Kronox Lab Sciences Limited IPO Full Details

Kronox Lab Sciences Initial public offering is a book fabricated issue of Rs 130.15 crores. The issue is totally a proposal available to be purchased of 0.96 crore shares.

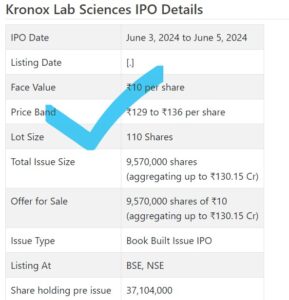

Kronox Lab Sciences Initial public offering opens for membership on June 3, 2024 and closes on June 5, 2024. The portion for the Kronox Lab Sciences Initial public offering is supposed to be settled on Thursday, June 6, 2024. Kronox Lab Sciences Initial public offering will list on BSE, NSE with conditional posting date fixed as Monday, June 10, 2024.

Kronox Lab Sciences Initial public offering cost band is set at ₹129 to ₹136 per share. The base parcel size for an application is 110 Offers. The base measure of venture expected by retail financial backers is ₹14,960. The base parcel size speculation for sNII is 14 parts (1,540 offers), adding up to ₹209,440, and for bNII, it is 67 parts (7,370 offers), adding up to ₹1,002,320.

• The organization is participated in the assembling and showcasing of high-virtue speciality fine synthetic substances.

• It stamped consistent development in its top and main concerns for the revealed periods.

• It has 185 items in its portfolio and another 122 are ready to go.

• In light of FY24 annualized profit, the issue shows up completely valued.

• Financial backers might stop assets for the medium to long haul rewards.

Prelude:

The organization initially recorded DRHP for a combo Initial public offering of new value issue worth Rs. 45 cr. furthermore, a proposal available to be purchased of 7800000 value shares. As per the Lead Director, SEBI returned this archive saying that organization has great profit and isn’t needing cash, thus pick OFS course as it were. In view of this idea by the controller, LM refiled the new DEHP in January 2024 with imperative size of proposition lastly got endorsement for an OFS of Rs. 130.15 cr.as per last RHP. It is an obligation free organization at this point and is fit for meeting any asset needs from its interior gatherings. In this way at the command of controller, the Initial public offering is a completely optional deal.

ABOUT Organization:

Kronox Lab Sciences Ltd. (KLSL) is a producer of high-immaculateness speciality fine synthetic compounds. It makes items agreeable with reagents, pharmacopeia, and different food grade principles utilized in the drug, nutraceutical, veterinary, food, biotech, substance examination and exploration, metallurgy, individual consideration and other specialty markets.

The organization’s item bunches incorporate acetic acid derivations, carbonates, chlorides, citrates, hypophosphates, nitrates, nitrites, phosphates, sulfates, and other super unadulterated fine synthetic compounds.

KLSL makes High Immaculateness Speciality Fine Synthetics for expanded end client enterprises. Its High Immaculateness Speciality Fine Synthetic substances are utilized chiefly as (I) responding specialists and natural substance in the assembling of Dynamic Drug Fixings (APIs); (ii) excipients in drug details; (iii) reagents for logical examination and lab testing; (iv) fixings in nutraceuticals definitions; (v) process intermediates and maturing specialists in biotech applications; (vi) fixings in agrochemical plans; (vii) fixings in private consideration items; (viii) refining specialists in metal treatment facilities; and (ix) fixings in creature wellbeing items, among others.

Organization’s items are made as per industry principles like IP, BP, EP, JP, USP, FCC, LR, AR, GR and ACS notwithstanding custom assembling particulars, which contrast from the business norms, expected by its clients in 10 cross section to 100 lattice. Its scope of in excess of 185 items traversing across the group of phosphate, sulfate, acetic acid derivation, chloride, citrate, nitrates, nitrites, carbonate, EDTA subsidiaries, hydroxide, succinate, gluconate, among others are provided to clients in India and in excess of 20 nations around the world.

Notwithstanding the assembling of items as per different homegrown and global principles, KLSL additionally attempts custom assembling to accomplish elevated degrees of virtue, as determined by the client, having different immaculateness levels than the endorsed business guidelines. Custom assembling requires profound area information, ability and comprehension of the attributes of every substance and its mixtures, including diminishing the degree of existing debasements and the cycles to be conveyed to arrive at the ideal degree of immaculateness.

