Shree Marutinandan Tubes Limited IPO

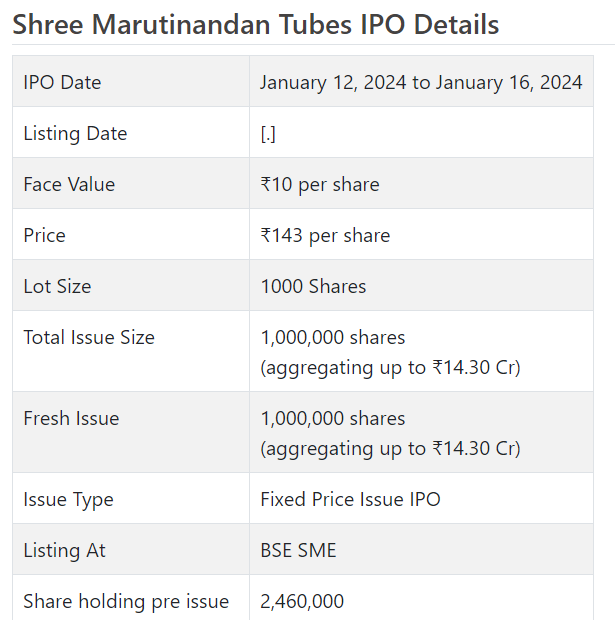

Shree Marutinandan Cylinders Initial public offering is a decent value issue of Rs 14.30 crores. The issue is totally a new issue of 10 lakh shares.

Shree Marutinandan Cylinders Initial public offering opened for membership on January 12, 2024 and will close on January 16, 2024. The distribution for the Shree Marutinandan Cylinders Initial public offering is supposed to be finished on Wednesday, January 17, 2024. Shree Marutinandan Cylinders Initial public offering will list on BSE SME with speculative posting date fixed as Friday, January 19, 2024.

Shree Marutinandan Cylinders Initial public offering cost is ₹143 per share. The base parcel size for an application is 1000 Offers. The base measure of venture expected by retail financial backers is ₹143,000. The base parcel size speculation for HNI is 2 parts (2,000 offers) adding up to ₹286,000.

• The organization is occupied with exchanging and conveyance of lines, tubes, and sun oriented underlying lines.

• It stamped static top line with fluctuating primary concerns for the last two fiscals.

• It stamped supported top and primary concern for H1-FY24 that cause a stir and worry over its supportability.

• In light of FY24 annualized profit, the issue shows up completely evaluated.

• A small post-Initial public offering value base shows longer growth period for movement.

• All around informed financial backers might stop assets for the drawn out remunerations.

ABOUT Organization:

Shree Marutinandan Cylinders Ltd. (SMTL) is participated occupied with exchanging of Electrifies Line, Electric Obstruction Welding Gentle Steel (“ERW MS”) Lines (round lines, square and rectangular empty segments) in different determinations, sizes going from 15NB to 1000 NB and furthermore in exchanging of Dark Lines and Sunlight based Primary Lines. Its items have wide application in fluctuated businesses like Horticulture, Oil, General Wellbeing, Lodging, Water system, Designing, Infrastructural, Modern and so on.

It has free deals and conveyance networks for items. A significant larger part of steel pipes are offered to wholesalers and Merchants in the homegrown business sectors. It acquires Steel Lines from the best makers in steel pipes at homegrown level. The organization has an obtainment strategy and for the most part buy in enormous volumes to stock and work with on time conveyance of items to end clients.

The Organization is a deeply grounded and has left a huge imprint in the exchanging of steel cylinders and lines. Notwithstanding, from FY 2023, it has made an essential stride of forward coordination to grow its business skylines and differentiate contributions. It concurs contract assembling of farming hardware to its gathering organization Shree Kamdhenu Apparatus Private Restricted. This move empowers it to give a more extensive scope of items to clients, taking care of the developing interest for farming hardware and gear on the lookout.

The item arrangement of the organization presently incorporates a variety of rural hardware, for example, potato digger machines, grader machines, container machines, groundnut de-stoner machines, pipe winder machines, and rotovators. As of December 25, 2023, it had 14 representatives on its finance.

ISSUE Subtleties/CAPITAL HISTORY:

The organization is emerging with its lady Initial public offering of a million value portions of Rs. 10 each at a decent cost of Rs. 143.00 per offer to assemble Rs. 14.30 cr. The issue opens for membership on January 12, 2024, and will close on January 16, 2024. The base application to be made is for 1000 offers and in products consequently, from that point. Post portion, offers will be recorded on BSE SME. The issue comprises 28.90% of the post-Initial public offering settled up value capital of the organization. SMTL is spending Rs. 0.70 cr. for this Initial public offering and from the net returns, it will use Rs. 10.60 cr. for working capital, and Rs. 3.00 cr. for general corporate purposes.

The issue is exclusively lead overseen by Insignia Investmart Ltd. also, Bigshare Administrations Pvt. Ltd. is the recorder of the issue. Insignia Investmart Ltd. is additionally the market creator for the organization.

The organization has given whole value capital at standard worth up until this point and has additionally given extra offers in the proportion of 11 for 1 in June 2023. The typical expense of obtaining of offers by the advertisers is Rs. 0.44, and Rs. 0.83 per share.

Post-Initial public offering, organization’s ongoing settled up value capital of Rs. 2.46 cr. will stand upgraded to Rs. 3.46 cr. In view of the Initial public offering estimating, the organization is searching for a market cap of Rs. 49.48 cr.

Monetary Execution:

On the monetary execution front, for the last three fiscals, the organization posted an all out income/net benefit of Rs. 35.97 cr. /Rs. 0.13 cr. (FY21), Rs. 47.19 cr. /Rs. 0.06 cr. (FY22), Rs. 47.23 cr. /Rs. 2.02 cr. (FAY23). For H1 of FY24 finished on September 30, 2023, it procured net benefit of Rs. 1.42 cr. on a complete income of Rs. 42.85 cr. Apparently the organization has window dressed its most recent year and a half’s presentation to match the asking cost.

For the last three fiscals, the organization has revealed a normal EPS of Rs. 51.27 (on pre-reward premise), and a typical RoNW of 44.41%. The issue is evaluated at a P/BV of 8.58 in light of its NAV of Rs. 16.66 as of September 30, 2023, and at a P/BV of 2.91 in view of post-Initial public offering NAV of Rs. 49.07 per share.

On the off chance that we trait annualized super income of FY24 to its post-Initial public offering completely weakened settled up value capital, then the asking cost is at a P/E of 17.42, and in light of FY23 income, the P/E remains at 24.53. Accordingly the issue shows up completely evaluated.

For the announced periods, the organization has posted PAT edges of 0.37% (FY21), 0.13% (FY22), 4.27% (FY23), and 3.31% (H1-FY24).

Profit Strategy:

The organization has not pronounced any profits for any announced monetary years. It will embrace a reasonable profit strategy in light of its monetary presentation and future possibilities.

Examination WITH Recorded Companions:

According to the proposition record, the organization has shown Swastik Lines, Hey Tech Lines, and APL Apollo Cylinders as their recorded friends. They are exchanging at a P/E of 25.79, 51.09, and 72.61 (as of January 09, 2024). Nonetheless, they are not similar on an apple-to-apple premise. As a matter of fact, the friend list incorporates Swastik Cylinders, however while checking no organization was found of this name on any trade.

Vendor BANKER’S History:

This is the ninth order from Insignia Investmart in the last three fiscals. Out of the last 8 postings, 2 opened at markdown, 1 at standard and the rest with charges going from 4.17% to 36.25% on the date of posting.