted settlement empower the organization to offer units at serious costs permitting it to extend tasks. These advantages have made it feasible for the organization to offer undertakings at reasonable costs at premium areas while staying beneficial.

The organization gives “esteem homes” with appealing plans and conveniences. It proactively looks to improve the worth of ventures by establishing a superior living climate through the arrangement of far reaching local area offices and by connecting with prestigious draftsmen. Its tasks under the AHP, regularly valued beneath Rs. 0.30 cr. per unit, incorporates conveniences like sporting facilities, gardens, open spaces and local area lobbies. Its tasks under the DDJAY – APHP, ordinarily estimated between Rs. 0.40 cr. what’s more, Rs. 1.20 cr. per unit, give offices including gyms, sporting spaces, diversion focuses, pools and wearing offices. All its AHP and DDJAY – APHP projects have a retail part inside them which are planned to offer further comfort to occupants, and these parts increment the worth of undertakings inferable from the shortfall of cost roofs. Every one of its tasks are situated in the advanced Delhi NCR district, with availability to different pieces of Delhi NCR. Notwithstanding the Gurugram region, it has additionally sent off specific tasks across key business sectors in Haryana like Karnal, under the DDJAY – APHP strategy. The organization likewise have one Continuous Venture being created by its Auxiliary, Sternal Buildcon Private Restricted, outside the AHP and DDJAY – APHP arrangements, to be specific Boundlessness Shopping center, which is found near its Continuous Tasks under the DDJAY – APHP in Sohna.

As of Walk 31, 2023, it had finished a total Developable Area of 7.64 million square feet in its Finished Undertakings and an extra 1.37 million square feet in Continuous Ventures, containing 11,427 private units and 932 business units, for which it has gotten occupation testaments. SGIL has sold 25,089 private units, adding up to 88.81% of the absolute number of private units sent off in its Finished and Progressing Activities as of Walk 31, 2023. As of Walk 31, 2023, it had 963 workers on its finance. As of Walk 31, 2023, its approaching undertakings have developable areas of 24506650 square feet which indicates brilliant possibilities ahead.

ISSUE Subtleties/CAPITAL HISTORY:

The organization is emerging with a lady combo Initial public offering of new value shares issue worth Rs. 603 cr. (approx. 15662346 offers at the upper cap) and a Proposal available to be purchased (OFS) worth Rs. 127 cr. (approx. 3298704 offers at the upper cap) to collect generally speaking Rs. 730 cr. (approx. 18961050 offers at the upper cap). The organization has reported a value band of Rs. 366 – Rs. 385 for every portion of Re. 1 each. The issue opens for membership on September 20, 2023, and will close on September 22, 2023. The base application to be made is for 38 offers and in products subsequently, from there on. Post apportioning, offers will be recorded on BSE and NSE. The issue is 13.50% of the post-Initial public offering settled up capital of the organization. From the net returns of the new value issue, the organization will use Rs. 264.00 cr. for reimbursement/prepayment of specific borrowings, Rs. 168.00 cr. for reimbursement/prepayment of borrowings by its four auxiliaries, and the rest for inorganic development through land acquisitions and general corporate purposes.

ICICI Protections Ltd., Hub Capital Ltd., Kotak Mahindra Capital Co. Ltd. are the three joint Book Running Lead Administrators (BRLMs) and Connection Intime India Pvt. Ltd. is the recorder of the issue.

Having given starting value shares at standard worth, the organization gave/changed over additional value partakes in the value scope of Rs.20.00 – Rs. 417.00 per divide among Walk 2000, December 2022. It has additionally given extra offers in the proportion of 5 for 2 in June 2016, and 1 for 1 in Walk 2022. The typical expense of procurement of offers by the advertisers/selling partners is Rs.0.14, Rs. 1.04, Rs. 1.05, Rs. 1.08, Rs. 1.09, Rs. 30.55, and Rs. 417.00 per share.

Post-Initial public offering, SGIL’s ongoing settled up value capital of Rs. 12.49 cr. (124848354 offers) will stand upgraded to Rs. 14.05 cr. (140510700 offers). At the upper cap of the Initial public offering cost band, the organization is searching for a market cap of Rs. 5409.66 cr.