M.V.K. Agro Food Product Ltd IPO Subscription or Allotments

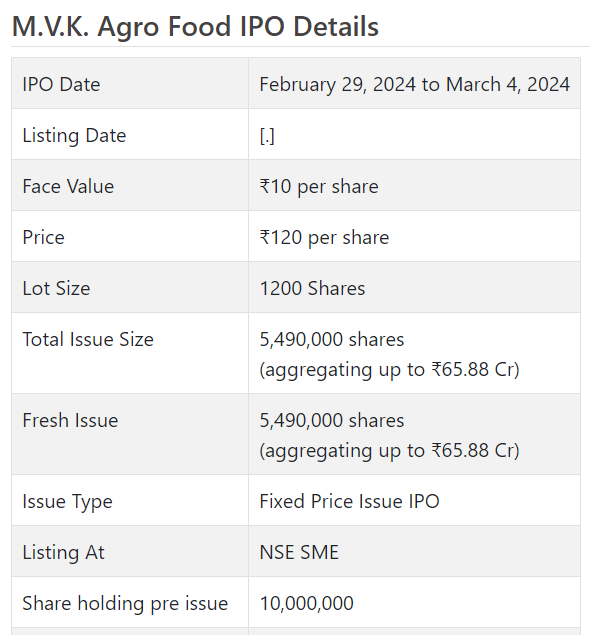

M.V.K. Agro Food Initial public offering is a decent value issue of Rs 65.88 crores. The issue is totally a new issue of 54.9 lakh shares.

M.V.K. Agro Food Initial public offering opens for membership on February 29, 2024 and closes on Walk 4, 2024. The assignment for the M.V.K. Agro Food Initial public offering is supposed to be settled on Tuesday, Walk 5, 2024. M.V.K. Agro Food Initial public offering will list on NSE SME with conditional posting date fixed as Thursday, Walk 7, 2024.

M.V.K. Agro Food Initial public offering cost is ₹120 per share. The base part size for an application is 1200 Offers. The base measure of venture expected by retail financial backers is ₹144,000. The base parcel size speculation for HNI is 2 parts (2,400 offers) adding up to ₹288,000.

• The organization is an incorporated sugar and other partnered item producer.

• It stamped irregularity in its top and main concerns for the detailed periods.

• In light of FY24 annualized super profit, the issue shows up forcefully estimated.

• Post extension, receiving more rewards as guaranteed by the management is probable.

• All around informed/cash overflow financial backers might stop assets for the medium to long haul rewards.

ABOUT Organization:

MVK Agro Food Item Ltd. (MAFPL) is a coordinated sugar and other unified items fabricating organization working from Nanded Region in the Territory of Maharashtra. It works a solitary area sugar unit having authorized pounding limit of 2,500 TCD. Notwithstanding sugar the organization likewise market and sell results and byproducts, to be specific, Molasses, Bagasse and Pressmud.

MAFPL is additionally participated in the age of Force for hostage utilization. Its business can consequently be separated into two portions, in particular Sugar and its results/byproducts. In the year 2020, it started activities of assembling of Sugar. In the year 2020, the Organization carried out in reverse joining and started business tasks of the side-effects and byproducts of Sugar alongside Co-Age abilities.

The Organization proposes to additionally differentiate its item portfolio by setting up a greenfield unit for assembling Ethanol and Bio-CNG and Compost. Ethanol is created after aging and refining of Molasses and can be additionally filtered into Fuel Ethanol, by eliminating the water content. It plans to make an extra income stream utilizing in reverse mix of waste material, i.e., Molasses for assembling Ethanol and promoting and selling something very similar for modern use. Further, in the said greenfield unit, the organization proposes to set up a different bio CNG packaging and manure plant for bio-gas age and packaging. The result created from the assembling of bio-gas is essentially utilized as a manure, subsequently the Organization proposes to market and sell such side-effect as a compost to outsiders.

It proposes to create bio-gas by handling Bagasse and Pressmud further advertising and selling something similar for modern utilization. As of September 30, 2023, it had 161employees on its finance.

ISSUE Subtleties/CAPITAL HISTORY:

The organization is emerging with a lady Initial public offering of 5490000 value portions of Rs. 10 each at a decent cost of Rs. 120 for each offer to activate Rs. 65.88 cr. The issue opens for membership on February 29, 2024, and will close on Walk 04, 2024. The base application to be made is for 1200 offers and in products consequently, from that point. Post portion, offers will be recorded on NSE SME Arise. The issue comprises 35.44% of the post-Initial public offering settled up capital of the organization. The organization is spending Rs. 7.63 cr. for this Initial public offering process and from the net returns, it will use Rs. 52.38 cr. for setting up a greenfield unit at Nanded for Ethanol and packaging of bio-CNG and manures, and Rs. 5.87 cr. for general corporate purposes.

