Proventus Agrocom Limited IPO May 24 to May 26

Consolidated in 2015, Proventus Agrochem Restricted is a coordinated well-being food brand. The organization has its presence in the whole scope of dry natural products, nuts, seeds, and berries. The result of the organization additionally incorporates different solid eating items across the worth chain.

The witticism of Proventus is to make ability in good food items. They endeavor at building the income stream by getting across the worth chain from beginning to appropriation and making an incorporated plan of action – from “ranch to homes”.

The organization is endeavoring to fill the vacuum in the solid nibbling range in the Indian market, particularly in the dry natural products, nuts, seeds, and berries class.

The results of the organization are promoted under the brand – “ProV”.

The item scope of Proventus Agrochem Restricted incorporates Nuts, Dry Natural products, Seeds, and Berries like:

• Buddy is taken part in the exchanging of coordinated well-being food sources.

• It posted irregularity in its top and main concerns for the detailed periods.

• It caused an enormous misfortune for FY20 and has deciphered its last three fiscals EPS in red.

• Given FY23 working, the issue is forcefully valued limiting all close-term up-sides.

• There is no damage in skirting this expensive bet.

ABOUT Organization:

Proventus Agrocom Ltd. (Buddy) is a coordinated well-being food brand with a presence in the whole scope of dry natural products, nuts, seeds, berries, and sound-eating items across the worth chain. Its methodology in the space centers around enhancing across the crates and heightening presence across the worth chain; eventually, being ‘all in one resource’ for shoppers.

The proverb of Proventus is to make aptitude in quality food items and assemble the income stream by getting across the worth chain from beginning to conveyance and making a coordinated plan of action – from “ranch to homes”. The key foundation of its methodology is to catch the interest and supply stream by fostering a steady base of obtaining and dissemination.

There is a huge vacuum in the “sound eating” space in India particularly in the dry organic products, nuts, seeds, and berries class. Over the most recent couple of years, there has been a change in purchaser inclination from unbranded/free produce to marked items right down to Level 2 city Kirana stores too. As shopper inclination floats towards better quality marked produce, they are searching for a reliable brand offering creative items from normal to enhance expanded solid tidbits – this is where ‘ProV’ is situated with its a great many sound snacks in the dry natural products, nuts, seeds, and berries class. With its Skillet India dispersion and simple accessibility, ProV intends to be THE brand shoppers consider at whatever point they need to purchase nuts or dry natural products.

With developing shopper mindfulness, well-being, and nourishment progressively framing an inseparable property of trendy food culture, our eating things, as well as propensities, are floating towards sound nibbling overall. Likewise, post the Coronavirus pandemic, the world has advanced – be it business or way of life. Furthermore, since this has not been limited simply to metropolitan regions and huge urban communities but on the other hand is creating requests in provincial pockets, solid eating has turned into a main concern. Indian families are probably going to build their spending on wellbeing-centered food varieties and refreshments in the following couple of years, as purchasers are progressively moving to better other options and purchasing food varieties with better fixings.

As well-being and cleanliness progressively become the game changer for buyers, they are presently intentionally keeping away from open unpackaged dry products of the soil nibble contributions. All things being equal, they are progressively moving to bundled dry products of the soil snacks. In the new past, the Coronavirus pandemic alarm and expanded center around the solid way of life have especially given a fillip to such bundled items, in this way expanding their interest. Its exercises are probably going to be upset by the shift of its activity place as its rent is moving past in the close to term and the organization needs to move to new premises. As of Walk 31, 2023, it has in general 39 workers on its finance and 145 provisional work (counting its auxiliary).

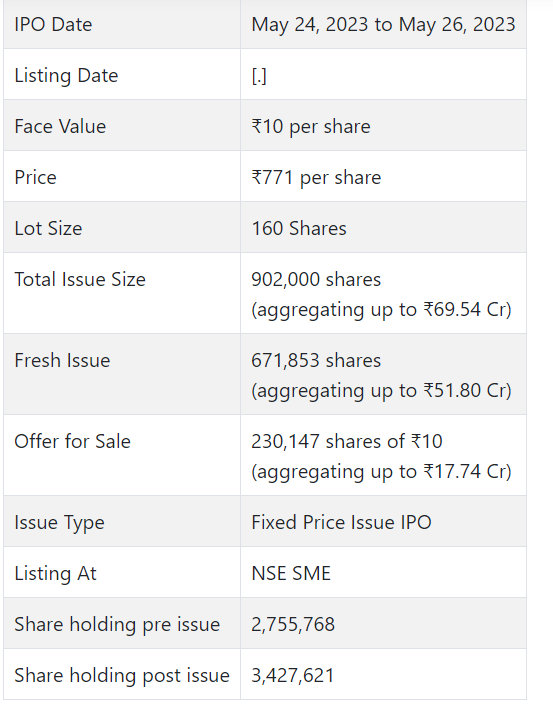

ISSUE Subtleties/CAPITAL HISTORY:

