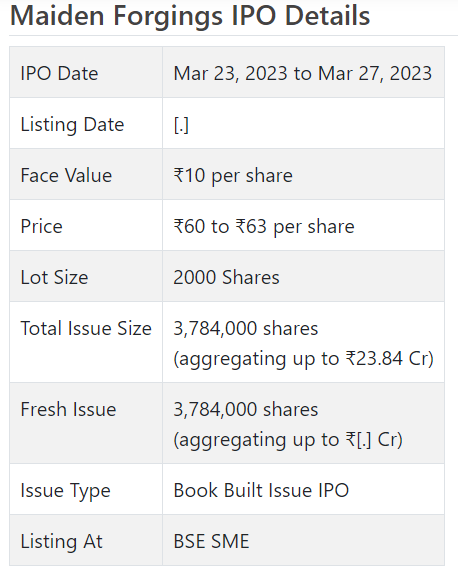

Maiden Forgings Limited IPO March 23 to March 27

Consolidated in 2005, Lady Forgings Restricted participated in assembling and selling ferrous metal items. The organization makes steel splendid bars, wires, profiles, grouped pneumatic nails, and ground bars.

The organization has three assembling plants, all situated in Ghaziabad, Uttar Pradesh, India. The consolidated collected assembling limit of these plants is 50,000 tons for each annum.

Lady Forgings has around 450+ B2B clients across the globe. The organization sells its items from Unique Hardware Producers (OEM) to huge assembling organizations in various industry areas like Eminence TTK, Everest, UM Auto, etc.

Lady Forgings Restricted has been granted threefold as of late in the year 2018 with the ‘quickest development in the business classification’ grant through business circle magazine given by the Hon’ble bureau serve Dr. Harshvardhan, “legends nearby honor” in the year 2019 presented by Hon’ble bureau serve Gen. V.K. Singh and the “most flexible organization for steel Brilliant bar in India” presented by Business Circle.

ABOUT Organization:

Lady Forgings Ltd. (MFL) is taken part occupied with assembling and dealing with ferrous metal items including steel brilliant bars, wires, profiles, and ground bars. The Organization has enhanced its item reach to incorporate specific items and modified/custom arrangements. Consequently, as of now, MFL is occupied with assembling and dealing with enhanced ferrous metal items and spotlights on giving modified and concentrated answers for a different client base across various ventures.

As of now, it has three assembling plants, all situated in Ghaziabad, Uttar Pradesh, India. The consolidated totaled assembling limit of these plants is 50,000 tons for every annum. The Organization supplies an enhanced arrangement of more than 450 B2B clients including Top Level I and Level II providers of significant bike and four-wheelers producers. Its items structure a significant unrefined substance base for the First Hardware Producers (OEMs) for B2B/B2C markets to marque clients like Glory TTK, Everest, UM Auto, and so on.

The item range fabricated by the Organization incorporates 1. Carbon Steel Brilliant Bars: 2mm to 100mm, 2. Treated Steel Brilliant Bars: 2mm to 100mm, 3. Compound steel Brilliant bars: 2mm to 100mm, 4. Carbon steel wires: 0.2mm to 22mm, 5. Treated steel wires: 0.8mm to 22mm, 6. Compound steel wires: 0.2mm to 22mm, 7. Profiles and ground bars in various sizes and shapes, 8. Ordered Pneumatic Nails

MFL has been decisively zeroing in on expanding the development of higher-worth add items through reverse and forward combination, an extension of specific items assembling and offering modified answers for its clients as well as expanding its commodities. The Organization intends to build its portion of higher worth added items to around 25 % of its general creation throughout the following couple of years, especially through in-house assembling to guarantee rigid minds the quality and have less reliance on outsider producers.

Our Organization is arranging further even development and expansion by introducing a 5000 TPA oil-tempered Enlistment Wire plant. This item is generally being used in the auto area broadly for the assembling of suspension, grip, and valve springs. As on January 31, 2022, it had 115 workers.

