Popular Vehicles & Services Limited IPO Subscription and Allotments

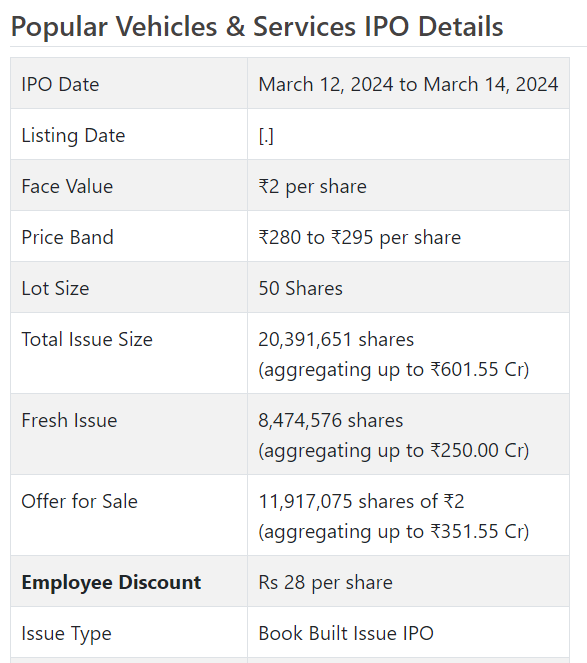

Famous Vehicles and Administrations Initial public offering is a book constructed issue of Rs 601.55 crores. The issue is a mix of new issue of 0.85 crore shares collecting to Rs 250.00 crores and make available for purchase of 1.19 crore shares conglomerating to Rs 351.55 crores.

Famous Vehicles and Administrations Initial public offering opens for membership on Walk 12, 2024 and closes on Walk 14, 2024. The portion for the Famous Vehicles and Administrations Initial public offering is supposed to be finished on Friday, Walk 15, 2024. Famous Vehicles and Administrations Initial public offering will list on BSE, NSE with conditional posting date fixed as Tuesday, Walk 19, 2024.

Famous Vehicles and Administrations Initial public offering cost band is set at ₹280 to ₹295 per share. The base parcel size for an application is 50 Offers. The base measure of venture expected by retail financial backers is ₹14,750. The base parcel size venture for sNII is 14 parts (700 offers), adding up to ₹206,500, and for bNII, it is 68 parcels (3,400 offers), adding up to ₹1,003,000.

• PVSL is one of the enhanced forerunner in car showroom and adjusting portion.

• It at present works in four states with 400 touch focuses.

• The organization stamped development in its top and primary concerns for the announced periods.

• In light of FY24 annualized profit, the issue shows up completely valued.

• Financial backers might stop assets for the medium to long haul rewards.

ABOUT Organization:

Well known Vehicles and Administrations Ltd. (PVSL) is a broadened vehicle showroom in India as far as income as of Monetary 2023, (Source: CRISIL Report) having a completely coordinated plan of action. It takes care of the total life pattern of vehicle possession, right from the offer of new vehicles, adjusting and fixing vehicles, circulating extra parts and frill, to working with deal and trade of used cars, working driving schools and working with the offer of outsider monetary and protection items.

PVSL orders its car showroom business into three key portions, to be specific, (a) traveler vehicles including extravagance vehicles, (b) business vehicles and (c) electric bike and three-wheeler vehicles, which added to its income from tasks amassing to Rs. 1691.85 cr., Rs. 961.63 cr., and Rs. 45.04 cr., separately, during the a half year’s time frame finished September 30, 2023. It work (a) traveler vehicle showrooms covering economy, premium and extravagance vehicles across showrooms for the OEMs like: (I) Maruti Suzuki India Restricted (“Maruti Suzuki”) for both Field and Nexa, through the Organization, (ii) Honda Vehicles India Restricted (“Honda”) through its Auxiliary, VMPL, and (iii) Puma Land Meanderer India Restricted (“JLR”) through its Auxiliary, PAWL; (b) business vehicle showrooms of (I) Goodbye Engines Restricted (“Goodbye Engines (Commercial)”), through its Auxiliary, PMMIL and (ii) Daimler India Business Vehicles Private Restricted (“BharatBenz”), through its Auxiliary, PMPL; and (c) electric three-wheeler vehicle showroom of Piaggio Vehicles Private Restricted, including business and freight vehicles (“Piaggio”), through its Auxiliary, KGPL and electric bike vehicle showroom of Ather Energy Private Restricted (“Ather”), through its Auxiliary, KCPL. The organization has numerous firsts amazingly for JV/association with new OEM for its showroom and adjusting focus in the states it presently works.

Its presence across vehicle classifications, including traveler vehicles, business vehicles, and electric bike and three-wheeler vehicles, further broadens organization’s income streams. As of December 31, 2023, the organization worked through its organization of 61 display areas, 133 deals outlets and booking workplaces, 32 used car display areas and outlets, 139 approved help habitats, 43 retail outlets, and 24 distribution centers situated across 14 locale of Kerala, 8 regions in Karnataka, 12 locale in Tamil Nadu and 9 locale in Maharashtra. While its business outlets and booking workplaces supplement deals through its display areas, its retail outlets work with deal and dispersion of extra parts and frill.

