Market Prediction Tomorrow: Bank Nifty and Nifty Trends & Analysis, April 5th

Indian value market lists finished the unpredictable meeting with moderate additions on Thursday. The market instability was because of the week by week expiry of Nifty list choices on the NSE. The opinions were hopeful as India’s HSBC administrations PMI rose to 61.2 in Spring, its most grounded development in 13.5 years. Notwithstanding, a benefit booking was seen because of carefulness in front of the RBI Money related strategy result, due on Friday.

Among the areas, IT, Banks, and Monetary Administrations areas were the top gainers, while selling pressure was seen in PSU Bank, Energy, and FMCG areas. The market broadness was solid today. On the NSE, 1671 offers were progressed, while 941 offers declined. The NSE’s unpredictability record “India VIX” slipped 1.34% to 11.22.

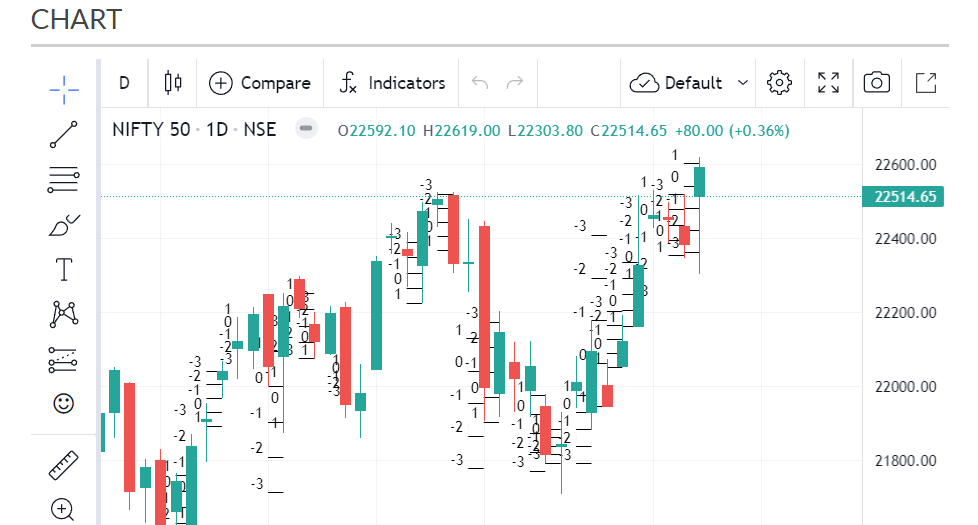

In the more extensive business sectors, the Nifty midcap list finished level to the positive up just 7.10 places, while the Clever smallcap record acquired 0.45%. The Sensex and Clever hit an unsurpassed high of 74,501.73 and 22619 separately toward the beginning of the day meeting. Eventually, Sensex acquired 350.82 focuses or 0.47% and shut down at 74227.64, while Nifty added 80 places or 0.36% and settled at 22514.65.

Nifty and Bank Nifty Futures Price Movement

The Nifty fates cost for the April series opened at 22640.05 making a hole up opening of 97.45 focuses on Thursday. It has contacted an intraday high of 22669 and a day’s low of 22420.05.

The Nifty fates cost has given an intraday development of 248.95 places. Eventually, the Nifty fates shut higher by 95.45 focuses or 0.42% at the 22637.85 level.