ISSUE Subtleties/CAPITAL HISTORY:

The organization is emerging with a lady Initial public offering of 3784000 value portions of Rs. 10 each through book building course to activate Rs. 23.84 cr. (at the upper cap). The organization has reported a value band of Rs. 60 – Rs. 63 for the Initial public offering. The issue opens on Walk 23, 2023, and will close on Walk 27, 2023. The base application to be made is for 2000 offers and in products consequently, from that point. Post-designation offers will be recorded on BSE SME. The issue is 26.62% of the post-Initial public offering settled up capital of the organization. In the wake of the expenditure of Rs. 2.41 cr. for the Initial public offering process, from the net returns, MFL will use Rs. 9.43 cr. for the combination and development of assembling offices, Rs. 8.00 cr. for working capital and Rs. 4.00 cr. for general corporate purposes. It has assigned not over half for QIBs, at the very least 15% for HNIs, and at least 35% for Retail financial backers.

Share India Capital Administrations Pvt. Ltd. is the sole lead supervisor and Maashitla Protections Pvt. Ltd. is the recorder of the issue. This is the new RTA having a lady command. Share India bunch organization Offer India Protections Ltd. is the market creator for the organization.

Having given starting value shares at standard, the organization gave further value partakes in the value scope of Rs. 30 to Rs. 105 for every divide between June 2005 and October 2020. It has likewise given extra offers in the proportion of 1 for 1 in November 2022. The typical expense of obtaining offers by advertisers is Rs. 1.67 and Rs. 2.73 per share.

The post-Initial public offering, MFL’s ongoing settled up value capital of Rs. 10.43 cr. will stand upgraded to Rs. 14.21 cr. Given the upper cap of the Initial public offering value, the organization is searching for a market cap of Rs. 89.54 cr.

Monetary Execution:

On the monetary execution front, for the last three fiscals, MFL posted a turnover/net benefit of Rs. 204.40 cr. /Rs. 1.66 cr. (FY20), Rs. 199.38 cr. /Rs. 1.69 cr. (FY21), and Rs. 210.84 cr. /Rs. 2.14 cr. (FY22). For 3Qs of FY23 finished on December 31, 2022, it procured a net benefit of Rs. 8.02 cr. on a turnover of Rs. 163.81 cr. The manageability of edges proceeding raises critical concerns. As indicated by the administration, after the static execution for the last three fiscals, the organization announced guard benefits for 3Qs of FY23 following broadening into high-edge item blend of carbon steel, and composite items and has moved its attention to such high-edge items with arranged development proceeding.

For the last three fiscals, MFL revealed a normal EPS of Rs. 3.57 and a normal RoNW of 7.77%. The issue is evaluated at a P/BV of 1.64 in light of its NAV of Rs. 38.30 as of December 31, 2022, and at a P/BV of 1.42 in light of its post-Initial public offering NAV of Rs. 44.32 per share (at the upper cap).

On the off chance that we annualize FY23 super income and characteristic it to post-Initial public offering completely weakened settled up value capital, then the asking cost is at a P/E of around 8.38. Given its FY22 income, the P/E remains at 41.72. Hence the issue shows up as completely valued.

Profit Strategy:

The organization has not proclaimed any profits since its consolidation. It will embrace a judicious profit strategy post-posting, in light of its monetary exhibition and future possibilities.

Examination WITH Recorded Companions:

According to the proposition record, the organization has shown Bharat Wire Ropes, Geekay Wires, and Metal Coatings as their recorded companions. They are right now exchanging at a P/E of 13.05, 8.26, and 34.61 (as of Walk 18, 2023). Nonetheless, they are not genuinely similar on an apple-to-apple premise.

Trader BANKER’S History:

This is the third command from Offer India Capital in the last five fiscals (counting the continuous one). Out of the last 2 postings, one was recorded at standard and the other with a premium of 1.82% upon the arrival of posting. Accordingly, it has a typical history.

End/Speculation Procedure

MFL is having fashioning exercises at a little level. It is presently participated occupied with ferrous metal items with different item goes and has added high-edge items like carbon steel and compound. It is extending its ability in such high-edge items. In any case, in light of annualized FY23 profit, the issue shows up altogether estimated limiting all close-term up-sides. All-around informed/cash overflow financial backers might stop assets for long-haul rewards.

Audit By Dilip Davda on Blemish 20, 2023