Live Analysis of Tesla Stock: Unveiling Price Movements and Support/Resistance Levels

Introduction:

In the fast-paced world of stock trading, real-time analysis of price movements and support/resistance levels is crucial for informed decision-making. Tesla, Inc. (TSLA), as a leading player in the electric vehicle industry, is subject to significant market volatility, making it an intriguing subject for analysis. This live analysis aims to provide insights into Tesla’s stock performance, chart patterns, and the identification of key support and resistance levels, all in real-time.

Understanding Support and Resistance Levels:

Support and resistance levels are fundamental concepts in technical analysis. Support represents a price level where buying interest tends to emerge, preventing further decline in the stock price. On the other hand, resistance denotes a level where selling pressure tends to intensify, hindering upward price movements. Identifying these levels can help traders anticipate potential reversals or breakout opportunities.

Live Analysis of Tesla Stock:

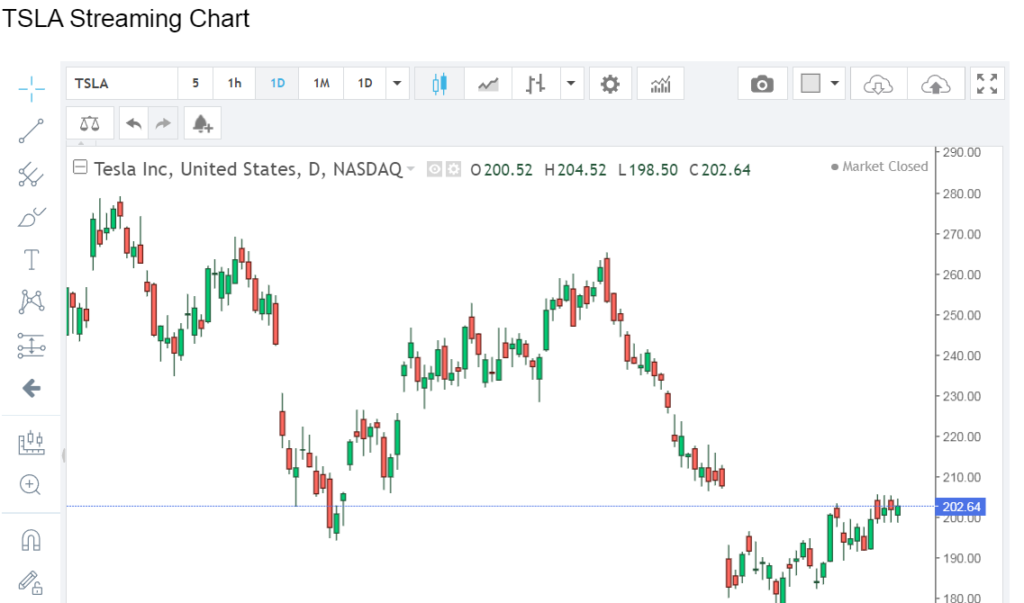

As of the time of this analysis, Tesla’s stock is experiencing significant volatility, influenced by factors such as company announcements, macroeconomic conditions, and market sentiment. By examining live price charts and employing technical indicators such as moving averages, trendlines, and candlestick patterns, we can gain insights into the current market sentiment and potential price movements.

Chart Patterns:

Chart patterns provide visual representations of price movements and can offer valuable insights into future price trends. Common chart patterns include triangles, head and shoulders, and flags, each indicating potential bullish or bearish signals. By identifying these patterns in real-time, traders can anticipate price movements and adjust their strategies accordingly.

Identifying Support and Resistance Levels:

Using live price data and technical analysis tools, we can identify key support and resistance levels for Tesla’s stock. Support levels may coincide with previous lows or areas of significant buying interest, while resistance levels may align with previous highs or areas of selling pressure. By analyzing price action around these levels, traders can gauge the strength of buying or selling sentiment.

Risk Management:

Incorporating support and resistance levels into trading strategies is essential for effective risk management. Traders can use these levels to set stop-loss orders, manage position sizes, and identify potential entry and exit points. By adhering to disciplined risk management practices, traders can mitigate losses and maximize profits in volatile market conditions.

Conclusion:

In conclusion, real-time analysis of Tesla’s stock provides valuable insights into price movements and support/resistance levels. By leveraging technical analysis tools and chart patterns, traders can make informed decisions and manage risk effectively. While market volatility presents both opportunities and challenges, understanding support and resistance levels empowers traders to navigate the market with confidence.

Remember, it’s crucial to conduct your own analysis and verify the information provided, as stock trading involves inherent risks.