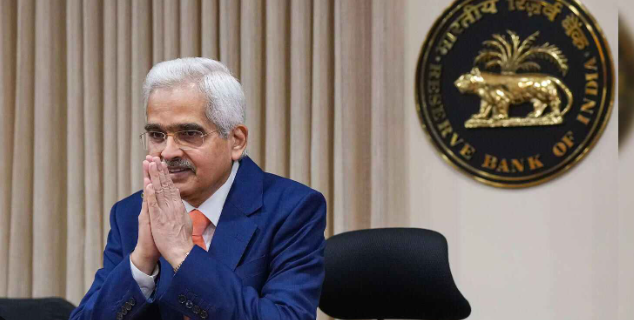

RBI Governor Shaktikanta Das Bullish on Consumption Amid Inflation Dip,Shaktikanta Das Upbeat: Consumption Set to Soar Amidst Inflation Moderation

As per recent statements from Reserve Bank of India (RBI) Governor Shaktikanta Das, there is a palpable sense of optimism in the air regarding consumption trends, even amidst the backdrop of moderating inflation. Das, an eminent figure in India’s financial landscape, has underscored the encouraging trajectory observed in inflation trends, suggesting a potential green light for consumers to ramp up their spending habits. This assertion from Das carries significant weight, given his pivotal role in shaping monetary policy and steering the country’s economy.

The notion of moderating inflation, as elucidated by Governor Das, paints a picture of price stability within the Indian economy. When inflation moderates, it indicates that the rate at which prices are increasing is decelerating, thereby alleviating some of the financial burdens on consumers. In practical terms, moderating inflation implies that the purchasing power of consumers remains relatively intact, as the erosion of their income through rising prices is mitigated to a certain extent.

For consumers, the implications of moderating inflation are profound. It fosters an environment conducive to confident spending, wherein individuals are less constrained by the specter of rapidly escalating prices. When consumers perceive that the cost of goods and services is stabilizing, they are more inclined to open their wallets and indulge in discretionary spending. This phenomenon can have a ripple effect across various sectors of the economy, driving demand for a plethora of goods and services, thereby stimulating economic activity.

Governor Das’s optimism regarding consumption trends in the face of moderating inflation underscores his astute understanding of the intricate dynamics at play within the Indian economy. His assessment suggests that the current economic landscape may provide a fertile ground for consumers to flex their purchasing power, potentially catalyzing a virtuous cycle of spending and economic growth.

It is imperative to delve deeper into the factors underpinning the moderation in inflation highlighted by Governor Das. Understanding the root causes of this phenomenon can provide invaluable insights into its sustainability and potential implications for consumption trends. One plausible explanation for moderating inflation could be the prudent monetary policies implemented by the RBI under Das’s stewardship.

The RBI plays a pivotal role in managing inflation through its monetary policy tools, such as interest rates and liquidity measures. Governor Das and his team have adopted a proactive approach to inflation management, employing a judicious mix of policy measures to maintain price stability while supporting economic growth. By striking the right balance between inflation control and growth promotion, the RBI has created an enabling environment for consumers to feel more confident about their spending decisions.

Moreover, external factors such as global commodity prices and exchange rate fluctuations also influence inflation dynamics in India. Governor Das’s optimism regarding consumption trends amidst moderating inflation reflects a nuanced understanding of how these external forces interact with domestic economic conditions. His assessment signals a degree of resilience in the Indian economy, capable of weathering external headwinds and sustaining consumption growth.

In addition to the macroeconomic factors driving consumption trends, it is essential to consider the microeconomic dynamics at play within different segments of the population. Consumer behavior is influenced by a myriad of factors, including income levels, employment prospects, and socio-cultural preferences. Governor Das’s optimism regarding consumption trends hints at a broader narrative of economic resilience and confidence among Indian consumers.

Furthermore, the COVID-19 pandemic has reshaped consumption patterns and behaviors, with individuals adapting to new norms such as remote work and online shopping. Governor Das’s optimism regarding consumption trends amidst moderating inflation reflects a forward-looking perspective, acknowledging the evolving nature of consumer preferences and the adaptability of the Indian economy.

In conclusion, Governor Shaktikanta Das’s optimism regarding consumption trends amidst moderating inflation underscores a nuanced understanding of the complex interplay between economic variables. His assessment signals a sense of confidence in the resilience of the Indian economy and the ability of consumers to navigate challenging times. As India charts its course towards economic recovery and growth, Governor Das’s insights provide valuable guidance for policymakers, businesses, and consumers alike.