Pratham EPC Projects Limited IPO Subscriptions and Allotments

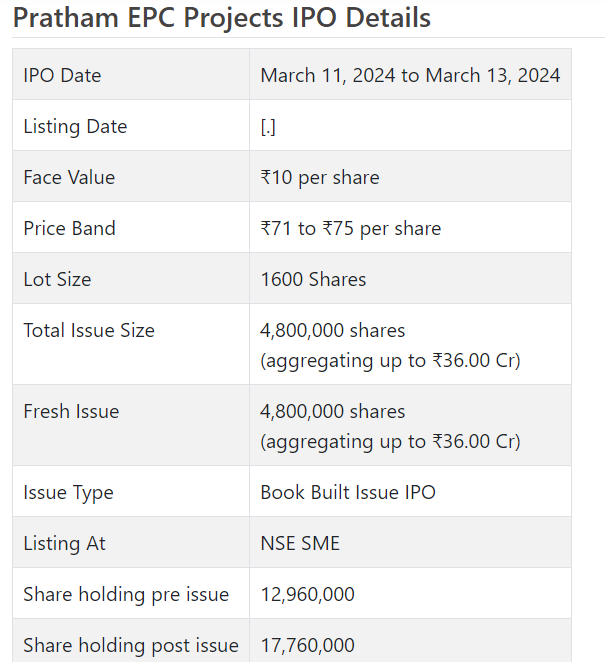

Pratham EPC Ventures Initial public offering is a book fabricated issue of Rs 36.00 crores. The issue is completely a new issue of 48 lakh shares.

Pratham EPC Ventures Initial public offering opens for membership on Walk 11, 2024 and closes on Walk 13, 2024. The apportioning for the Pratham EPC Tasks Initial public offering is supposed to be concluded on Thursday, Walk 14, 2024. Pratham EPC Activities Initial public offering will list on NSE SME with speculative posting date fixed as Monday, Walk 18, 2024.

Pratham EPC Ventures Initial public offering cost band is set at ₹71 to ₹75 per share. The base part size for an application is 1600 Offers. The base measure of venture expected by retail financial backers is ₹120,000. The base parcel size venture for HNI is 2 parts (3,200 offers) adding up to ₹240,000.

• PEPL is an arising player in gas pipeline infra with significant spotlight on crosscountry projects.

• It has eminent client list that incorporates Adani, GAIL, HPCL, BPCL and so forth.

• The organization checked development from FY23 ahead with its engaged crosscountry projects.

• In view of FY24 annualized profit, the issue shows up sensibly estimated.

• Financial backers might stop assets for the medium to long haul rewards.

ABOUT Organization:

Pratham EPC Ventures Ltd. (PEPL) is a coordinated designing, acquisition, development and dispatching organization being ready to go of start to finish specialist co-ops to Oil and Gas dispersion organizations in India. The organization has been executing different gas pipeline project taking care of all pipeline exercises like, mainline welding, tie-in, covering, hydro testing, pipeline authorizing and so on. PEPL works in oil and gas pipelines for crosscountry circulation and city gas appropriation. It additionally attempts seaward activities for water conveyance explicitly project offering and undertaking the board.

PEPL is an Oil and Gas pipeline foundation specialist organization in India, zeroed in on laying pipeline networks alongside development of related offices; and giving Activities and Support administrations to the City Gas Dissemination (“CGD”) Organizations in India. It is a coordinated EPC organization offering a broadened scope of pipeline and unified administrations for oil and gas industry. It offers types of assistance for crosscountry pipeline projects for various applications viz. Oil, gas and water and so on and furthermore attempt Pipeline laying work on Turnkey premise including designing, obtainment, pipeline development for city gas conveyance, even course penetrating, stations including common, electromechanical and instrumentation for clients.

The organization is ISO 10002:2018 confirmed for consumer loyalty and grievance the board framework by Worldwide Principles Enrollments, ISO 14001:2015 ensured for climate the executives framework by Global Norms Enlistments, ISO 18001:2007 guaranteed for Word related Wellbeing and Security the board framework by Worldwide Guidelines Enlistments and ISO 9001:2015 affirmed for quality administration framework by ROHS Affirmation Private Restricted. Its client list incorporates prestigious corporates like ONGC, BPCL, HPCL, Gujarat Gas, GAIL, Adani and so on and is presently having significant spotlight on crosscountry gas pipe line projects.

