K2 Infragen Limited IPO Subscription and Allotments

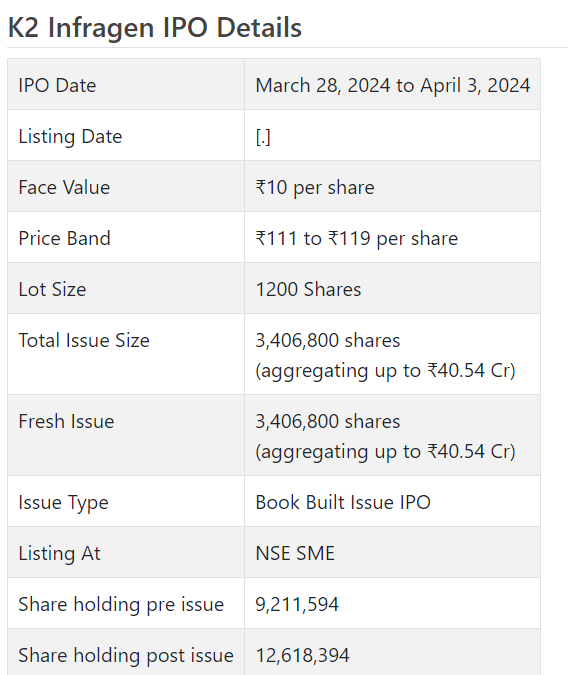

K2 Infragen Initial public offering is a book constructed issue of Rs 40.54 crores. The issue is completely a new issue of 34.07 lakh shares.

K2 Infragen Initial public offering opened for membership on Walk 28, 2024 and will close on April 3, 2024. The distribution for the K2 Infragen Initial public offering is supposed to be concluded on Thursday, April 4, 2024. K2 Infragen Initial public offering will list on NSE SME with provisional posting date fixed as Monday, April 8, 2024.

K2 Infragen Initial public offering cost band is set at ₹111 to ₹119 per share. The base part size for an application is 1200 Offers. The base measure of speculation expected by retail financial backers is ₹142,800. The base part size venture for HNI is 2 parcels (2,400 offers) adding up to ₹285,600.

• KIL is a coordinated EPC with an emphasis on power designing and venture designing.

• It checked static top lines for FY21 and FY22, with a beating misfortune for FY22.

• Set of monetary consequences of FY23 and H1-FY24 carried enormous shocks with guard benefits.

• It is working in a profoundly serious field, manageability of such edges raise concern.

• Very much educated financial backers might stop moderate assets for the medium to long haul rewards.

ABOUT Organization:

K2 Infragen Ltd. (KIL) is a coordinated designing, obtainment and development (“EPC”) with an emphasis on Power Designing and Venture Designing having experience in plan and development of different undertakings across 8 States in India viz. Uttar Pradesh, Rajasthan, Madhya Pradesh, Karnataka, Haryana, Gujarat, Punjab and Delhi. It offers types of assistance across the worth chain, going from plan, acquirement, development oversight, subcontract the board and work request the executives to present development exercises on clients.

The organization has been certify with different enrollments as a project worker with different divisions and offices viz. Public Works Office, Rajasthan (Class AA), Public Works Division, Madhya Pradesh, Bhopal (Class AA), in accordance with which it is likewise qualified to partake and embrace projects granted by different offices and organizations. It has in-house capacities to convey a task from conceptualization to the end with quicker time required to circle back and spotlight on de-gambling at every possible opportunity. KIL’s center skill lies in expertly dealing with the worth chain and drawing in and holding ability to expand esteem creation.

KIL’s business is comprehensively partitioned into two classes: 1. Designing, Obtainment and Development (EPC) a. Contract Business, b. Administration Business, and 2. Exchanging Business.

As of the date of the Distraction Plan, its hardware base contained north of 13 development and mining apparatus and 25 vehicles. As of February 29, 2024, it had a request book worth Rs. 395+cr.

The Organization is having some expertise in the acquirement of materials like non-ferrous waste from the open market and, on occasion, through sell off processes. These materials are cautiously filling in as a delegate that overcomes any issues between material obtaining and supply through increase model, its exchanging business assumes a crucial part in upgrading the production network and supporting different partners in the worth chain.