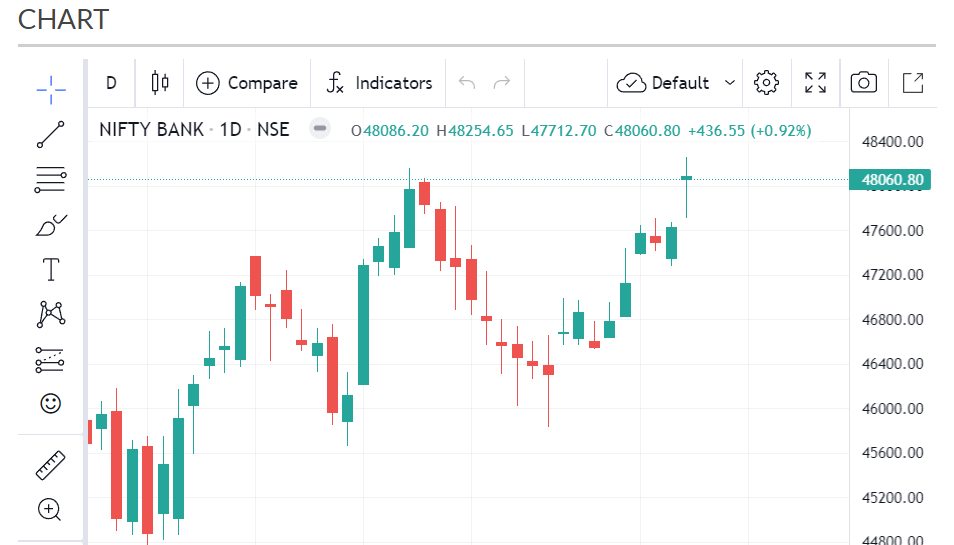

The Bank Nifty fates for the April series opened at 48185 It made a hole up opening of 272.7 focuses on Thursday. The Bank Nifty fates contacted an intraday high at 48323.50 and a day’s low at 47920.

During the day, the Bank Nifty fates have given a development of 403.5 places. Eventually, Bank Nifty Fates shut barely higher by 348.05 focuses or 0.73 percent and shut down at 48260.35 levels.

Nifty Futures Prediction for Tomorrow, 5 April 2024

Essential Pattern in Nifty Fates: Positive

Range-Bound Pattern: All Up Moves can start benefit Booking @ 22730 though Generally Down Moves can Start Short Covering @ 22500.

Nifty fates Walk series shut down at 22637.85 a premium of 123.2, contrasted with Nifty’s end 22514.65 in the money market.

Assume the Nifty fates move over 22665 and maintain. Then, at that point, the Nifty record can exchange a scope of 22695-22728-22754 levels during the day.

Assuming the Nifty fates share cost moves under 22590 and is maintained. Then the file prospects can exchange at 22560-22527-22480 levels during the day

Bank Nifty Futures Prediction for Tomorrow, 5 April 2024

Essential Pattern in Bank Nifty Fates Positive

Range-Bound Pattern of Bank Nifty Future: All up moves can Start Benefit Booking @ 48600 though Generally down moves can Start Short Covering @ 48000.

Bank Nifty fates for the April series shut down at 48260.35, at a higher cost than expected of 199.55 contrasted with Bank Nifty end of 48060.80 in the money market.

Assume the Bank Nifty fates move over 48360 and support, then, at that point, the record can exchange the scope of 48480-48640-48790 levels during the day.

On the off chance that the Bank Nifty fates move under 48105 and maintain, the record can exchange the scope of, 48012-47905-47775 levels during the day.

Global Stock Market Updates

The other Asian financial exchange records shut higher on Thursday, as financial backers processed US Took care of Seat Powell’s remarks for the time being. The financial exchanges in China, Hong Kong, and Taiwan were shut today because of a public occasion. Japan’s Nikkei 225 managed a few early gains and shut higher by 0.81% at 39773.14, in the wake of raising a ruckus around town mark on an intraday premise. Australia’s S&P ASX 200 file was up by 0.45%, snapping its two-day long string of failures.

South Korea’s Kospi list acquired the most, and finished higher by 1.28%, as heavyweight Samsung up around 1.5% on assumption for more grounded quarterly benefits. The Waterways Times and Jakarta finished positive while the SET composite shut in the negative region.

European securities exchange records are exchanging higher following positive prompts from US markets and Asian friends. Wednesday’s information that showed a decrease in eurozone expansion perusing, raised trust among financial backers for loan cost cuts in June. The Dow and Nasdaq fates are exchanging higher in the US markets, showing a positive opening for the US showcases today.