Ramdevbaba Solvent Limited IPO full Details

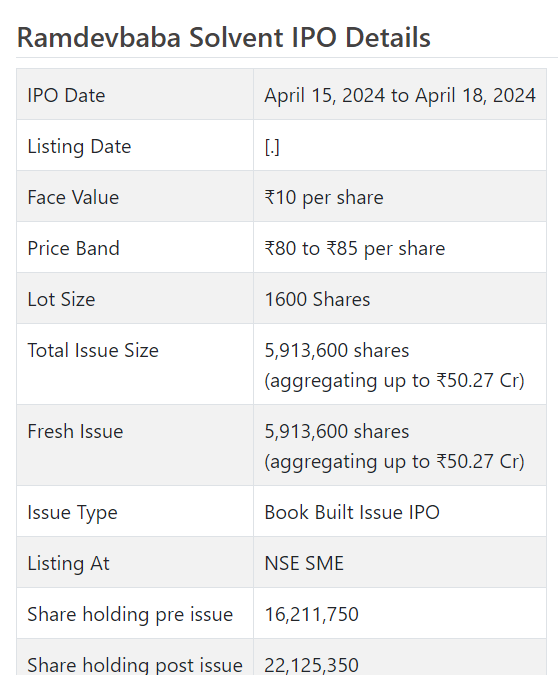

Ramdevbaba Dissolvable Initial public offering is a book fabricated issue of Rs 50.27 crores. The issue is completely a new issue of 59.14 lakh shares.

Ramdevbaba Dissolvable Initial public offering opens for membership on April 15, 2024 and closes on April 18, 2024. The apportioning for the Ramdevbaba Dissolvable Initial public offering is supposed to be concluded on Friday, April 19, 2024. Ramdevbaba Dissolvable Initial public offering will list on NSE SME with provisional posting date fixed as Tuesday, April 23, 2024.

Ramdevbaba Dissolvable Initial public offering cost band is set at ₹80 to ₹85 per share. The base parcel size for an application is 1600 Offers. The base measure of speculation expected by retail financial backers is ₹136,000. The base part size venture for HNI is 2 parcels (3,200 offers) adding up to ₹272,000.

• The organization is fundamentally in rice wheat oil and related items producing

• It is currently wandering into ethanol mixing by means of its auxiliary.

• It is extending limits and adding de-oiling office that will support its edges going ahead.

• In view of FY23/FY24 profit, the issue shows up completely valued.

• Very much educated financial backers might stop assets for the medium to long haul rewards.

Prelude:

RSL is basically into rice grain oil and related items assembling and promoting. It is adding de-oiling office and wandering into ethanol mixing which is the dawn business. Indeed, however its name incorporates Ramdevbaba, it has no association with Patanjali bunch or any relationship with Yoga Master Ramdeo Baba.

ABOUT Organization:

Ramdevbaba Dissolvable Ltd. (RSL) is occupied with assembling, dispersion, promoting and selling of Truly Refined Rice Wheat Oil (“Rice Grain Oil”). It produced and sells Rice Wheat Oil to FMCG organizations like Mother Dairy Natural product and Vegetable Confidential Restricted, Marico Restricted and Realm Flavors and Food varieties Ltd. The organization additionally produces, markets and sells Rice Wheat Oil under its own brands “Tulsi” and “Sehat” through 38 (38) merchants who thusly offer to different retailers across Maharashtra.

Rice grain oil is the oil separated from the hard external earthy colored layer of rice called ‘wheat’. It is notable for its high smoke point of 232 °C for example 450 °F and gentle flavor, making it fit for high-temperature cooking strategies, for example, pan-searing and profound broiling. It has an optimal equilibrium of Polyunsaturated Fats (PUFA) and Monounsaturated Fats (MUFA), in very nearly a 1:1 proportion. Since rice wheat oil is produced using grain, it is plentiful in Vitamin E, a cancer prevention agent.

The organization likewise creates De-Oiled Rice Grain (DORB), which is a result in the extraction of Rice Wheat Oil and sells equivalent to dairy cattle feed, poultry feed and fish feed in the Territories of Maharashtra, Goa, Gujarat, Madhya Pradesh, Andhra Pradesh, Telangana, Karnataka, Kerala and Tamil Nadu. Other side-effects, for example, unsaturated fat, lecithin, gums, spent earth and wax are sold in the open market. As of the date of recording this deal archive, it had 491 representatives on its finance.

RSL means to set up corn de-oiling fabricating office, bordering its current assembling unit at Brahmapuri, which includes pounding and handling of grains like corn utilizing an interaction called dry-processing. The plant proposed to be introduced depends on “Zero Fluid DisSilo), Dry Processing, Dissolvable Extraction, Stockpiling of Raw petroleum, Refining and Stockpiling of Refined Oil and Bundling in view of the DRI-CORN Innovation.