The end utilization of the expressed items to the clients includes reusing scrap materials by softening them and produce different items for rail lines, power, car, telecom, developments, painstaking work, and numerous modern and homegrown things. The idea of clients under this vertical incorporate makers. This exchanging business works as a basic connection in the production network, working with the proficient progression of materials from the more extensive market to assembling units. Its obligation to quality control and client explicit necessities guarantees that the assembling clients get exactly the unrefined substances they need to keep up with item honesty and consistency. Whether obtaining materials from the open market or partaking in barters, this business’ mastery in material choice and quality isolation improves KIL’s standing as a believed accomplice in empowering consistent, top notch creation processes for its assembling clients.

As of the date of RHP, it had 61 representatives on its finance. Moreover, it additionally recruits authoritative workers as and when required.

ISSUE Subtleties/CAPITAL HISTORY:

The organization is emerging with its lady book building course Initial public offering of 3406800 value portions of Rs. 10 each to assemble Rs. 40.54 cr. at the upper cap. It has reported a value band of Rs. 111 – Rs. 119 for every offer. The issue opens for membership on Walk 28, 2024, and will close on April 03, 2024. The base application to be made is for 1200 offers and in products consequently, from that point. Post distribution, offers will be recorded on NSE SME Arise. The issue is 27% of the post-Initial public offering settled up capital of the organization. From the net returns of the Initial public offering, it will use Rs. 16.00 cr. for working capital, Rs. 8.31 cr. for capex, and the rest for general corporate purposes.

The issue is exclusively lead overseen by Master Worldwide Experts Pvt. Ltd., and KFin Advances Ltd. is the recorder of the issue. Rikhav Protections Ltd. is the market creator for the organization.

Having given beginning value shares at standard, the organization gave further value partakes in the value scope of Rs. 11 – Rs. 119 between July 2016 and August 2023. It has additionally given extra offers in the proportion of 2.90 for 1 in July 2023. The typical expense of securing of offers by the advertisers is Rs. 3.82, Rs. 4.57, Rs. 5.44, Rs.5.46, and Rs. 8.48 per share.

Post-Initial public offering, organization’s ongoing settled up value capital of Rs. 9.21 cr. will stand upgraded to Rs. 12.62 cr. In view of the upper Initial public offering cost band, the organization is searching for a market cap of Rs. 150.16 cr.

Monetary Execution:

On the monetary execution front, for the last three fiscals, the organization has (on a merged premise) posted a complete pay/net benefit/ – (loss) of Rs. 35.68 cr. /Rs. 0.22 cr. (FY21), Rs. 36.85 cr. /Rs. – 3.11) cr. (FY22), Rs. 74.90 cr. /Rs. 11.32 cr. (FY23). For H1 of FY24 finished on September 30, 2023, it procured a net benefit of Rs. 6.07 cr. on an all out pay of Rs. 59.68 cr. While it posted tremendous misfortune for FY22, the quantum hop in main concern for FY23 cause a stir, yet in addition worry over the manageability of such a high edge.

For the last three fiscals, it has revealed a normal EPS of Rs. 5.80, and a typical RONW of 129.20%. The issue is estimated at a P/BV of 4.32 in view of its NAV of Rs. 27.53 as of September 30, 2023. The Initial public offering cost band promotion is feeling the loss of the post-Initial public offering NAV information at the lower and upper cap.

On the off chance that we characteristic annualized FY24 income to its post-Initial public offering completely weakened paid-p capital, then the asking cost is at a P/E of 12.36. Accordingly the issue shows up completely estimated based on announced super benefits.

For the announced periods, the organization has posted PAT edges of 0.63% (FY21), – (8.51) % (FY22), 15.14% (FY23), 10.23% (H1-FY24), and RoCE edges of 8.41%, – (4.98) %, 46.22%, 19.91% separately for the alluded periods.

Profit Strategy:

The organization has not announced any profits since joining. It will take on a reasonable profit strategy in view of its monetary exhibition and future possibilities.

Examination WITH Recorded Companions:

According to the proposition record, the organization has shown Markolines Asphalt, WS Enterprises, Udayshivakumar Infra and Advait Infra as their recorded companions. They are exchanging at a P/E of 16.4, 24.6, 13.4 and 00 (as of Walk 22, 2024). Nonetheless, they are not similar on an apple-to-apple premise.

Dealer BANKER’S History:

This is the eighth order from Master Worldwide in the last two fiscals, out of the last 6 postings, 1 opened at markdown, 1 at standard and the rest with charges going from 10.47% to 90% upon the arrival of posting.