The issue is exclusively lead overseen by Skyline The board Pvt. Ltd. furthermore, MAS Administrations Ltd. is the enlistment center of the issue. Nikunj Stock Agents Ltd. is the market creator for the organization.

The organization has given whole value capital at standard worth up until this point and has additionally given extra offers in the proportion of 1 for 1 in December 2023. The typical expense of procurement of offers by the advertisers is Rs. 2.71, Rs. 6.66, Rs. 7.25, and Rs. 9.95 per share.

Post-Initial public offering, organization’s ongoing settled up value capital of Rs. 10.00 cr. will stand upgraded to Rs. 15.49 cr. In view of the Initial public offering estimating, the organization is searching for a market cap of Rs. 185.88 cr.

Monetary Execution:

On the monetary execution front, for the last three fiscals, the organization has (on an independent premise) posted a complete pay/net benefit of Rs. 25.83 cr. /Rs. 1.40 cr. (FY21), Rs. 132.64 cr. /Rs. 3.20 cr. (FY22), and Rs. 93.94 cr. /Rs. 3.77 cr. (FY23). For H1 of FY24 finished on September 30, 2023, on a united premise, it procured a net benefit of Rs. 4.30 cr. on an all out pay of Rs. 60.44 cr. Hence it communicated irregularity in its top and primary concerns. Specifically, its primary concern flood from FY23 ahead cause a commotion.

For the last three fiscals, the organization has revealed a normal EPS of Rs. 3.23 and a normal RoNW of 35.66%. The issue is evaluated at a P/BV of 3.40 in view of its NAV of Rs. 35.35 as of September 30, 2023, and at a P/BV of 2.22 in view of its post-Initial public offering NAV of Rs. 53.94.

On the off chance that we trait FY24 annualized super income to its post-Initial public offering completely weakened settled up value capital, then the asking cost is valued at a P/E of 21.62. In this way the issue shows up forcefully evaluated. The administration is certain of keeping up with the patterns before long with extra income from the proposed extensions.

For the detailed periods, the organization has posted PAT edges of 6.11% (FY21), 2.45% (FY22), 4.05% (FY23), 7.15% (H1-FY24), and RoCE edges of 5.98%, 14.49%, 13.44%, 14.09% separately for the alluded periods.

Profit Strategy:

The organization has not pronounced any profits for the detailed times of the proposition archive. It will embrace a reasonable profit strategy in view of its monetary exhibition and future possibilities.

Correlation WITH Recorded Companions:

According to the deal record, the organization has shown Ugar Sugar, Dwarikesh Sugar, Balrampur Chini and Dhampur Sugar as their recorded companions. They are exchanging at a P/E of 13.7, 14.1, 13.1, and 11.6 (as of February 23, 2024). In any case, they are not practically identical on an apple-to-apple premise.

Shipper BANKER’S History:

This is the third command from Skyline The executives in the progressing financial. Out of the last 2 postings, 1 opened at rebate and 1 at standard. Hence it has an unfortunate history.

End/Speculation Methodology

The organization is principally in sugar creations and has not many other side-effects. It is adding ethanol plant to tap the rising interest for this result. The organization stamped irregularity in its top and main concerns for the revealed periods. In light of its FY24 annualized super profit, the issue shows up forcefully valued. All around informed/cash overflow financial backers might stop assets for the medium to long haul rewards.

Survey By Dilip Davda on February 24, 2024

Audit Creator

DISCLAIMER: No monetary data at all distributed anyplace here ought to be understood as a proposal to trade protections, or as exhortation to do as such in any capacity at all. All matter distributed here is only for instructive and data purposes just and by no means ought to be utilized for pursuing speculation choices. My surveys don’t cover GMP market and administrators strategies. Perusers should counsel a certified monetary guide prior to going with any genuine speculation choices, put together the with respect to data distributed here. With section boundaries, SEBI believes that main very much educated financial backers should partake in such offers. With insane postings in the new past, SME Initial public offerings drew the consideration of financial backers in all cases and lead to diviner frenzy. In any case, as SME issues have section obstructions and proceeded with low inclination from the broking local area, any peruser taking choices in view of any data distributed here does so altogether in spite of the obvious danger ahead. The above data depends on data accessible as of date combined with market insights. The Creator has no designs to put resources into this proposition.