Pune E-Stock Broking Limited IPO Subscription and Allotments

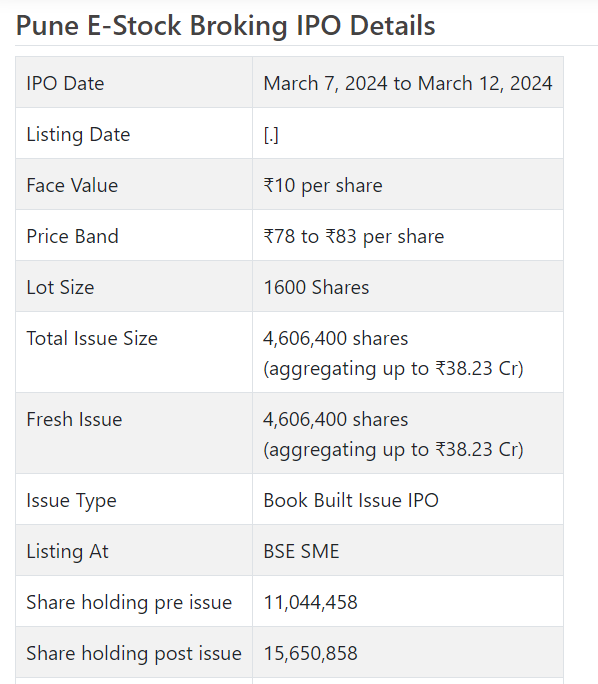

Pune E-Stock Broking Initial public offering is a book fabricated issue of Rs 38.23 crores. The issue is totally a new issue of 46.06 lakh shares.

Pune E-Stock Broking Initial public offering opened for membership on Walk 7, 2024 and will close on Walk 12, 2024. The designation for the Pune E-Stock Broking Initial public offering is supposed to be finished on Wednesday, Walk 13, 2024. Pune E-Stock Broking Initial public offering will list on BSE SME with speculative posting date fixed as Friday, Walk 15, 2024.

Pune E-Stock Broking Initial public offering cost band is set at ₹78 to ₹83 per share. The base parcel size for an application is 1600 Offers. The base measure of venture expected by retail financial backers is ₹132,800. The base parcel size venture for HNI is 2 parts (3,200 offers) adding up to ₹265,600.

• PESB is in the field of monetary administrations with broking business and going into other money related adjusting.

• It checked irregularity in its monetary execution for FY21 to FY23.

• In view of FY24 annualized super profit, the issue shows up completely valued.

• Financial backers might stop assets for the medium to long haul rewards.

ABOUT Organization:

Pune E-Stock Broking Ltd. (PESB) is in the field of monetary administrations, and is known for its critical presence and accomplishments. Established in 2007, Pune E – Stock Broking Restricted (PESB) set out on a surprising excursion that has been described by a progression of key blends, spearheading IT drives, and an unflinching obligation to growing its span and impact inside the monetary administrations area. This exhaustive profile gives a nitty gritty investigation of the critical achievements that poor person just characterized PESB’s remarkable direction throughout the long term however have likewise added to its persevering through progress.

The Organization essentially offers stage to its clients for execution of exchanges (Value, Fates and Choices, Cash, and Item) with the Stock Trade (NSE, BSE, MCX) through CTCL (PC to PC Connection) Terminals, Web Point of interaction and Versatile Application (Android and iOS). Organization’s client base incorporates Approved People (spread across 10+ Urban communities) as well as Immediate Clients. All out count of client was 60,640 as of Walk 2023. The organization has 2 branch workplaces in Ahmedabad and Delhi.

Organization’s business from Approved People (AP) includes enrollment of the AP according to the prerequisites of SEBI and Stock Trades. The AP brings clients by offering every one of the expected administrations like record opening, KYC, exchange execution, question goal and client overhauling at his own expenses. AP chooses how much business to be charged for the clients during the record opening cycle and in light of the characterized piece rates, financier gets charged to client at each exchange. PESB holds a decent piece of that financier for offering the foundation and back-end support. In this way, assortment of all the financier is finished by PESB accounted as Income from tasks and it dispenses the sub-business consistently to the APs accounted as Costs.

All through its excursion, PESB has consistently adjusted to the advancing monetary scene, embracing change and advancement to meet the assorted necessities of its clients and partners. The organization’s business tasks have extended as well as exhibited a hearty capacity to explore intricacies, in this way empowering reliable development and improving its future possibilities.

Alongside stock broking administrations, organization additionally offers subordinate administrations like Edge Exchanging Office, Vault Records, Fixed Store and Common Asset Dissemination. Organization is additionally participated in restrictive exchanging which is right now 0.1% of absolute turnover of the organization and Calculation based exchanging, by which organization needs to have edge from the trades in F&O portion which expects organization to put its asset as security as Fixed Stores with the trades. Banks give twofold openness against such Fixed Stores made with the Banks.

At the core of PESB’s prosperity lies its unflinching obligation to mechanical advancement. The organization has reliably utilized state of the art innovation to improve client encounters and smooth out inward cycles. The presentation of web based exchanging (IBT) altered how clients draw in with the market. It carried accommodation and availability to the front, permitting clients to exchange consistently from the solace of their homes or workplaces. This move met the changing requirements of clients as well as situated PESB as an industry chief in taking on computerized arrangements. PESB’s easy to understand Exchanging Application further exemplified its devotion to mechanical development. The application furnished clients with an incredible asset to deal with their ventures, remain refreshed on market drifts, and execute exchanges in a hurry.

