Nifty and Banknifty full analysis on 13th march 2024

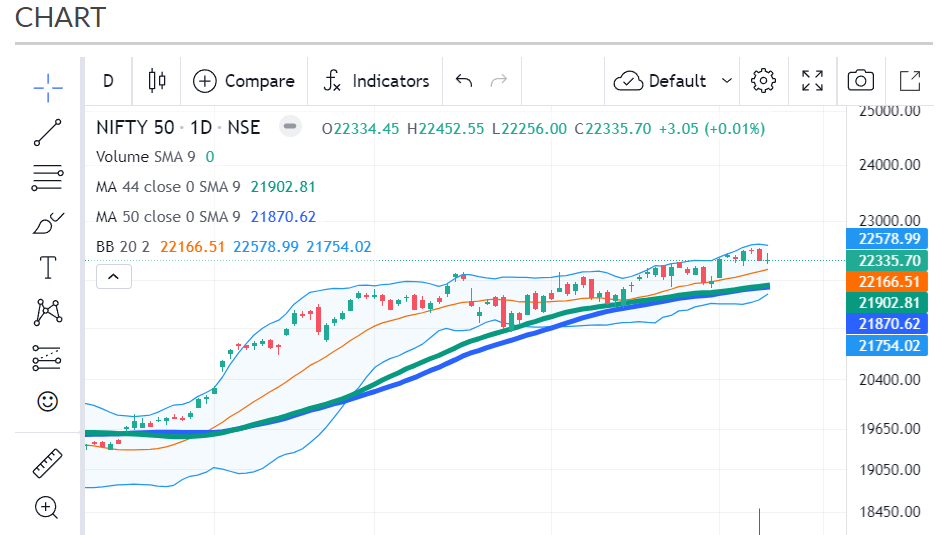

The Nifty 50 stayed unstable and shut the meeting on a level note, Walk 12, while protecting 10-day EMA (put at 22,318). The development of Doji candle design on the everyday graphs showed uncertainty among bulls and bears about future market pattern, subsequently specialists feel 22,500 is supposed to be urgent for additional vertical excursion in the file, with help at 22,200 (which somewhat agrees with 21-day EMA – outstanding moving normal).

The Nifty 50, subsequent to getting going Tuesday’s exchange level at 22,334, hit an intraday high of 22,453 and low of 22,256. The file, after unpredictability, settled at 22,336, up 3.05 places and the development of Doji implies the end was like opening levels.

“The development of a Doji candle recommends hesitation at current levels, and a breakout on either side could prompt moving moves,” said Kunal Shah, senior specialized and subsidiary examiner at LKP Protections.

He feels the quick obstruction for Nifty 50 is at 22,500, and a break over this on an end premise would flag a resumption of the vertical development.

Alternately, the prompt help is situated at 22,200-22,150, and supporting over this level could observer some recuperation in the record, he said.

Choices information showed that 22,500 is supposed to stay key obstruction region for the Clever 50, with help at 22,300.

On the Call side, the greatest open interest was apparent at 22,500 strike, trailed by 23,000 and 22,800 strikes, with significant composition at 22,800 strike, then, at that point, 22,900 and 22,400 strikes, while on the Put side, the 22,000 strike possessed the most extreme open interest, trailed by 22,300 and 21,500 strikes, with composing at 22,000 strike, then 22,100 and 22,300 strikes.

Bank Nifty

The Bank Nifty was additionally unstable and exchanged 900-point range during the day. It has tried the 20-day moving normal (46,900) as well as 21-day EMA (46,940) and saw a fair pullback to deter day’s low, down 45 focuses at 47,282.

The financial list has likewise shaped Doji or High Wave sort of candle design on the day to day outlines, demonstrating the back-and-forth among bulls and bears.

“Vital help for Bank Nifty is set at 47,000 – 46,900 while opposition is set in the zone 47,820 – 48,000,” Jatin Gedia, specialized research expert at Sharekhan by BNP Paribas said.

The more extensive business sectors fell more than benchmark lists given the expansiveness for bears. The Nifty Midcap 100 list dropped 1.4 percent and Smallcap 100 record declined 2%.

Disclaimer: The perspectives and speculation tips communicated by venture specialists on Moneycontrol.com are their own and not those of the site or its administration. Moneycontrol.com encourages clients to check with confirmed specialists prior to taking any speculation choices.