Omfurn India Limited FPO Subscription and allotments

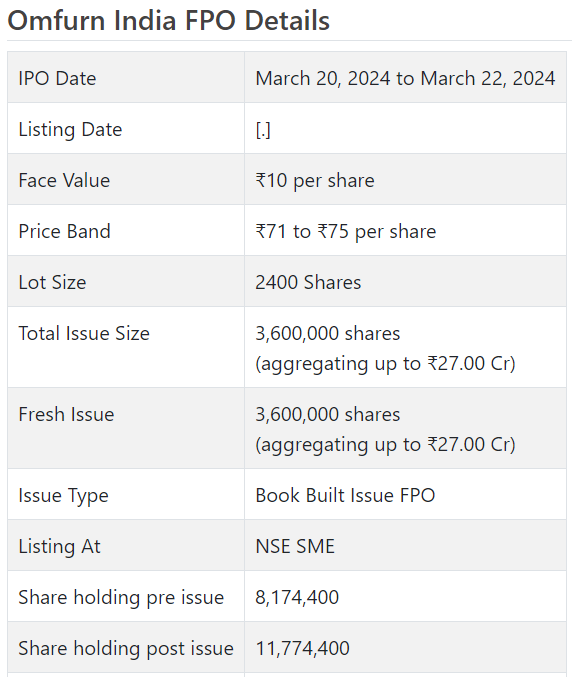

Omfurn India FPO is a book fabricated issue of Rs 27.00 crores. The issue is completely a new issue of 36 lakh shares.

Omfurn India FPO opens for membership on Walk 20, 2024 and closes on Walk 22, 2024. The apportioning for the Omfurn India FPO is supposed to be concluded on Tuesday, Walk 26, 2024. Omfurn India FPO will list on NSE SME with speculative posting date fixed as Thursday, Walk 28, 2024.

Omfurn India FPO cost band is set at ₹71 to ₹75 per share. The base parcel size for an application is 2400 Offers. The base measure of speculation expected by retail financial backers is ₹180,000. The base part size speculation for HNI is 2 parcels (4,800 offers) adding up to ₹360,000.

• OIL is taken part in the assembling and showcasing of pre-completed wooden entryways and measured furnishings.

• After misfortune for FY21 because of pandemic, it checked development in top and primary concerns.

• The unexpected lift in its top and main concerns from FY23 forward causes a stir.

• It is working in a profoundly cutthroat and divided section.

• In view of FY24 annualized super profit, the issue shows up completely evaluated.

• All around informed financial backers might stop moderate asset for the medium term rewards.

Prelude:

The RHP is dated Walk 14, 2024, for this FPO, however till Sunday early afternoon, this was not accessible on NSE SME site. The organization accompanied its lady Initial public offering in Sept./Oct. 2017 at a cost of Rs. 23 for every offer to activate Rs. 4.17 cr. (1812000 offers). For Initial public offering the order was with Sarthi Capital Counselors Pvt. Ltd. For FPO, the order is given to Gretex Corporate Administrations Ltd. For Initial public offering, it gave command to Decision Value Broking Pvt. Ltd. what’s more, presently for this FPO, Gretex gathering’s Gretex Offer Broking Ltd. is the market producer. The FPO is of 3600000 portions of Rs. 10 each with a value band of Rs. 71 – Rs. 75 for every offer to prepare Rs. 27.00 cr. at the upper cap. The last exchanged cost of the scrip is Rs. 82.00 per share on NSE SME as of Walk 15, 2024. Its higher part of 2400 offers against typical 1600 offers is maybe because of its ongoing exchanging market parcel on NSE.

ABOUT Organization:

Omfurn India Ltd. (OIL) is producer and provider of Pre-Completed Wooden Entryways and Particular Furniture in India. It has been doing business since November 13, 1997. From that point forward, the organization has been arriving at surprising achievements in creation and advancement. It makes a large number of wooden entryways and furniture for Measured Kitchens, Closets, Vanities and Present day Office furniture through redid, framework based, or turnkey projects Container India, got recorded in NSE the year 2017.

Its group comprises of experts spent significant time in their separate fields. A group of specialized regulatory, project faculty and designers work related to engineers, inside fashioners, the board staff, and so on, to offer the best achieved outfitted items. OIL is profoundly dedicated to its obligation to nature and planet Earth.