The natural connection point and ongoing information access changed the manner in which clients collaborated with their speculations. PESB Exchanging Application is a shrewd and gotten exchanging stage for Android gadgets which gives consistent exchanging experience stock and wares. It presents Brilliant Administrative center application – an exceptionally simple and helpful that lets one to keep refreshed with live market. One can get to whenever from anyplace to check Record Equilibrium, Stock Status, Vacant Position, Bill Subtleties on one bit of finger. As of September 30, 2023, it had 79 representatives on its finance.

ISSUE Subtleties/CAPITAL HISTORY:

The organization is emerging with its lady book building course Initial public offering of 4606400 value portions of Rs. 10 each to assemble Rs. 38.23 cr. (at the upper cap of the cost band). The organization has declared a value band of Rs. 78 – Rs. 83 for each offer. The issue opens for membership on Walk 07, 2024, and will close on Walk 12, 2024. The base application to be made is for 1600 offers and in products consequently, from that point. Post distribution, offers will be recorded on BSE SME. The issue comprises 29.43% of the post-Initial public offering settled up capital of the organization. From the net returns of the Initial public offering, it will use Rs. 35.00 cr. for working capital, and Rs. 0.20 cr. for general corporate purposes.

The issue is exclusively lead overseen by Offer India Capital Administrations Pvt. Ltd., and Bigshare Administrations Pvt. Ltd. is the enlistment center of the issue. Share India gathering’s Portion India Protections Ltd. is the market producer for the organization.

The organization has given introductory value capital at standard and has given further value shares at a decent cost of Rs. 33.70 in February 2016. The typical expense of procurement of offers by the advertisers is Rs. 6.67, Rs. 12.56, Rs. 13.28, Rs. 14.28, and Rs. 21.24 per share.

Post-Initial public offering, organization’s ongoing settled up value capital of Rs. 11.05 cr. will stand upgraded to Rs. 15.65 cr. In view of the upper Initial public offering cost band, the organization is searching for a market cap of Rs. 129.90 cr.

Monetary Execution:

On the monetary execution front, for the last three fiscals, the organization has (on a merged premise) posted a complete pay/net benefit of Rs. 34.75 cr. /Rs. 6.51 cr. (FY21), Rs. 46.66 cr. /Rs. 10.12 cr. (FY22), and Rs. 41.03 cr. /Rs. 9.65 cr. (FY23). For H1 of FY24 finished on September 30, 2023, it procured a net benefit of Rs. 6.11 cr. on an all out pay of Rs. 30.11 cr.

For the last three fiscals, it has revealed a normal EPS of Rs. 7.81, and a typical RONW of 13.16%. The issue is estimated at a P/BV of 1.11 in light of its NAV of Rs. 74.79 as of September 30, 2023. Initial public offering cost band promotion is feeling the loss of its post-Initial public offering NAV information on the upper and lower cap.

On the off chance that we quality annualized FY24 income to its post-Initial public offering completely weakened paid-p capital, then the asking cost is at a P/E of 10.64. In this way the issue shows up completely valued.

For the revealed periods, the organization has posted PAT edges of 19.98% (FY21), 24.54% (FY22), 26.98% (FY23), 22.90% (H1-FY24), and RoCE edges of 14.54%, 15.79%, 14.77%, 8.25% individually for the alluded periods.

Profit Strategy:

The organization has not announced any profits for the revealed times of the proposition record. It will take on a reasonable profit strategy in light of its monetary exhibition and future possibilities.

Examination WITH Recorded Friends:

According to the proposition report, the organization has shown Offer India Protections, ICICI Protections, and Holy messenger One, as their recorded friends. They are exchanging at a P/E of 16.4, 18.8, and 22.6 (as of Walk 02, 2024). Nonetheless, they are not similar on an apple-to-apple premise.

Vendor BANKER’S History:

This is the eleventh order from Offer India Capital in the last four fiscals, out of the last 10 postings, 4 opened at standard and the rest with charges going from 1.82% to 118.52% on the posting date. There is a befuddle in Annexure A subtleties of the vendor broker (see pages 213 – 214 of the RHP).

End/Speculation Methodology

The organization that is right now giving broking administrations is reflecting on extension of its exercises by adding more portions to be a monetary administrations supplier under one rooftop. However it posted irregularity in its top and primary concerns for FY21 to FY23, its working for H1-FY24 demonstrates the aftereffects of its extension. In view of FY24 annualized profit, the issue shows up completely valued. Financial backers might stop assets for the medium to long haul rewards.

Analyst prescribes Buying into the issue.

Audit By Dilip Davda on Walk 3, 2024

Survey Creator

DISCLAIMER: No monetary data at all distributed anyplace here ought to be understood as a proposal to trade protections, or as counsel to do as such in any capacity at all. All matter distributed here is only for instructive and data purposes just and by no means ought to be utilized for settling on venture choices. My surveys don’t cover GMP market and administrators blueprints. Perusers should counsel a certified monetary consultant prior to pursuing any genuine speculation choices, put together the with respect to data distributed here. With passage hindrances, SEBI maintains that main very much educated financial backers should partake in such offers. With insane postings in the new past, SME Initial public offerings drew the consideration of financial backers in all cases and lead to soothsayer franticness. Nonetheless, as SME issues have section obstructions and proceeded with low inclination from the broking local area, any peruser taking choices in view of any data distributed here does so altogether despite the obvious danger. The above data depends on data accessible as of date combined with market discernments. The Creator has no designs to put resources into this proposition.