Kundan Edifice Limited IPO September 12, 2023 to September 15, 2023

Consolidated in 2010, Kundan Building Restricted is taken part occupied with assembling, get together, and offer of light-radiating diode (“Drove”) strip lights.

Kundan Building is fundamentally a unique plan maker (“ODM”) and configuration, create, assembling, and supply items to clients who then, at that point, further circulate these items under their own brands. The organization likewise gives custom items. Its item list incorporates HV Flex-High voltage flex, LV Flex-Low voltage flex, RGB LV Flex (Savvy Lights), and Extras Pack.

The organization has two assembling and get together offices in the territory of Maharashtra situated in Vasai and Bhiwandi. As of August 31, 2023, Kundan utilizes more than 311 representatives in its assembling offices, including provisional laborers.

• KEL is taken part occupied with Drove and EMS portions.

• The organization posted development in its top and primary concerns for the revealed periods.

• The abrupt lift in its top and primary concerns causes a stir and worry over supportability.

• In view of its Initial public offering process spending, the issue is completely organized.

• Very much educated financial backers might stop assets for the medium to long haul rewards.

ABOUT Organization:

Kundan Building Ltd. (KEL) went into get together and offer of lighting items in Monetary 2014. After the ongoing Advertiser assumed control over the control of the organization in 2016, it zeroed in its business procedure on assembling, gathering and offer of light radiating diode (“Drove”) strip lights and from that point forward, it arose as one of the believed gadgets producing administrations (“EMS”) Organizations for clients by giving start to finish arrangements in the space of activity.

As an EMS Organization, it has fundamentally a unique plan maker (“ODM”) and plans, creates, fabricates and supplies items to clients who then further circulate these items under their own brands. The organization centers around eccentric types of lighting items i.e., Drove strip lights that have shifted applications across ventures like land, railroads, vehicles, beautiful lighting, and so on. It gives lighting answers for a portion of the key electrical and electronic assembling brands in India. The Drove strip lights or adaptable straight lights as an idea supplanting customary lighting like bulbs, tube lights and numerous different sorts of lights since the adaptable direct lights have indoor as well as outside applications.

KEL has two assembling and get together offices in the territory of Maharashtra with one situated in Vasai and the other in Bhiwandi (aggregately “fabricating offices”). As of August 31, 2023, it utilized more than 311 representatives in the assembling offices, including provisional laborers.

ISSUE Subtleties/CAPITAL HISTORY:

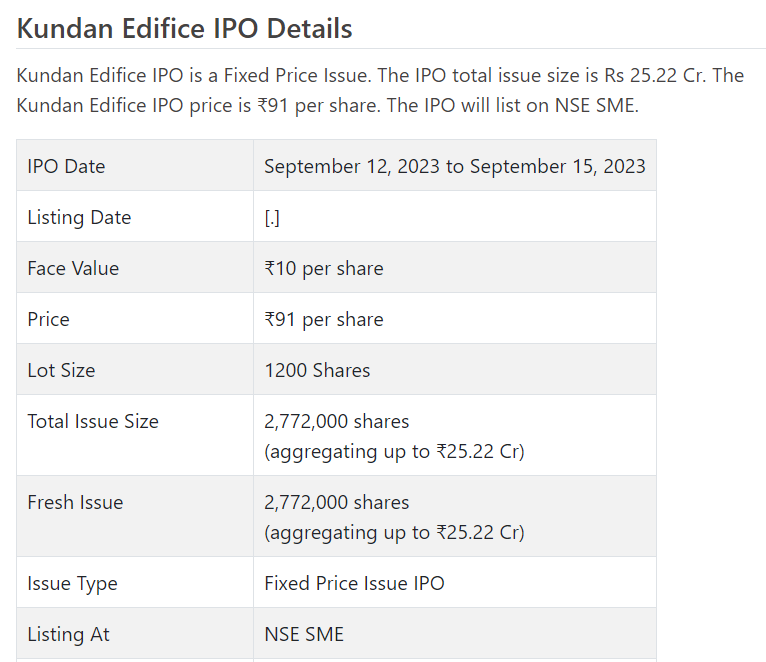

The organization is emerging with a lady Initial public offering of 2772000 value portions of Rs. 10 each at a decent cost of Rs. 91 for each offer to prepare Rs. 25.23 cr. The issue opens for membership on September 12, 2023, and will close on September 15, 2023. The base application to be made is for xxx offers and in products subsequently, from that point. Post distribution, offers will be recorded on NSE SME Arise. The issue comprises 26.99% of the post-Initial public offering settled up value capital of the organization. KEL is spending Rs. 3.69 cr. for this Initial public offering process, showing a completely organized method of the Initial public offering. From the net returns, it will use Rs. 15.46 cr. for working capital, and Rs. 6.08 cr. for general corporate purposes.

Fedex Protections Pvt. Ltd. is the sole lead chief and Appearance Corporate Administrations Ltd. is the recorder of the issue. Gretex Offer Broking Pvt. Ltd. is the market producer for the organization.

The organization has given whole beginning value shares at standard and has likewise given extra offers in the proportion of 1.5 for 1 in Walk 2023. The typical expense of procurement of offers by the advertisers is Rs. 1.71, and Rs. 9.89 per share.

Post-Initial public offering, KEL’s ongoing settled up value capital of Rs. 7.50 cr. will stand improved to Rs. 10.27 cr. In light of the Initial public offering evaluating, the organization is searching for a market cap of Rs. 93.48 cr.

Monetary Execution:

On the monetary execution front, for the last three fiscals, KEL has posted a complete pay/net benefit of Rs. 15.22 cr. /Rs. 0.77 cr. (FY21), Rs. 32.51 cr. /Rs. 1.68 cr. (FY22), land Rs. 60.46 cr. /Rs. 5.13 cr. (FY23). The abrupt lift in its top and primary concerns for FY23 causes a stir and worries over maintainability.

For the last three fiscals, KEL has revealed a normal EPS of Rs. 4.34 and a normal RoNW of 60.34%. The issue is estimated at a P/BV of 8.42 in view of its NAV of Rs. 10.81 as of Walk 31, 2023, and at a P/BV of 2.80 in light of its post-Initial public offering NAV of Rs. 32.45 per share.

On the off chance that we trait FY23 super income to the post-Initial public offering completely weakened settled up capital of the organization, then, at that point, the asking cost is at a P/E of 18.2.

The organization has posted PAT edges of 5.10 % for FY21, 5.17% for FY22, and 8.52% for FY23. Its RoCE edges for similar periods were 16.40%, 20.41% and 43.69% individually.

Profit Strategy:

The organization has not pronounced any profits since fuse. It will embrace a judicious profit strategy in view of its monetary exhibition and future possibilities.

Correlation WITH Recorded Friends:

According to the deal archive, the organization has shown Artemis Electricals and Center Lighting as their recorded friends. They are right now exchanging at a P/E of 35.93, and 42.32 (as of September 07, 2023). Nonetheless, they are not really similar on an apple-to-apple premise.

Shipper BANKER’S History:

This is the eighteenth command from Fedex Protections in the last four fiscals (counting the continuous one). Out of the last 10 postings, 2 opened at markdown, 1 at standard and the rest with charges going from 0.21% to 108.93% on the date of posting.

End/Speculation ProcedureThe organization is participated in Drove and EMS sections. It checked development in its top and primary concerns for the revealed periods, yet the abrupt lift in FY23 execution causes a commotion and worries over maintainability. The issue shows up completely estimated in view of its closed financial exhibition. All around informed financial backers might stop assets for the medium to long haul rewards.

Survey By Dilip Davda on September 7, 2023