The organization keeps on growing its scope of items to fulfill changing needs of the end client enterprises. For the nine months’ time frames finished December 31, 2023, December 31, 2022 and Monetary 2023, Financial 2022 and Financial 2021, it made and sold 188, 155, 157, 156 and 159 items, separately. The Organization’s income from trades have developed at a CAGR of 37.46% between Monetary 2021 and 2023. The organization has served in excess of 592 clients during the revealed periods, and during the nine months’ time frame finished December 31, 2023 of which 141 clients adding up to 23.82% of all out clients submitted recurrent requests. Its all out items under advancements were 122 as of December 31, 2023. As of the date of recording this proposition archive, its item portfolio involved more than 185 items. As of December 31, 2023, it had complete 212 representatives (counting 155 on agreement premise) on its finance.

KLSL’s blue-chip client list included name as divi Sanofi’s, Humankind Pharma, Lupin, Dr. Reddy’s, Sun Pharma, Zydus to give some examples.

ISSUE Subtleties/CAPITAL HISTORY:

The organization is emerging with its lady book building course auxiliary Initial public offering of 9570000 value portions of Rs. 10 each to assemble Rs. 130.15 cr. (at the upper cap). The organization has reported a value band of Rs. 129 – Rs. 136 for every offer. The issue opens for the membership on June 03, 2024, and will close on June 05, 2024. The base application to be made is for 110 offers and in products consequently, from that point. Post distribution, offers will be recorded on BSE and NSE. The issue is 25.79% of the post-Initial public offering settled up capital of the organization. This being an unadulterated Proposal available to be purchased (OFS), no assets are coming to organization. The issue is being made to give incomplete exit to a portion of its partners and for the posting benefits. The organization has assigned not over half for QIBs, at the very least 15% for HJNIs and at least 35% for Retail financial backers.

The Initial public offering is exclusively lead overseen by Pantomath Capital Counselors Pvt. Ltd. furthermore, KFin Advancements Ltd. is the enlistment center to the issue. Pentagon Stock Dealers Pvt. Ltd. also, Asit C Mehta Speculation Intermediates Ltd. are the organization individuals for the Initial public offering. The proposition report is missing guaranteeing course of action data.

Having given starting value shares at standard, the organization has given extra offers in the proportion of 161 for 1 in August 2022. The typical expense of procurement of offers by the advertisers/selling partners is Rs. 0.07 per share.

This being an unadulterated OFS, post-Initial public offering, organization’s settled up capital will stay same at Rs. 37.10 cr. In view of the upper cap of Initial public offering cost band, the organization is searching for a market cap of Rs. 504.61 cr.

Monetary Execution:

On the monetary execution front, for the last three fiscals, the organization has posted a complete income/net benefit of Rs. 63.24 cr. /Rs. 9.73 cr. (FY21), Rs. 83.34 cr. /Rs. 1.36 cr. (FY22), and Rs. 97.50 cr. /Rs. 1.66 cr. (FY23). For 9M of FY24 finished on December 31, 2023, it procured a net benefit of Rs. 1.55 cr. on an all out income of Rs. 68.44 cr. Subsequently the organization has posted normal development in its top and main concerns for the revealed periods.

For the last three fiscals, it has revealed a normal EPS of Rs. 3.71 and a normal RoNW of 35.90x%. The issue is estimated at a P/BV of 8.37 in view of its NAV of Rs. 16.25 as of December 31, 2023, and will stay same on post-Initial public offering premise. Notwithstanding, its Initial public offering promotion shows its post-Initial public offering NAV of Rs. 12.04 based on last finished fiscals (which is Walk 31, 2023 finished period for this situation and in view of it the issue is estimated at a P/BV of 11.30. (As per the lead director, this is according to the modified rules from SEBI on such revelations).

On the off chance that we characteristic annualized FY24 income to its post-Initial public offering settled up capital, then, at that point, the asking cost is at a P/E of 24.46. The issue shows up completely estimated in view of its monetary exhibition up until this point.

Profit Strategy:

While the organization has not pronounced any profits for the revealed times of the deal record, it has proactively taken on a profit strategy in November 2023 based on its monetary execution and what’s in store possibilities.

Examination WITH Recorded Friends:

According to the proposition report, the organization has shown Tatva Chintan, Tanfac Ind., Neogen Chem., Sigachi Ind., and DMCC Spl. Chem., as their recorded companions. They are exchanging at a P/E of 82.6, 37.9, 107, 37.4, and 64.8 (as of May 29, 2024). Nonetheless, they are not really similar on an apple-to-apple premise.

Trader BANKER’S History:

This is the eighth command from Pantomath Capital in the last three fiscals (counting the continuous one). Out of the last 7 issues, all recorded with expenses going from 27% to 100.45% on the date of posting.

End/Speculation Methodology

The organization is in high-immaculateness speciality synthetic fragment and appreciates virtual imposing business model in specific items. Its item portfolio presently has 185 items and another 122 is ready to go. In view of FY24 annualized profit, the issue shows up completely evaluated. Financial backers might stop assets for the medium to long haul rewards.