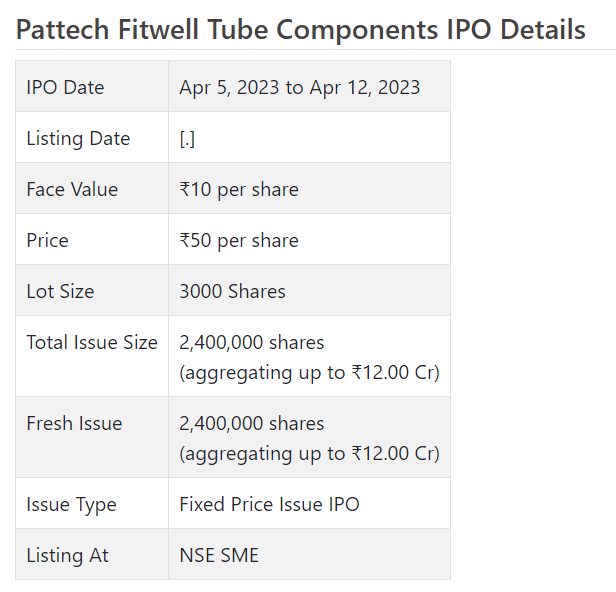

Pattech Fitwell Tube Components Limited IPO April 05 to April 12

Consolidated in 2022, Pattech Fitwell Cylinder Parts Restricted started its excursion 10 years prior in the year 2012. The organization participated in the assembling of fashioning items for the non-car area.

Pattech Fitwell has an all-out introduced limit of 14104.13 MTPA for assembling fashioned spines, complicated and concentrated machined parts, and welded congregations in the space of open kick-the-bucket forgings. They convert semifinished/crude items to completed items by doing different worth-added processes like framing, twisting, penetrating, cutting, examination, cleaning, painting, impacting, welding, punching, checking, testing, and bundling.

RISK According to THE Primary ISSUE

This being the primary public issue of our Organization, there has been no proper market for the Value Offers. The presumptive worth of the Value Offers is ₹ 10/ – each and the Issue Cost

is [●] seasons of the presumptive worth of the Value Offers. The not set in stone and legitimized by our Organization in conference with the Lead Administrator as expressed in “Reason for

Issue Cost” on page 79 of this Draft Plan ought not to be taken to be characteristic of the market cost of the Value Offers after the Value Offers are recorded. No affirmation

can be given concerning a functioning or supported exchanging of the Value Offers or in regards to the cost at which the Value Offers will exchange after the list.

GENERAL Dangers

Interests in Value and Value related protections imply a level of hazard and financial backers shouldn’t put any subsidies on this Issue except if they can bear to face the challenge of

losing their speculation. Financial backers are encouraged to peruse the gamble factors cautiously before taking a speculation choice in this contribution. For taking a speculation choice, financial backers

should depend on their assessment of our Organization and the Issue, including the dangers, implied. The Value Offers presented in the Issue have not been suggested nor

supported by the Protections and Trade Leading body of India (“SEBI”) nor does the Protections and Trade Leading group of India ensure the precision or ampleness of this Draft Plan.

Explicit consideration of the financial backers is welcome in the section named “Hazard Variables” starting this Draft Outline.

COMPANY’S Outright Liability

Our Organization, having made every single sensible request, acknowledges liability regarding and affirms that this Draft Plan contains all data concerning our Organization

furthermore, the Issue, which is material with regards to the Issue, that the data contained in this Draft Outline is valid and correct in every material angle and isn’t deluding

in any material regard, that the conclusions and expectations communicated thus are held and that there could be no different realities, the oversight of which makes this Draft Plan

overall or any of such data or the outflow of any such conclusions or expectations deceiving in any material regard.

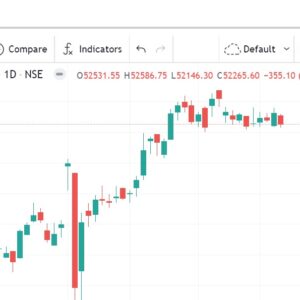

Posting

The Value Offers presented through this Draft Outline are proposed to be recorded on the Arise foundation of NSE India (‘NSE’), regarding the Section IX of the SEBI

(ICDR) Guidelines, 2018, as altered every once in a while. Our Organization has gotten an In – Guideline endorsement letter dated [•] from NSE Restricted.

