Naman In-Store (India) Limited IPO Subscription and Allotments

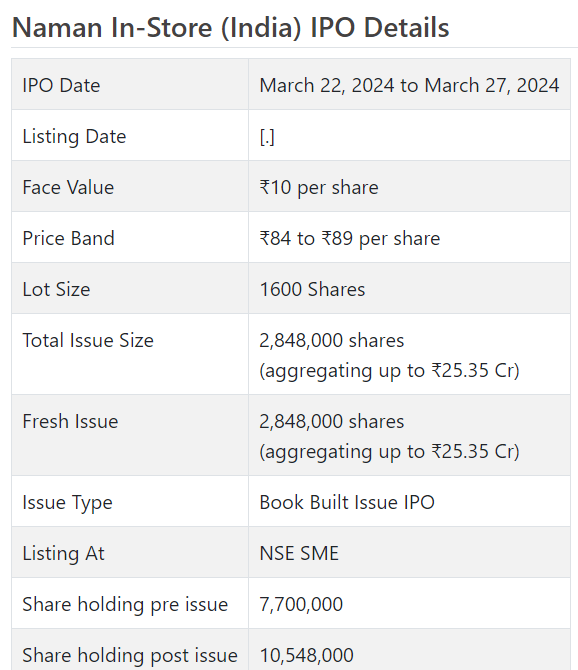

Naman Coming up (India) Initial public offering is a book constructed issue of Rs 25.35 crores. The issue is completely a new issue of 28.48 lakh shares.

Naman Coming up (India) Initial public offering opened for membership on Walk 22, 2024 and will close on Walk 27, 2024. The distribution for the Naman Coming up (India) Initial public offering is supposed to be concluded on Thursday, Walk 28, 2024. Naman Coming up (India) Initial public offering will list on NSE SME with speculative posting date fixed as Tuesday, April 2, 2024.

Naman Coming up (India) Initial public offering cost band is set at ₹84 to ₹89 per share. The base part size for an application is 1600 Offers. The base measure of speculation expected by retail financial backers is ₹142,400. The base part size speculation for HNI is 2 parcels (3,200 offers) adding up to ₹284,800.

• NIIL is taken part in retail furniture and apparatuses show and promoting.

• It has wide item range contributions to meet the prerequisites of its B2B clients.

• The organization posted development in its top and main concerns for the announced periods.

• The unexpected lift in top and primary concerns from FY23 cause a stir.

• In light of FY24 annualized super profit, the issue is completely valued.

• All around informed financial backers might stop moderate assets for medium term rewards.

Prelude:

However the Initial public offering is opening on 22.03.24, and the RHP is dated 16.03.24, the proposition archive was not recorded on assigned trade site till the evening of 18.03.24. This is the way the compliances are stuck to. The super edges posted for H1 of FY24 seems to have been created to match the asking cost. The deal report has obscured connections of budget summaries.

ABOUT Organization:

Naman available (India) Ltd. (NIIL) is one of the noticeable showcase and retail furniture and apparatus organization with an expansive range of contributions and in-store answers for different businesses and retail locations. Further, it produces particular furniture for workplaces, excellence store, low-lodging kitchens, instructive organization as well as grocery store racking arrangements.

The Organization works in the plan and execution of turnkey projects by uniting under similar rooftop each of the assets important to address the issues of any fit-out project. It practices to give one-stop arrangements across different retail locations and ventures as all designing and shop drawing is acted in-house, under one rooftop. The organization produces in-store altered furnishings and apparatuses in wood, metal and plastic and in regard of booths, full shops, Ledge Units (CTU), Ledge Show Unit (CDU), Retail location Promoting (POSM), and so forth. It works on a B2B (Business-to-Plan of action.

NIIL’s scope of apparatuses is intended to improve the visual allure and usefulness of retail spaces. It has a different customers spreading over various topographies, industry verticals, and administration contributions.

As on September 30, 2023 the organization has served around 32 retail clients and their establishments and 04 modern clients. Its assembling offices is situated at Vasai, Maharashtra, having built area of approx. 1,41,687 Sq. Ft. The organization has deeply grounded and cutting edge fabricating types of gear and plan office to make the different blend and size items according to the plan and detail of clients.

NIIL offers types of assistance on Skillet India premise. Further, it has extended its compass and presence by effectively acquiring send out request in USA to supply retail furniture and apparatuses. Its retail item commitment has seen declining patterns for the detailed periods from 98.45% inFY21 to 78% in H1-FY24. As of September 30, 2023, it had 491 representatives on its finance.