Its assembling manufacturing plant in Umbergaon has an all out area of 1,61,460 sq. ft. to increment producing limit and started assembling of furniture for premium lodgings. The processing plant is furnished with the most recent CNC carpentry machine from Germany and Italy. It likewise has an in-house plan office that gives total furniture arrangements, remembering consistent advancements in global plans. As of November 30, 2023, it had 221 representatives on its finance.

ISSUE Subtleties/CAPITAL HISTORY:

The organization is emerging with its Follow-on Open Proposition (FPO) of 3600000 value portions of Rs. 10 each to prepare Rs. 27.00 cr. at the upper cap. It has reported a value band of Rs. 71 – Rs. 75 for every offer. The issue opens for membership on Walk 20, 2024, and will close on Walk 22, 2024. The minim um application to be made is for 2400 offers and in products subsequently, from that point. Post assignment, offers will be recorded on NSE SME Arise. The issue is 30.57% of the post-FPO settled up capital of the organization. From the net returns of the Initial public offering, it will use Rs. 11.75 cr. for capex on plant and apparatus and related infra expenses, Rs. 1.25 cr. for reimbursement of specific borrowings, and Rs. 7.50 cr. cr. for working capital and the rest for general corporate purposes.

The issue is exclusively lead overseen by Gretex Corporate Administrations Ltd., and Bigshare Administrations Pvt. Ltd. is the enlistment center of the issue. Gretex Gathering’s Gretex Offer Broking Ltd. is the market producer for the organization.

The organization has given introductory value capital at standard, and has given further value share by means of Initial public offering at a cost of Rs. 23 for each offer in October 2017. It has additionally given extra offers in the proportion of 9 for 1 in Walk 2007, 9 for 1 in February 2017, and 1 for 5 in October 2023.The normal expense of securing of offers by the advertisers is Rs. Nothing per share. In any case, the Initial public offering was made at Nothing cost according to the deal report (Allude page no. 60)

Post-FPO, organization’s ongoing settled up value capital of Rs. 8.17 cr. will stand upgraded to Rs. 11.77 cr. In view of the upper Initial public offering cost band, the organization is searching for a market cap of Rs. 88.31 cr.

Monetary Execution:

On the monetary execution front, for the last three fiscals, the organization has posted a complete pay/net benefit/ – (loss) of Rs. 21.85 cr. /Rs. – (0.99) cr. (FY21), Rs. 32.30 cr. /Rs. 0.60 cr. (FY22), and Rs. 71.08 cr. /Rs. 4.15 cr. (FY23). For H1 of FY24 finished on September 30, 2023, it procured a net benefit of Rs. 2.89 cr. on an all out pay of Rs. 44.75 cr. Subsequently most recent year and a half’s unexpected lift in its top and primary concern cause a stir and worry over its maintainability proceeding.

For the last three fiscals, it has revealed a normal EPS of Rs. 2.58, and a typical RONW of 8.19%. The issue is evaluated at a P/BV of 2.14 in view of its NAV of Rs. 35.02 as of September 30, 2023, and at a P/BV of 1.59 in light of its post-Initial public offering NAV of Rs. 47.25 per share (at the upper cap).

On the off chance that we characteristic annualized FY24 income to its post-FPO completely weakened paid-p capital, then the asking cost is at a P/E of 15.27. In view of FY23 profit, the P/E remains at 21.31. Hence the FPO shows up completely estimated.

For the revealed periods, the organization has posted PAT edges of – (0.05) % (FY21), 0.02% (FY22), 0.06% (FY23), 0.07% (H1-FY24), and RoCE edges of 1.79%, 5.39%, 19.36%, 10.28% individually for the alluded periods.

Profit Strategy:

The organization has not announced any profits for the detailed times of the proposition archive. It will take on a reasonable profit strategy in light of its monetary presentation and future possibilities.

Examination WITH Recorded Friends:

According to the proposition archive, the organization has no recorded companions to contrast and.

Vendor BANKER’S History:

This is the 23rd order from Gretex Corporate in the last three fiscals, out of the last 10 postings, 2 opened at markdown, and the rest with charges going from 27.00% to 187.36% upon the arrival of posting.