The organization is emerging with a lady Initial public offering of 902000 value portions of Rs. 10 each at a proper cost of Rs. 771 for each offer to activate Rs. 69.54 cr. The issue involves 671853 new value shares (Rs. 51.80cr.) and 230147 value shares (Rs. 17.74 cr.) by Offer available to be purchased (OFS). The issue opens for membership on May 24, 2023, and will close on May 26, 2023. Post portion, offers will be recorded on NSE SME Arise. The issue is 26.32% of the post-Initial public offering settled up capital of the organization. Buddy is spending Rs. 1.74 cr. (counting costs of Rs. 1.25 cr. for new value issue) for this Initial public offering process and from the net returns it will use Rs. 9.91 cr. for working capital and Rs. 29.86 cr. for working capital of its auxiliary – Prov Food Varieties Pvt. Ltd., and Rs. 10.78 cr. for general corporate purposes. Barring the market creator saving a piece of 45100 offers, it has assigned 428450 offers for HNI and 428500 offers for Retail financial backers.

Parfait Capital Consultants Pvt. Ltd. is the sole lead supervisor and Bigshare Administrations Pvt. Ltd. is the recorder of the issue. Ajcon Worldwide Administrations Ltd. is the market creator of the organization.

Having given starting value shares at standard, the organization gave further value partakes in the value scope of Rs. 197 – Rs. 240 between Walk 2016 and June 2017. The typical expense of procurement of offers by the advertisers/selling partners is Rs. 10.00, Rs. 199.34, Rs. 206.00, Rs. 208.14, and Rs. 240.00 per share.

Post-Initial public offering Buddy’s ongoing settled up value capital of Rs. 2.76 cr. will stand improved to Rs. 3.43 cr. In light of the Initial public offering evaluation, the organization is searching for a market cap of Rs. 264.27 cr.

Monetary Execution:

On the monetary execution front, for the last three fiscals, Buddy has posted a turnover/net benefit – (loss) of Rs. 900.89 cr. /Rs. – (21.90) cr. (FY20), Rs. 301.74 cr. /Rs. 1.88 cr. (FY21), and Rs. 404.35 cr. /Rs. 1.14 cr. (FY22). For 9M of FY23 finished on December 31, 2022, it procured a net benefit of Rs. 1.90 cr. on a turnover of Rs. 319.10 cr. Consequently, while its top line checked irregularity post the uncommon fall in FY21, its main concern too posted irregularity.

For the last three fiscals, Buddy has revealed a normal EPS of Rs. – (8.91) and a typical RoNW of 2.43%. The issue is evaluated at a P/BV of 3.45 in light of its NAV of Rs. 223.80 as of December 31, 2022, and at a P/BV of 2.33 given its post-Initial public offering NAV of Rs. 331.05 per share.

On the off chance that we annualize FY23 income and characteristic them to completely weakened post-Initial public offering value capital, then the asking cost is at a P/E of 104.61. In this way, the issue is forcefully evaluated.

Profit Strategy:

The organization has not announced any profits for the detailed times of the proposition archive. It will embrace a judicious profit strategy post-posting, given its monetary presentation and future possibilities.

Examination WITH Recorded Friends:

According to the proposition archive, the organization has shown Krishival Food varieties as their recorded companion. It is right now exchanging at a P/E of 157.56 (as of May 19, 2023). Be that as it may, they are not tantamount on an apple-to-apple premise.

Trader BANKER’S History:

This is the first command from Dessert Capital and has no history of its past presentation.

End/Venture Methodology

The organization works in a profoundly serious and divided portion with numerous large players around. Its new exhibition checked irregularity in its top and primary concerns. In light of the FY23 profit, the issue shows up forcefully evaluated. The post-Initial public offering, small settled-up value capital likewise demonstrates longer incubation for movement to the mainboard. There is no damage in skirting this expensive bet.