Magenta Lifecare Limited IPO Full Details

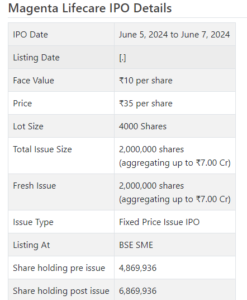

Fuchsia Lifecare Initial public offering is a decent value issue of Rs 7.00 crores. The issue is completely a new issue of 20 lakh shares.

Fuchsia Lifecare Initial public offering opens for membership on June 5, 2024 and closes on June 7, 2024. The distribution for the Maroon Lifecare Initial public offering is supposed to be concluded on Monday, June 10, 2024. Fuchsia Lifecare Initial public offering will list on BSE SME with speculative posting date fixed as Wednesday, June 12, 2024.

Fuchsia Lifecare Initial public offering cost is ₹35 per share. The base part size for an application is 4000 Offers. The base measure of venture expected by retail financial backers is ₹140,000. The base parcel size speculation for HNI is 2 parts (8,000 offers) adding up to ₹280,000.

• MLL is participated in the assembling and showcasing of froth based items.

• It has posted static execution for the revealed periods.

• The organization is working in an exceptionally serious and divided fragment.

• In light of FY24 annualized profit, the issue shows up forcefully valued.

• With resource light model and cost administration, the administration is certain of further developing its presentation proceeding.

• All around informed/cash overflow financial backers might stop assets as long as possible.

ABOUT Organization:

Maroon Lifecare Ltd. (MLL) is the producer of froth based item, for example, beddings and cushions which is promoted under our image “Red” in India. Its Item contributions incorporate extensive variety of sleeping cushions, for example, adaptive padding, plastic based, reinforced beddings, took spring and so on and pads, for example, adaptive padding pad, shaped adaptive padding pad, formed shape froth pad and so on.

Its prosperity is inferable from the nature of items that MLL offers to clients, spread across retail, lodgings and establishments. Driven by development, it endeavors to present new and creative items consistently with the assistance of its group. It has presented green tea and bamboo water driven bed) which it imports under own image Red.

MLL has created merchant and vendor/retailer network across numerous states in India. It likewise sells items through disconnected channel of multi brand outlet and through an organization of vendors and furthermore through web-based online business stage. As of the date of this proposition archive, it had 41 workers on its finance. The organization is working a resource light model combined with cost administration in an exceptionally cutthroat and divided section and that holds the key.

ISSUE Subtleties/CAPITAL HISTORY:

The organization is emerging with its lady Initial public offering of 2000000 value portions of Rs. 10 each at a proper cost of Rs. 35 for each offer to assemble Rs. 7.00 cr. The issue opens for membership on June 05, 2024, and will close on June 07, 2024. The base application to be made is for 4000 offers and in products subsequently, from there on. Post portion, offers will be recorded on BSE SME. The issue is 29.11% of the post-Initial public offering settled up capital of the organization. The organization is spending Rs. 1.02 cr. for this Initial public offering process, and from the net returns of the Initial public offering, it will use Rs. 4.24 cr. for working capital, and Rs. 1.74 cr. for general corporate purposes.

The issue is exclusively lead overseen by Fedex Protections Pvt. Ltd., and Appearance Corporate Administrations Ltd. is the recorder to the issue. Sunflower Broking Pvt. Ltd. is the market producer for the organization. The issue is endorsed to the tune of 85% by Sunflower Broking and 15% by Fedex Protections.

Having given beginning value capital at standard, it gave further value share in the value scope of Rs. 100 – Rs. 110 for each divide among December 2021 and May 2023. It has likewise given extra offers in the proportion of 2 for 1 in June 2023. The typical expense of obtaining of offers by the advertisers is Rs. 7.50, and Rs. 8.74 per share.

Post-Initial public offering, organization’s ongoing settled up value capital of Rs. 4.87 cr. will stand improved to Rs. 6.87 cr. In light of the upper Initial public offering cost band, the organization is searching for a market cap of Rs. 24.04 cr.

Monetary Execution:

On the monetary execution front, for the last three fiscals, the organization has posted an all out pay/net benefit of Rs. 9.66 cr. /Rs. 0.19 cr. (FY21), Rs. 9.39 cr. /Rs. 0.19 cr. (FY22), and Rs. 9.55 cr. /Rs. 0.25 cr. (FAY23). For 9M of FY24 finished on December 31, 2023, it procured a net benefit of Rs. 0.24 cr. on an all out pay of Rs. 6.31 cr.

For the last three fiscals, it has revealed a normal EPS of Rs. 0.50, and a typical RoNW of 6.37%. The issue is estimated at a P/BV of 2.68 in light of its NAV of Rs. 13.07 as of December 31, 2023, and at a P/BV of 1.80 in view of its post-Initial public offering NAV of Rs. 19.47 per share.

On the off chance that we characteristic annualized FY24 income to its post-Initial public offering completely weakened settled up capital, then the asking cost is at a P/E of 74.47. Consequently the Initial public offering shows up forcefully evaluated. As per the administration, since it is having a resource light model and their sticking to cost administration plans, it checked improvement in its edges and the patterns are probably going to see further improvement.

For the revealed periods, the organization has posted PAT edges of 2.02% (FY21), 2.04% (FY22), 2.71% (FY23), 4.05% (9M-FY24), and RoCE edges of 7.64%, 8.95%, 11.86%, 13.41% individually for the alluded periods.

Profit Strategy:

The organization has not proclaimed any profits since consolidation. It will take on a judicious profit strategy in view of its monetary presentation and future possibilities.

Correlation WITH Recorded Companions:

According to the deal record, the organization has shown Sheela Froth, and Tirupati Froth as their recorded companions. They are exchanging at a P/E of 58.3, and 15.6 (as of May 31, 2024). Nonetheless, they are not practically identical on an apple-to-apple premise.

Vendor BANKER’S History:

This is the 30th order from Fedex Protections in the last four fiscals (counting the continuous one), out of the last 11 postings, all recorded with charges going from 0.14% to 140.82% on the date of posting.

End/Speculation System

The organization is working in an exceptionally serious and divided fragment. With its resource light model and cost administration, the organization is sure of keeping up with and working on its exhibition as shown by most recent 21 months working. In view of FY24 annualized profit, the issue shows up forcefully estimated. Little value post-Initial public offering shows longer incubation for relocation. Very much educated/cash overflow financial backers might stop assets for the drawn out remunerations.

Audit By Dilip Davda on June 1, 2024

Survey Creator

DISCLAIMER: No monetary data at all distributed anyplace here ought to be understood as a proposal to trade protections, or as counsel to do as such in any capacity at all. All matter distributed here is only for instructive and data purposes just and by no means ought to be utilized for going with speculation choices. My surveys don’t cover GMP market and administrators courses of action. Perusers should counsel a certified monetary consultant prior to settling on any genuine venture choices, put together the with respect to data distributed here. With passage boundaries, SEBI believes just all around informed financial backers should take part in such offers. With insane postings in the new past, SME Initial public offerings drew the consideration of financial backers in all cases and lead to diviner frenzy. In any case, as SME issues have passage obstructions and proceeded with low inclination from the broking local area, any peruser taking choices in view of any data distributed here does so totally despite all advice to the contrary. The above data depends on data accessible as of date combined with market discernments. The Creator has no designs to put resources into this proposition.