Sattrix Information Security Limited IPO Full Details

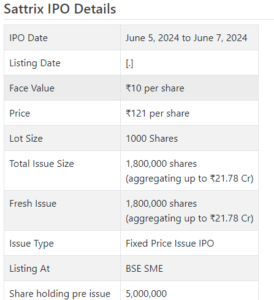

Sattrix Initial public offering is a proper value issue of Rs 21.78 crores. The issue is totally a new issue of 18 lakh shares.

Sattrix Initial public offering opens for membership on June 5, 2024 and closes on June 7, 2024. The assignment for the Sattrix Initial public offering is supposed to be concluded on Monday, June 10, 2024. Sattrix Initial public offering will list on BSE SME with conditional posting date fixed as Wednesday, June 12, 2024.

Sattrix Initial public offering cost is ₹121 per share. The base part size for an application is 1000 Offers. The base measure of venture expected by retail financial backers is ₹121,000. The base parcel size venture for HNI is 2 parts (2,000 offers) adding up to ₹242,000.

• The organization is participated in creating client driven network safety arrangements.

• It is working in an exceptionally cutthroat and divided section.

• After static exhibitions for FY21 and FY22, it checked supported top and primary concerns for FY23.

• Little value post-Initial public offering shows longer growth for relocation.

• In view of FY24 annualized profit, the issue shows up completely valued.

• Very much educated financial backers might stop assets for the medium to long haul.

ABOUT Organization:

Sattrix Data Security Ltd. (SISL) is in the business to foster client driven network protection arrangements, it plans to convey start to finish online protection administrations to undertakings in the India, USA and Center East (UAE). With 10 years of involvement, the organization has set up a good foundation for itself as a believed accomplice in giving an exhaustive scope of digital protection arrangements.

The organization assists associations with safeguarding their information from unapproved access against and safeguard against security dangers. SISL’s information security arrangements mean to dispose of information protection dangers to make business processes secure and run as expected. The organization plans and assembles information security arrangements on cloud and on premise in light of the client necessity. It utilizes most ideal that anyone could hope to find advances to create network safety arrangement, and its point is to create coordinated digital protection arrangement which assists in consistent redesign and its answers with taking on to the changing prerequisite of the client. As of December 31, 2023, it had 145 representatives on its finance.

ISSUE Subtleties/CAPITAL HISTORY:

The organization is emerging with its lady Initial public offering of 1800000 value portions of Rs. 10 each at a decent cost of Rs. 121 for every offer to assemble Rs. 21.78 cr. The issue opens for membership on June 05, 2024, and will close on June 07, 2024. The base application to be made is for 1000 offers and in products consequently, from that point. Post portion, offers will be recorded on BSE SME. The issue comprises 26.47% of the post-Initial public offering settled up capital of the organization. The organization is spending Rs. 1.98 cr. for this Initial public offering process, and from the net returns of the Initial public offering, it will use Rs. 2.52 cr. for capex on acquisition of furniture, apparatuses, climate control systems and so on, Rs. 2.18 cr. for buy and establishment of IT gear, PC equipment, CCTV, SAN Stockpiling, LAN hardware and so on, Rs. 7.56 cr. for advancement of new item and innovation and so on, Rs. 2.12 cr. for business extension, Rs. 2.50 cr. for working capital, and Rs. 2.92 cr. for general corporate purposes.

The issue is exclusively lead overseen by ISK Counsels Pvt. Ltd., and Bigshare Administrations Pvt. Ltd., is the enlistment center to the issue. Sunflower Broking Pvt. Ltd., is the market producer for the organization. The Initial public offering is guaranteed 94.89% by ISK Consultants and 5.11% by Sunflower Broking.

The organization has given whole value capital at standard worth up until this point, and has likewise given extra offers in the proportion of 499 for 1 in October 2023. The typical expense of procurement of offers by the advertisers is Rs. 0.02 per share.

