Dow or Nasdaq: Full Analysis for 22nd July 2024 Introduction to Market Trends On 22nd July 2024, investors are keenly…

Tomorrow’s Nifty and Bank Nifty Index Market Prediction: 22nd July 2024 The trading day on 22nd July 2024 promises to…

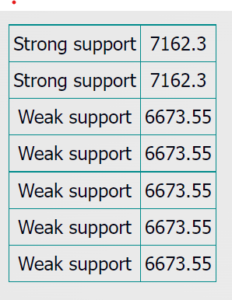

Tomorrow’s Fin Nifty and Sensex Index Market Prediction for 22nd July 2024 As we approach the trading day on 22nd…

RNFI Services Limited IPO Full Details RNFI Administration’s Initial public offering is a book constructed issue of Rs 70.81 crores.…

Sanstar Limited IPO Full Details and Full Analysis Sanstar Initial public offering is a book fabricated issue of Rs 510.15…

Macobs Technologies Limited IPO Full Details Macobs Innovations Initial public offering is a book constructed issue of Rs 19.46 crores.…

Tomorrow’s Fin Nifty and Sensex Index Market Prediction for 15th July 2024 As we approach the trading day on 15th…

Tomorrow’s Nifty and Bank Nifty Index Market Prediction: 15th July 2024 As we look towards the trading day on 15th…

Dow or Nasdaq: Full Analysis for 15th July 2024 In the ever-evolving landscape of financial markets, understanding the nuances between…

Sahaj Solar Limited IPO Full details Sahaj Sun based Initial public offering is a book fabricated issue of Rs 52.56…