Mukka Proteins Limited IPO Subscription and Allotments

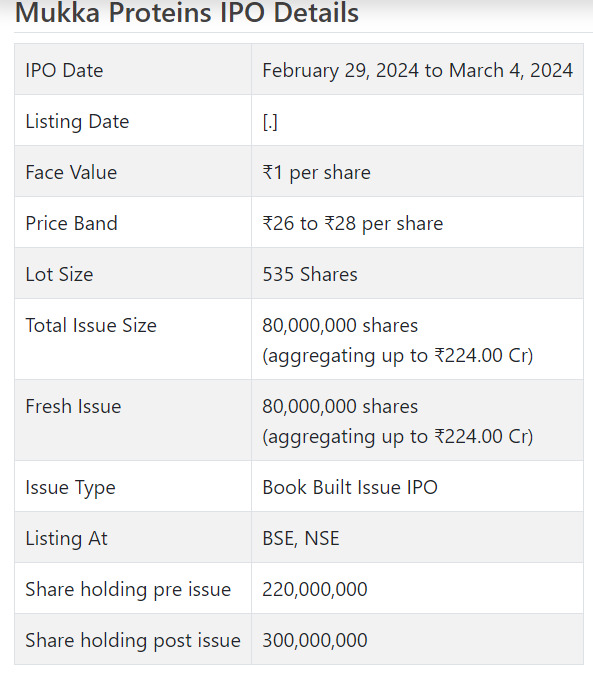

Mukka Proteins Initial public offering is a book constructed issue of Rs 224.00 crores. The issue is completely a new issue of 8 crore shares.

Mukka Proteins Initial public offering opens for membership on February 29, 2024 and closes on Walk 4, 2024. The distribution for the Mukka Proteins Initial public offering is supposed to be concluded on Tuesday, Walk 5, 2024. Mukka Proteins Initial public offering will list on BSE, NSE with conditional posting date fixed as Thursday, Walk 7, 2024.

Mukka Proteins Initial public offering cost band is set at ₹26 to ₹28 per share. The base parcel size for an application is 535 Offers. The base measure of speculation expected by retail financial backers is ₹14,980. The base part size venture for sNII is 14 parcels (7,490 offers), adding up to ₹209,720, and for bNII, it is 67 parts (35,845 offers), adding up to ₹1,003,660.

• MPL is one of the main organization for assembling and promoting of fish feast, fish oil and united items in homegrown as well as worldwide business sectors.

• It has around 25-30% piece of the pie in India that has two-third waterfront land.

• The organization posted development in its top and primary concerns, that demonstrates future possibilities.

• In view of FY24 annualized profit, the issue shows up sensibly estimated.

• Financial backers (who have no booking for the portion) can lap it up for the medium to long haul rewards.

Prelude:

Here is the one more instance of brief time frame between delivering the proposition report/directing a street show and the issue opening date. This is truly absurd and denying the financial backers on the loose to assess the proposition record and finish up their growth strategies. Allow us to trust that the concerned controllers and specialists accomplishes something in such manner.

ABOUT Organization:

Mukka Proteins Ltd. (MPL) is Reliably being granted by MPEDA, during the last 7 (seven) years for its commodity execution, bury alia, remembering as a remarkable execution for commodity of fish dinner, fish oil and unified items for Monetary 2021, Financial 2020 and Financial 2019 (Source: https://mpeda.gov.in/?page_id=557)., MPL is one of the central participants of the Fish Protein industry in India. In Monetary 2023, of the all out assessed income of the Indian fish feast and fish oil industry of Rs. 3200 cr. to Rs. 4100 cr. the income of the Organization was Rs. 1066.40 cr., demonstrating their specialty place being 25%-30% supporter of the assessed income of the Indian fish dinner and fish oil industry for the comparing time frame (Source: CRISIL Report).

The Organization is additionally among the initial not many Indian organizations to have popularized bug feast and bug oil (all in all “Bug Protein”) as an element for water feed, creature feed and pet food. Fish Protein and Bug Protein are hereinafter, all things considered, alluded to as “Creature Protein”.

As a maker of Fish Protein items, it produces and supplies fish dinner, fish oil and fish solvent glue which is a fundamental fixing in the assembling of water feed (for fish and shrimp), poultry feed (for oven and layer) and pet food (canine and feline food). Further, fish oil likewise tracks down its application in drug items (also, Omega-3 pills and related items got from fish oil are acquiring significance as high supplement and sound dietary enhancements), cleanser producing, calfskin tanneries and paint enterprises.

MPL sells its items locally and furthermore trade them to more than 10 nations, including Bahrain, Bangladesh, Chile, Indonesia, Malaysia, Myanmar, Philippines, China, Saudi Arabia, South Korea, Oman, Taiwan and Vietnam. As on the date of this Distraction Plan, it had 6 (six) fabricating offices worked by it out of which 4 (four) producing offices are situated in India and 2 (two) fabricating offices, held through its Unfamiliar Auxiliary, to be specific Sea Oceanic Proteins LLC is situated in Oman. Further, the Organization works 3 (three) mixing offices and 5 (five) storerooms situated in India. Every one of its offices are decisively situated inside the nearness to the shore.

