Shivam Chemicals Limited IPO Full Details

Shivam Synthetic substances Initial public offering is a decent value issue of Rs 20.18 crores. The issue is completely a new issue of 45.87 lakh shares.

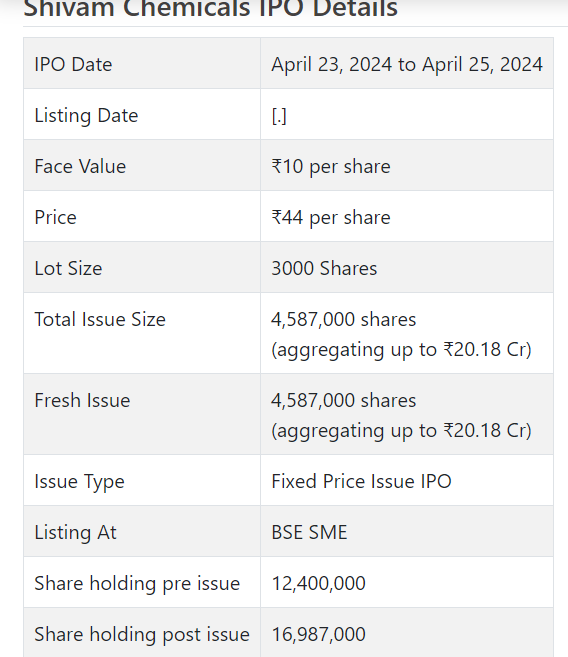

Shivam Synthetic substances Initial public offering opens for membership on April 23, 2024 and closes on April 25, 2024. The distribution for the Shivam Synthetic compounds Initial public offering is supposed to be settled on Friday, April 26, 2024. Shivam Synthetics Initial public offering will list on BSE SME with provisional posting date fixed as Tuesday, April 30, 2024.

Shivam Synthetic substances Initial public offering cost is ₹44 per share. The base parcel size for an application is 3000 Offers. The base measure of speculation expected by retail financial backers is ₹132,000. The base part size speculation for HNI is 2 parcels (6,000 offers) adding up to ₹264,000.

• The organization is in Hydrated Lime fabricating and is a wholesaler for poultry/creature feed items.

• It has posted irregularity in its top and main concerns for the revealed periods.

• From FY23, its top and primary concerns are showing degrowth. 9M-FY24 checked horrible showing.

• In view of FY24 annualized profit, the issue shows up extravagantly valued.

• There is no mischief in skirting this “High Gamble/Low Return” bet.

ABOUT Organization:

Shivam Synthetic substances Ltd. (SCL) is a producer of Hydrated Lime (Calcium Hydroxide) and a merchant of different items, for example, Poultry feed supplement (MBM), Di-Calcium Phosphate (Feed Grade), Magnesium Oxide, Limestone Powder, and so on. With rich experience and information, it has constructed a deep rooted promoting network across India and it disseminates creature feed items for different well famous production throughout the long term.

With a typical month to month deals volume of 2,650 metric tons, it keeps a reliable presence and add to the consistent progression of items on the lookout. Its process started with an essential spotlight on creature feed supplement exchanging till FY 2022-23 and its development into assembling is occurred through the foundation of a 100 percent possessed auxiliary.

SCL’s entirely claimed auxiliary organization Shivam Synthetics and Minerals Private Restricted is situated at Dahej Gujarat with an assembling limit of 60,000 MT. They are taken part in assembling of Hydrated lime (Calcium hydroxide) item. As of December 31, 2023 it had 25 representatives on a merged premise. It has 12 agreements works in its auxiliary organization for example Shivam Synthetic substances and Minerals Private Restricted.

ISSUE Subtleties/CAPITAL HISTORY:

The organization is emerging with its lady Initial public offering of 4587000 value portions of Rs. 10 each at a proper cost of Rs. 44 for each offer to prepare Rs. 20.18 cr. The issue opens for membership on April 23, 2024, 2024, and will close on April 25, 2024. The base application to be made is for 3000 offers and in products subsequently, from there on. Post allocation, offers will be recorded on BSE SME. The issue comprises 27.00% of the post-Initial public offering settled up capital of the organization. The organization is spending Rs. 2.50 cr. for this Initial public offering process and from the net returns of the Initial public offering, it will use Rs. 7.05 cr. for working capital, Rs. 5.62 cr. for interest in auxiliary – Shivam Synthetic substances and Minerals Pvt. Ltd., and Rs. 5.01 cr. for general corporate purposes.

The issue is exclusively lead overseen by Aryaman Monetary Administrations Ltd., and Appearance Corporate Administrations Ltd. is the enlistment center of the issue. Shreni Offers Ltd. is the market producer for the organization. While Aryaman Monetary has guaranteed the issue to the tune of 94.96%, Shreni Offers has endorsed for 5.04%.

The organization has given whole value capital at standard worth up to this point and has likewise given extra offers in the proportion of 30 for 1 in September 2023. The typical expense of obtaining of offers by the advertisers is Rs. Nothing, and Rs. 0.32 per share.

Post-Initial public offering, organization’s ongoing settled up value capital of Rs. 12.40 cr. will stand upgraded to Rs. 16.99 cr. In view of the upper Initial public offering cost band, the organization is searching for a market cap of Rs. 74.74 cr.

Monetary Execution:

On the monetary execution front, for the last three fiscals, the organization has posted an all out pay/net benefit of Rs. 95.58 cr. /Rs. 0.87 cr. (FY21), Rs. 177.99 cr. /Rs. 4.44 cr. (FY22), (independent for FY21 and FY22) and Rs. 156.58 cr. /Rs. 3.57 cr. (FY23), For 9M of FY24, it procured a net benefit of Rs. 0.71 cr. on a complete pay of Rs. 107.11 cr. – on a solidified premise from FY23 onwards. Accordingly the organization stamped irregularity in its top and primary concerns for the announced periods.

For the last three fiscals, it has detailed a normal EPS of Rs. 2.75, and a typical RONW of 31.41%. The issue is evaluated at a P/BV of 3.90 in view of its NAV of Rs. 11.29 as of December 31, 2023, and at a P/BV of 2.19 in light of its post-Initial public offering NAV of Rs. 20.12 per share.

On the off chance that we characteristic annualized FY24 income to its post-Initial public offering completely weakened paid-p capital, then the asking cost is at a P/E of 78.57. In view of FY23 income, the issue is valued at a P/E of 20.95. Subsequently the issue shows up forcefully valued.

For the revealed periods, the organization has posted PAT edges of 0.91% (FY21), 2.49X% (FY22), 2.33% (FY23), 0.66% (9M-FY24), and RoCE edges of 23.84%, 42.35%, 19.88%, 6.19% separately for the alluded periods.

Profit Strategy:

The organization has not proclaimed any profits since fuse. It will embrace a judicious profit strategy in light of its monetary presentation and future possibilities.

Examination WITH Recorded Companions:

According to the proposition record, the organization has shown Narmada Agro and Godrej Agrovet as their recorded companions. They are exchanging at a P/E of 54.7 and 33.3 (as of April 19, 2024). Nonetheless, they are not similar on an apple-to-apple premise.

Shipper BANKER’S History:

This is the thirteenth command from Aryaman Monetary in the last three fiscals (counting the continuous one), out of the last 10 postings, 1 opened at rebate, 1 at standard, and the rest with expenses going from 0.29% to 31.15% on the date of posting.