Post-Initial public offering, organization’s ongoing settled up value capital of Rs. 5.00 cr. will stand improved to Rs. 6.80 cr. In light of the upper Initial public offering cost band, the organization is searching for a market cap of Rs. 82.28 cr.

Monetary Execution:

On the monetary execution front, for the last three fiscals, the organization has (on a merged premise) posted a complete pay/net benefit of Rs. 21.20 cr. /Rs. 1.94 cr. (FY21), Rs. 23.49 cr. /Rs. 2.14 cr. (FY22), Rs. 37.76 cr. /Rs. 4.00 cr. (FY23). For 9M of FY24 finished on December 31, 2023, it procured a net benefit of Rs. 2.51 cr. on a complete pay of Rs. 30.62 cr.

For the last three fiscals, it has detailed a normal EPS of Rs. 6.07, and a typical RoNW of 31.75%. The issue is valued at a P/BV of 4.18 in light of its NAV of Rs. 28.94 as of December 31, 2023, and at a P/BV of 2.27 in view of its post-Initial public offering NAV of Rs. 53.31 per share.

As indicated by the administration, it has around 10% income from sends out which will ascend to around 40% to half post arranged development. Its entrance in worldwide market brought about helped top and primary concerns from FY23 onwards. The organization is serving on a B2B model with tailor made arrangements, and this perspective is the significant focal point of the organization.

On the off chance that we trait annualized FY24 income to its post-Initial public offering completely weakened settled up capital, then, at that point, the asking cost is at a P/E of 24.59. Accordingly the issue shows up completely evaluated.

For the announced periods, the organization has posted PAT edges of 9.18% (FY21), 9.34% (FY22), 10.93% (FY23), 8.26% (9M-FY24), and RoCE edges of 50.43%, 28.59%, 42.67%, 20.93% separately for the alluded periods.

Profit Strategy:

The organization has not proclaimed any profits for the announced times of the deal report. It will embrace a judicious profit strategy in view of its monetary exhibition and future possibilities.

Correlation WITH Recorded Companions:

According to the proposition archive, the organization has shown Systango Techno., Dev Data, and TAC Infosec, as their recorded companions. They are exchanging at a P/E of 20.3, 27.6 and 71.4 (as of May 31, 2024). In any case, they are not equivalent on an apple-to-apple premise.

Shipper BANKER’S History:

This is the eighth order from ISK Guide in the last five fiscals (counting the continuous one), out of the last 7 postings, 1 opened at markdown and the rest with expenses going from 1.08% to 49.21% on the date of posting.

End/Speculation Methodology

The organization is participated in giving client driven network protection arrangements. It is working in an exceptionally serious and divided portion. The organization desires to post higher income from rising commodity income that will ascend to around 40-half post development from current degree of 10%. In view of FY24 annualized profit, the issue shows up completely evaluated. Little value post-Initial public offering shows longer growth for relocation. All around informed financial backers might stop assets for the medium to long haul.

Audit By Dilip Davda on June 1, 2024

Audit Creator

DISCLAIMER: No monetary data at all distributed anyplace here ought to be understood as a proposal to trade protections, or as counsel to do as such in any capacity at all. All matter distributed here is only for instructive and data purposes just and by no means ought to be utilized for pursuing venture choices. My audits don’t cover GMP market and administrators approaches. Perusers should counsel a certified monetary consultant prior to pursuing any real speculation choices, put together the with respect to data distributed here. With passage obstructions, SEBI maintains that main very much educated financial backers should take part in such offers. With insane postings in the new past, SME Initial public offerings drew the consideration of financial backers in all cases and lead to diviner franticness. Notwithstanding, as SME issues have passage hindrances and proceeded with low inclination from the broking local area, any peruser taking choices in view of any data distributed here does so totally despite the obvious danger ahead. The above data depends on data accessible as of date combined with market discernments. The Creator has no designs to put resources into this proposition.