Throughout the long term, it has effectively executed in excess of 12 undertakings with its major finished projects evaluating to roughly Rs. 131.84 cr. Its execution capacities have developed altogether with time, both regarding the size of undertakings that it offers for and execute, and the quantity of ventures that it executes all the while. As of February 23, 2024, the organization had 8 significant on-going ventures out of which 7 activities worth roughly Rs. 296.66 cr. has been affirmed in light of Letter of Portion/Buy Request for which Rs. 240.16 cr. worth undertaking execution is forthcoming and 1 venture has been finished with Buy Request, which is worth roughly Rs. 406.67 cr., in light of the executives gauges, areas of strength for recommending book. As of September 30, 2023, it had 770 workers on its finance.

ISSUE Subtleties/CAPITAL HISTORY:

The organization is emerging with its lady book building course Initial public offering of 4800000 value portions of Rs. 10 each to prepare Rs. 36.00 cr. (at the upper cap). It has reported a value band of Rs.71-Rs.75 per share. The issue opens for membership on Walk 11, 2024, and will close on Walk 13, 2024. The base application to be made is for 1600 offers and in products subsequently, from that point. Post allocation, offers will be recorded on NSE SME Arise. The issue comprises 27.03% of the post-Initial public offering settled up capital of the organization. From the net returns of the Initial public offering, it will use Rs. 8.84 cr. for acquisition of hardware, Rs. 15.15 cr. for working capital and the rest for general corporate purposes.

The issue is exclusively lead overseen by Straight shot Capital Counsels Pvt. Ltd., and Connection Intime India Pvt. Ltd. is the recorder of the issue. Shortcut Gathering’s Spread X Protections Pvt. Ltd. is the market producer for the organization.

The organization has given whole value capital at standard up to this point and has likewise given extra offers in the proportion of 15 for 1 in July 2023. The typical expense of obtaining of offers by the advertisers is Rs. 0.62 per share.

Post-Initial public offering, organization’s ongoing settled up value capital of Rs. 12.96 cr. will stand upgraded to Rs. 17.76 cr. In view of the upper Initial public offering cost band, the organization is searching for a market cap of Rs. 133.20 cr.

Monetary Execution:

On the monetary execution front, for the last three fiscals, the organization has posted a complete pay/net benefit of Rs. 30.85 cr. /Rs. 1.13 cr., (FY21), Rs. 50.63 cr. /Rs. 4.41 cr. (FY22), and Rs. 51.67 cr. /Rs. 7.64 cr. (FY23). For H1 of FY24 finished on September 30, 2023, it procured a net benefit of Rs. 5.23 cr. on an all out pay of Rs. 35.81 cr.

On a merged premise, for the last two fiscals, it posted an all out pay/net benefit of Rs. 50.63 cr. /Rs. 4.42 cr. (FY22), and Rs. 51.69 cr. /Rs. 7.66 cr. (FY23). For H1 of FY24 finished on September 30, 2023, it procured a net benefit of Rs. 5.24 cr. on a complete pay of Rs. 36.30 cr. However it stamped static top lines for FY22 and FY23, it checked quantum bounce in its main concern, that causes a stir. The flood went on for H1 of FY24 also. As per the administration, this is credited to their significant spotlight on crosscountry high edge projects.

For the last three fiscals, it has detailed a normal EPS of Rs. 4.23, and a typical RONW of 38.66%. The issue is evaluated at a P/BV of 4.19 in view of its NAV of Rs. 17.91 as of September 30, 2023, and at a P/BV of 2.25 in light of its post-Initial public offering NAV of Rs. 33.34 per share (at the upper cap).

On the off chance that we characteristic annualized FY24 income to its post-Initial public offering completely weakened paid-p capital, then, at that point, the asking cost is at a P/E of 12.71.

For the revealed periods, the organization has posted PAT edges of 3.69% (FY21), 8.74% (FY22), 15.22% (FY23), 15.26% (H1-FY24), and RoCE edges of 27.40%, 61.54%, 48.40%, 24.81% individually for the alluded periods.

Profit Strategy:

The organization has not pronounced any profits for the revealed times of the proposition report. It will embrace a judicious profit strategy in light of its monetary presentation and future possibilities.

Correlation WITH Recorded Friends:

According to the proposition record, the organization has shown Likhitha Infra as their recorded companions. It is exchanging at a P/E of 16.4 (as of Walk 05, 2024). Nonetheless, they are not similar on an apple-to-apple premise.

Vendor BANKER’S History:

This is the 32nd command from Direct route Capital in the last two fiscals, out of the last 10 postings, all opened at charges going from 6.58% to 200.00% on the date of posting. Nonetheless, the proposition archive is feeling the loss of its year-wise count data.

End/Venture Methodology

The organization is arising player in gas pipeline framework related benefits and making strides with its crosscountry centered projects. It stamped flood in benefits from FY23 onwards with its changed methodology. It has great client list. In light of FY24 profit, the issue shows up sensibly evaluated. Financial backers might stop assets for the medium to long haul rewards.