ISSUE Subtleties/CAPITAL HISTORY:

The organization is emerging with its lady book building course Initial public offering of 2848000 value portions of Rs. 10 each to prepare Rs. 25.35 cr. (at the upper cap). The organization has declared a value band of Rs. 84 – Rs. 89 for each offer. The issue opens for membership on Walk 22, 2024, and will close on Walk 27, 2024. The base application to be made is for 1600 offers and in products consequently, from that point. Post allocation, offers will be recorded on NSE SME Arise. The issue is 27% of the post-Initial public offering settled up capital of the organization. From the net returns of the Initial public offering, the organization will use Rs. 4.67 cr. for land securing at Butibori, MIDC, Rs. 12.18 cr. for development of manufacturing plant building, and the rest for general corporate purposes.

The issue is exclusively lead overseen by GYR Capital Consultants Pvt. Ltd., and Bigshare Administrations Pvt. Ltd. is the enlistment center of the issue. Giriraj Stock Broking Pvt. Ltd. is the market producer for the organization.

The organization has given whole value capital at standard and has given extra offers in the proportion of 9 for 2 in November 2023. The typical expense of procurement of offers by the advertisers is Rs.1.82, Rs.2.32, and Rs. 2.48 per share.

Post-Initial public offering, organization’s ongoing settled up value capital of Rs. 7.70 cr. will stand upgraded to Rs. 10.55 cr. In view of the upper Initial public offering cost band, the organization is searching for a market cap of Rs. 93.88 cr.

Monetary Execution:

On the monetary execution front, for the last three fiscals, the organization has posted an all out income/net benefit of Rs. 13.41 cr. /Rs. 0.05 cr. (FY21), Rs.51.09 cr. /Rs. 0.21 cr. (FY22), Rs. 149.94 cr. /Rs. 3.82 cr. (FY23). For H1 of FY24 finished on September 30, 2023, it procured a net benefit of Rs. 6.19 cr. on an all out income of Rs. 79.30 cr. The pages of monetary subtleties are obscured and mixed up in the deal archive (pages no. 56 to 58 and pages no. 191 to 230). The abrupt lift in its top and primary concerns from FY23 onwards seems to have been created to match the asking cost.

For the last three fiscals, it has detailed a normal EPS of Rs. 2.64, and a typical RONW of 36.78%. The issue is evaluated at a P/BV of 1.04 in view of its NAV of Rs. 85.96 as of September 30, 2023, and at a P/BV of 2.51 in light of its post-Initial public offering NAV of Rs. 35.44 per share (at the upper cap).

On the off chance that we quality annualized FY24 income to its post-Initial public offering completely weakened paid-p capital, then the asking cost is at a P/E of 7.59. In light of FY23 profit, the P/E remains at 24.59. In this way the Initial public offering shows up completely estimated.

For the detailed periods, the organization has posted PAT edges of 0.38% (FY21), 0.42% (FY22), 2.55% (FY23), 7.81% (H1-FY24), and RoCE edges of 3.81%, 6.82%, 23.98%, 24.51% individually for the alluded periods.

Profit Strategy:

The organization has not pronounced any profits for the revealed times of the proposition record. It will take on a judicious profit strategy in light of its monetary exhibition and future possibilities.

Correlation WITH Recorded Friends:

According to the deal archive, the organization has no recorded companions to contrast and.

Vendor BANKER’S History:

This is the 23rd command from GYR Capital Counselor in the last three fiscals, out of the last 10 postings, all recorded with charges going from 20.00% to 366.67% upon the arrival of posting.

End/Speculation Procedure

The organization is working in an exceptionally cutthroat and divided section. The edges posted for H1 of FY24 seems to have been manufactured one to match the asking cost. The abrupt lift in edges from FY23 onwards cause a commotion. Very much educated financial backers might stop moderate assets for the medium term rewards.

Survey By Dilip Davda on Walk 18, 2024

Survey Creator

DISCLAIMER: No monetary data at all distributed anyplace here ought to be understood as a proposal to trade protections, or as guidance to do as such in any capacity at all. All matter distributed here is only for instructive and data purposes just and by no means ought to be utilized for going with venture choices. My audits don’t cover GMP market and administrators courses of action. Perusers should counsel a certified monetary consultant prior to going with any genuine venture choices, put together the with respect to data distributed here. With passage boundaries, SEBI believes just very much educated financial backers should take part in such offers. With insane postings in the new past, SME Initial public offerings drew the consideration of financial backers no matter how you look at it and lead to soothsayer franticness. In any case, as SME issues have passage boundaries and proceeded with low inclination from the broking local area, any peruser taking choices in view of any data distributed here does so altogether despite copious advice to the contrary. The above data depends on data accessible as of date combined with market discernments. The Creator has no designs to put resources into this proposition.