The auto business is one of the essential supporters of the Indian economy. Its commitment to India’s Gross domestic product has expanded from 2.80% in Financial 1993 to roughly 7.10% in Monetary 2023. India’s homegrown car market is one of the biggest car markets on the planet, with yearly homegrown deals of north of 20 million vehicles in Monetary 2023.

PVSL procured 11 help habitats and 2 display areas from a vendor of Maruti Suzuki in Kerala in 2021. Further, it gained 8 display areas, 17 assistance places and 3 deals outlets and booking workplaces of BharatBenz in Tamil Nadu and Maharashtra. It has additionally extended post-deal administrations and fix verticals in the last three Fiscals. As of December 31, 2023, it had 10468 workers on its finance.

ISSUE Subtleties/CAPITAL HISTORY:

The organization is emerging with its lady combo book building course Initial public offering of new value shares worth Rs. 250 cr. (approx. 8474600 offers at the upper cap), and a Proposal available to be purchased (OFS) of 11917075 offers (worth Rs. 351.55 cr. at the upper cap). Subsequently the general size of the Initial public offering will be of 20391675 offers worth Rs. 601.55 cr. (at the upper cost band). The organization has declared a value band of Rs. 280 – Rs. 295 for each portion of Rs. 2 each. The base application to be made is for 50 offers and in products subsequently, from there on. The issue opens for membership on Walk 12, 2024, and will close on Walk 14, 2024. Post designation, offers will be recorded on BSE and NSE. The issue comprises 28.64% of the post-Initial public offering settled up capital of the organization. From the net returns of the new value issue, it will use Rs. 192.00 cr. for reimbursement/prepayment of specific borrowings by the organization and its auxiliaries, and the rest for general corporate purposes.

The organization has saved shares worth Rs. 1.00 cr. for its qualified representatives and offering them a rebate of Rs. 28 for every offer. From the rest, it has assigned not over half for QIBs, at the very least 15% for HNIs and at the very least 35% for Retail financial backers.

The three Book Running Lead Supervisors (BRLMs) to this issue are ICICI Protections Ltd., Nuvama Abundance The executives Ltd., and Centrum Capital Ltd., while Connection Intime India Pvt. Ltd.is the recorder of the issue.

Having given starting value shares at standard worth, the organization gave/changed over additional value partakes in the value scope of Rs. 20.00 – Rs. 97.51 per divide among December 2015 and September 2018. It has likewise given extra offers in the proportion of 3 for 1 in September 2010, 11 for 5 in September 2018. The typical expense of procurement of offers by the advertisers/selling partners is Rs. 3.17, Rs. 3.50, and Rs. 27.28 per share.

Post-Initial public offering, organization’s ongoing settled up value capital of Rs. 12.54 cr. will stand improved to Rs. 14.24 cr. In light of the upper cap of the Initial public offering cost band, the organization is searching for a market cap of Rs. 2100.28 cr.

Monetary Execution:

On the monetary execution front, for the last three fiscals, the organization has posted all out pay/net benefit of Rs. 2919.25 cr. /Rs. 32.46 cr. (FY21), Rs. 3484.20 cr. /Rs. 33.67 cr. (FY22), and Rs. 4892.63 cr. /Rs. 64.07 cr. (FY23). For H1 of FY24 finished on September 30, 2023, it procured a net benefit of Rs. 40.04 cr. on a complete pay of Rs. 2848.21 cr. In this way it posted development in its top and main concerns. It has stamped better edges from FY23 onwards.

According to the genius forma combined monetary outcomes for FY23, it denoted a net benefit of Rs. 67.46 cr. on an all out pay of Rs. 5154.03 cr.

For the last three fiscals, the organization detailed a normal EPS of Rs. 7.76, and a typical RoNW of 15.55%. The issue is valued at a P/BV of 4.82 in light of its NAV of Rs. 61.26 as of September 30, 2023, and at a P/BV of 3.54 in view of its post-Initial public offering NAV of Rs. 83.30 per share (at the upper cap).

On the off chance that we trait FY24 annualized income to its post-Initial public offering completely weakened settled up value capital, then the asking cost is at a P/E of 26.22. Subsequently the issue shows up completely valued. The administration is sure of keeping up with the patterns proceeding with its item blend in with high edge business.

For the detailed periods, it has revealed a PAT edges of 1.11% (FY21), 0.97% (FY22), 1.31% (FY23), 1.41% (H1-FY24), and RoCE edges of 17.09%, 16.79%, 18.32%, 8.83% separately for the alluded periods.

Profit Strategy:

The organization has not delivered any profits for the revealed times of the proposition record. It has proactively taken on a profit strategy in June 2021, in light of its monetary exhibition and future possibilities.

Correlation WITH Recorded Friends:

According to the deal archive, the organization has shown Milestone Vehicles at their recorded companions. It is exchanging at a P/E of 40.8 (as of Walk 06, 2024). Be that as it may, they are not practically identical on an apple-to-apple premise.

Trader BANKER’S History:

The three BRLMs related with the issue have taken care of 72 public issues in the beyond 3 years, out of which 23 issues shut underneath the proposition cost on the posting date.

End/Venture Technique

However the organization has presence in four states, it has more than 400 touch focuses and that makes it the forerunner in the fragment with an organization with a front running Indian player Maruti. The organization will keep on moving its item blend to work on its main concerns. In view of FY24 annualized profit, however the issue shows up completely evaluated, it merits considering for the medium to long haul rewards.