The de-oiled corn cake got from this cycle alongside de-oiled rice wheat (DORB) from its current assembling offices will be provided to RBS Renewables Private Restricted, a Partner organization, which is setting up Ethanol fabricating unit connecting to its current Brahmapuri unit. The Organization has a 30% (30%) stake in this Partner organization. RSL will go into a course of action with RBS Renewables Private Restricted to supply the de-oiled corn cake and de-oiled rice wheat (DORB).

ISSUE Subtleties/CAPITAL HISTORY:

The organization is emerging with its lady book building course Initial public offering of 5913600 value portions of Rs. 10 each to assemble Rs. 50.27 cr. at the upper cap. It has reported a value band of Rs. 80 – Rs. 85 for every offer. The issue opens for membership on April 15, 2024, and will close on April 18, 2024. The base application to be made is for 1600 offers and in products subsequently, from there on. Post designation, offers will be recorded on NSE SME Arise. The issue comprises 26.73% of the post-Initial public offering settled up capital of the organization. From the net returns of the Initial public offering, it will use Rs. 18.81 cr. for setting up of new assembling office, Rs. 8.42 cr. for reimbursement of specific extraordinary borrowings, Rs. 12.00 cr. for working capital, and the rest for general corporate purposes.

The issue is exclusively lead overseen by Decision Capital Counselors Pvt. Ltd., and Bigshare Administrations Pvt. Ltd. is the enlistment center of the issue. Decision gathering’s Decision Value Broking Pvt. Ltd. is the market producer for the organization.

Having given starting value capital at standard, the organization gave further value capital in the value scope of Rs. 20.00 – Rs. 130.00 per share (based on FV of Rs. 10) between Walk 2014 and November 2023. It has likewise given extra offers in the proportion of 2 for 1 in October 2023. The typical expense of procurement of offers by the advertisers is Rs. 3.33, Rs. 4.90, Rs. 5.07, and Rs. 6.01 per share.

Post-Initial public offering, organization’s ongoing settled up value capital of Rs. 16.21 cr. will stand upgraded to Rs. 22.13 cr. In view of the upper Initial public offering cost band, the organization is searching for a market cap of Rs. 188.07 cr.

Monetary Execution:

On the monetary execution front, for the last three fiscals, the organization has posted a complete income/net benefit of Rs. 427.17 cr. /Rs. 6.17 cr. (FY21), Rs. 585.26 cr. /Rs. 6.59 cr. (FY22), and Rs. cr. /Rs. 13.00 cr. (FY23). For 9M of FY24 finished on December 31, 2023, it procured a net benefit of Rs. 8.29 on an all out income of Rs. 465.70 cr. This shows that the organization is working in a high volume/low edge section.

For the last three fiscals, it has detailed a normal EPS of Rs. 7.07, and a typical RONW of 26.69%. The issue is estimated at a P/BV of 2.45 in light of its NAV of Rs. 34.76 as of Walk 31, 2023, and at a P/BV of 3.74 in light of its post-Initial public offering NAV of Rs. 22.72 per share (at the upper cap). In any case, the NAV information as of December 31, 2023 is absent in the proposition report.

As per the administration, while its FY24 execution might stay same as FY23 because of liberal import of palatable oils in front of decisions and may keep a strain on edge. As the organization is adding de-oiling office and wandering into ethanol mixing through its auxiliary, it will help its top and primary concerns going ahead.

On the off chance that we characteristic annualized FY24 income to its post-Initial public offering completely weakened paid-p capital, then, at that point, the asking cost is at a P/E of 17. In view of FY23 income, the issue is at a P/E of 14.46. Hence the issue shows up completely evaluated.

For the revealed periods, the organization has posted PAT edges of 1.46% (FY21), 1.13% (FY22), 1.86% (FY23), 1.79% (9M-FY24), and RoCE edges of 16.50%, 14.07%, 15.26%, 10.76% separately for the alluded periods.

Profit Strategy:

The organization has not pronounced any profits for the revealed times of the deal archive. It will take on a reasonable profit strategy in view of its monetary presentation and future possibilities.

Correlation WITH Recorded Companions:

According to the deal archive, the organization has shown BCL Ind., Gokul Refoils, Kriti Nutri, and Shri Venkatesh Treatment facilities as their recorded friends. They are exchanging at a P/E of 18.1, 178, 11.9, and 16.8 (as of April 05, 2024). Be that as it may, they are not tantamount on an apple-to-apple premise.

Dealer BANKER’S History:

This is the second order from Decision Capital in the last two fiscals (counting the continuous one), out of which the only one posting opened at a higher cost than expected of 66.67% on the posting day.