RISK Variables

An interest in our Value Offers implies a specific level of chance. You ought to painstakingly think about all the data in this Draft Plan, including the dangers and vulnerabilities portrayed beneath, previously

making an interest in our Value Offers. The dangers depicted beneath are by all accounts not the only ones applicable to us or our Value Offers or the business in which we work. Extra dangers and vulnerabilities not by and by known to us or that we presently consider unimportant may likewise hinder our organizations, consequences of tasks, monetary condition, and incomes. Assuming any of the accompanying dangers or different dangers that are not as of now known or are right now considered unimportant happen, our organizations, aftereffects of tasks, monetary condition, and incomes could endure, and the exchanging cost of our Value Offers could decline, and you might lose all or part of your speculation. Planned financial backers ought to peruse this part related to “Business Outline”, “Industry Outline” and “The executives’ Conversation and Investigation of Monetary Condition and Consequences of Tasks” starting on pages 99, 87, and 192, separately,

as well as the monetary and other data contained in, this Draft Plan. Imminent financial backers ought to give specific consideration to the way that our Organization is integrated under

the laws of India and is dependent upon a legitimate and administrative climate which might vary in specific regards from that of different nations. This Draft Outline likewise contains forward-looking articulations that include chances, suppositions, appraisals, and vulnerabilities. Our genuine outcomes could contrast from those expected in these forward-looking explanations because of specific variables, including the contemplations portrayed underneath and somewhere else in this Draft Outline. For additional subtleties, if it’s not too much trouble, see the part named

“Forward-Looking Articulations” starting on page 15 of this Draft Plan. Except if generally demonstrated or setting requires in any case, the monetary data included in this is

gotten from our Repeated Monetary Data for quite a long period finished on November 30, 2022, furthermore, for the monetary year finished 2022, the monetary year finished 2021 and monetary year finished 2020 remembered for this Draft Plan. Except if determined or measured in the pertinent gamble factors beneath, we are not in that frame of mind to evaluate the monetary or different ramifications of any of the dangers portrayed in this segment. In making a speculation choice, planned financial backers should depend on their assessment of our Organization and the provisions of the Issue including the benefits and dangers implied. You ought to counsel your assessment, monetary and legitimate guides about the specific outcomes to you of interest in our Value Offers.

Inward Gamble Elements

1. We are exceptionally reliant upon our providers for a continuous stockpile of unrefined components. We have not gone into any drawn-out supply arrangement for the significant unrefined substances expected for

assembling our items. Likewise, unpredictability in the costs and non-accessibility of these crude materials might have an unfavorable effect on our business possibilities, consequences of tasks, and

monetary conditions. Our best 10 providers 86.14%, 73.09%, 84.27%, and 48.48% % months time span finished November 30, 2022, Monetary Year finished Walk 31, 2022, Monetary Year finished Walk 31, 2021 and Monetary Year finished Walk 31, 2020 individually for the supply of our superb natural substance, for example, CS, AS and SS pipes, curls, plates, designs and forgings. We acquire our stockpile of crude materials from different merchants on the lookout. We have not gone into any drawn-out supply arrangement for the significant unrefined components. At present, we have had the option to convenient secure

a supply of the required natural substances for our current action. The natural substance is effectively accessible in the homegrown market and no trouble is visualized in obtaining the unrefined substance. In the event of any disturbance in the supply of unrefined substances from these providers/merchants or our acquirement of crude materials based on conditions that are not good for us; will unfavorably influence our tasks and monetary cost. Further on the off chance that our Organization can’t acquire the essential amounts of unrefined components well in time and at cutthroat costs because of unpredictability in the costs of natural substances, the execution of our Organization might be impacted, consequently unfavorably influencing our business, possibilities,

aftereffects of activities and monetary condition.