The organization keeps up with its Offices along the shoreline to limit reliance on a specific beach front landing destinations and fish catchments and in this manner furnishing it with new, sufficient and financially savvy admittance to key natural substance for example pelagic fish, like sardine, mackerel, anchovy, and so forth. Its decisively found Offices likewise empower it to keep up with high item quality and streamline on the vehicle cost.

As of September 30, 2023, its annualized total assembling limit is 115050 MTPA of fish feast, 16950 MTPA of fish oil and 20340 MTPA of fish dissolvable glue. As of September 30, 2023, it has likewise gone into authoritative game plan with outsider assembling units, arranged at Sasihithlu (Karnataka), Udupi (Karnataka), Ullal (Karnataka), Taloja (Maharashtra), Porbandar (Gujarat) and Mangrol (Gujarat), for supply of fish dinner and fish oil. The outsider assembling units at Udupi (Karnataka) and Ullal (Karnataka) are on work premise where the crude fish are provided by the Organization and are changed over into fish feast and fish oil. These outsider assembling units are near the wellspring of its key natural substance i.e., pelagic fish, hence expanding MPL’s presence across the western shore of India. The Organization ceaselessly tries to recognize new assembling units, on work premise or comparable game plans, to accomplish functional proficiency and furthermore to approach key unrefined substance, i.e., pelagic fish. As of September 30, 2023, it had 414 representatives on its finance.

As per the administration, it’s the main organization to enter in Ento Protein items which has colossal worldwide interest. This item has a high edge and will get reflected before long execution.

ISSUE Subtleties/CAPITAL HISTORY:

The organization is emerging with a lady book building course Initial public offering of 80000000 value portions of Re. 1 each to activate Rs. 224.00 cr. at the upper cap. It has reported a value band of Rs. 26 – Rs. 28 for every offer. The issue opens for membership on February 29, 2024, and will close on Walk 04, 2024. The base application is to be made for 535 offers and in products subsequently, from there on. Post portion, offers will be recorded on BSE land NSE. The issue comprises 26.67% of the post-Initial public offering settled up capital of the organization. From the net returns of the Initial public offering reserves, it will use Rs. 120.00 cr. for working capital, Rs. 10.00 cr. for interest in partner for example Ento Proteins Pvt. Ltd. what’s more, the equilibrium for general corporate purposes.

The sole Book Running Lead Chief to this issue is Fedex Protections Pvt. Ltd. furthermore, Appearance Corporate Administrations Ltd. is the recorder of the issue.

Having given its underlying capital at standard, the organization likewise gave extra offers in the proportion of 3 for 1 in January 2022 (based on Re. 1 FV). The typical expense of procurement of offers by the advertisers is Rs. 0.98 per share.

Post-Initial public offering, organization’s ongoing settled up value capital of Rs. 22.00 cr. will stand upgraded to Rs. 30.00 cr. In view of the upper cap of Initial public offering cost band, the organization is searching for a market cap of Rs. 840 cr.

Monetary Execution:

On the monetary execution front, for the last three fiscals, the organization has (on a united premise) posted an all out income/net benefit of Rs. 609.95 cr. /Rs. 11.01 cr. (FY21), Rs. 776.15 cr. /Rs. 25.82 cr. (FY22), and Rs. 1183.80 cr. /Rs. 47.53 cr. (FY23). For H1 of FY24 finished on September 30, 2023, it procured a net benefit of Rs. 32.98 cr. on an all out income of Rs. 612.88 cr. This shows its development design in top and primary concerns and prospects ahead.

For the last three fiscals, the organization has revealed a normal EPS of Rs. 1.44 and a normal RoNW of 28.66%. The issue is evaluated at a P/BV of xx in light of its NAV of Rs. 7.23 as of September 30, 2023, and at a P/BV of xx in view of its post-Initial public offering NAV of Rs. xx per share (at the upper cap)

On the off chance that we characteristic FY24 annualized income to its post-Initial public offering completely weakened settled up value capital, then the asking cost is at a P/E of 12.73.

For the detailed periods, the organization has revealed a PAT edges of 1.82% (FY21), 3.35% (FY22), 4.04% (FY23),5.44% (H1-FY24), and RoCE edges of 5.86%, 13.86%, 17.62%, 9.41% individually for the alluded periods.

Profit Strategy:

The organization has not announced any profits for the detailed times of the proposition archive. It will take on a judicious profit strategy in light of its monetary presentation and future possibilities.

Correlation WITH Recorded Friends:

According to the deal report, the organization has shown Avanti Feeds, Godrej Agrovet, Energy Water, and Waterbase as their recorded companions. They are exchanging at a P/E of 19.9, 31.5, 22.2, and 00 (as of February 26, 2024). Be that as it may, they are not equivalent on an apple-to-apple premise. As per the administration, as a matter of fact, this large number of friends are their clients.

Dealer BANKER’S History:

This is the 27th order from Fedex Protections in the last four fiscals. Out of the last 10 postings, 1 recorded at markdown, 1 at standard and the rest with charges going from 1.67% to 140.82% on the date of posting.

End/Speculation Technique

MPL is a numero uno organization in fish feasts, fish oils and related partnered items with 25-30% piece of the pie locally. It likewise has great interest in worldwide business sectors. The organization has posted development in its top and primary concerns for the revealed periods. In view of FY24 annualized profit, the issue shows up sensibly evaluated. The organization might draw in first mover extravagant post posting. Financial backer (who have no booking for the fragments) may lap it up for the medium to long haul rewards.