Juniper Hotels Limited IPO Subscription and allotment

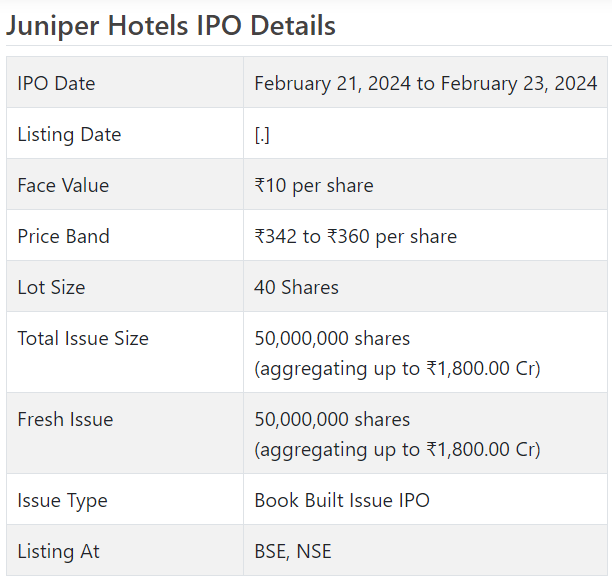

Juniper Lodgings Initial public offering is a book constructed issue of Rs 1,800.00 crores. The issue is completely a new issue of 5 crore shares.

Juniper Lodgings Initial public offering opens for membership on February 21, 2024 and closes on February 23, 2024. The apportioning for the Juniper Lodgings Initial public offering is supposed to be settled on Monday, February 26, 2024. Juniper Lodgings Initial public offering will list on BSE, NSE with conditional posting date fixed as Wednesday, February 28, 2024.

Juniper Lodgings Initial public offering cost band is set at ₹342 to ₹360 per share. The base part size for an application is 40 Offers. The base measure of speculation expected by retail financial backers is ₹14,400. The base part size venture for sNII is 14 parcels (560 offers), adding up to ₹201,600, and for bNII, it is 70 parcels (2,800 offers), adding up to ₹1,008,000.

• JHL is the main accommodation organization with worldwide accomplice “Hyatt” as financial backer too.

• The organization utilized obligation model to extend its abilities during the pandemic.

• The organization is reimbursing around 67% obligation from the Initial public offering continues that will bring finance cost saving before long.

• However the issue is at a negative P/E because of its shortfall making status at the net level for the revealed monetary exhibition, it’s a commendable wagered.

• Very much educated financial backers might stop assets for medium to long haul rewards.

ABOUT Organization:

Juniper Inns Ltd. (JHL) is a lavish inn improvement and possession organization, and are the biggest proprietor, by number of Keys of “Hyatt” subsidiary lodgings in India as of September 30, 2023. (source: Horwath Report). It has an arrangement of seven inns and overhauled condos and work a sum of 1,836 keys as of September 30, 2023. JHL benefits from a one of a kind and longstanding organization of north of 40 years between Saraf Lodgings (counting past and current members, on the whole alluded to as the “Saraf Gathering”), an inn designer with a solid and deeply grounded history in India, and partners of a universally perceived chief neighborliness brand, Hyatt Lodgings Enterprise (NYSE: H) (“HHC”) (by and large with its subsidiaries “Hyatt”).

JHL is the main inn improvement organization in India with which Hyatt has an essential venture. It claims 19.6% of Hyatt bunch partnered lodgings and condos in India as on September 30, 2023 (source: Horwath Report) and have broad involvement with recognizing open doors in cordiality objections, growing top of the line inns in these areas and supporting them through dynamic resource the board. The organization is additionally centered around giving quality visitor experience, while working its resources productively.

Its lodgings and adjusted condos are available across the extravagance, upper upscale and upscale classification of inns and are laid out tourist spots in Mumbai, Delhi, Ahmedabad, Lucknow, Raipur and Hampi. Other than Excellent Hyatt Mumbai Inn and Homes being the biggest lavish inn in India, the Hyatt Rule Lucknow and Hyatt Regime Ahmedabad are the biggest upper upscale lodgings in their particular business sectors and Hyatt Raipur is the main upper upscale inn in Raipur (source: Horwath Report).

The Organization is together held by Saraf Inns and its member, Juniper Speculations and Two Oceans Property (an aberrant auxiliary of HHC). The organization between its key partners has been worked north of quite a few years. Saraf Gathering has north of 40 years of industry experience and have fostered various lodgings across South Asia. HHC is a worldwide friendliness organization with generally perceived, industry-driving brands and a practice of development created more than 65 years, with an inn portfolio comprising of 1,310 lodgings and 313,257 rooms, across full help inns and resorts, comprehensive retreats, select help inns, way of life lodgings and different properties, as of September 30, 2023.

JHL benefits from the experience of its critical investors and can use their well established brand legacy, inside and out market grasping, functional experience, and the Universe of Hyatt steadfastness program with around 42 million individuals as of September 30, 2023. It at present claims an arrangement of seven lodgings and overhauled condos which are situated across six urban communities in India, containing laid out metro urban areas (Mumbai and Delhi), arising business objections (Ahmedabad, Lucknow and Raipur) and forthcoming vacationer locations (Hampi), giving visitor and geographic expansion. Its inns and overhauled lofts are grouped under three particular sections: (a) extravagance – the Stupendous Hyatt Mumbai Inn and Homes and Andaz Delhi; (b) upper upscale – the Hyatt Delhi Homes, Hyatt Regime Ahmedabad, Hyatt Rule Lucknow and Hyatt Raipur; and (c) upscale – Hyatt Spot Hampi (source: Horwath Report).

It has the biggest total stock of upper level marked adjusted lofts in Mumbai and New Delhi among lodgings claimed by significant confidential financial backers (source: Horwath Report). As of September 30, 2023, (a) the Terrific Hyatt Mumbai Inn and Homes had 665 keys, which addresses roughly 12% of the complete stockpile of 5.4k extravagance room stock in Mumbai, and (b) Andaz Delhi had 401 keys, which addresses around 12% of the all out supply of 3.3k extravagance room stock in New Delhi (source: Horwath Report). JHL’s huge presence in New Delhi and Mumbai furnishes it with an upper hand from both global and homegrown travel through these urban communities and the deeply grounded business biological systems. Ahmedabad is a center point for financial development in Gujarat and Lucknow stands to profit from the push for dynamic interests in Uttar Pradesh. As of September 30, 2023, (a) the Hyatt Rule Ahmedabad had 211 keys, which addresses roughly 26% of the all out supply of 0.8k upper upscale stock in Ahmedabad; and (b) the Hyatt Regime Lucknow had 206 keys, which addresses roughly 52% of the complete stock of 0.4k upper upscale stock in Lucknow (source: Horwath Report). In Raipur, the Hyatt Raipur was laid out to profit from the modern development in the capital city of Chhattisgarh, the asset rich state. The Hyatt Spot Hampi was laid out to take special care of sightseers visiting the Hampi UNESCO World Legacy Site, as well as to business explorers visiting the close by steel producing offices.

JHL distinguishes and gains locales to foster its inns and overhauled condos, representing variables like area, monetary capability of the area, target clients and marking. The Amazing Hyatt Mumbai Lodging and Homes is situated between the Bandra Kurla Complex (“BKC”) (which is the business focal point of the city) and the Chhatrapati Shivaji Maharaj Worldwide Air terminal, arranged in Mumbai. Essentially, Andaz Delhi and Hyatt Delhi Homes are situated at the Indira Gandhi Global Air terminal friendliness locale (Delhi Aerocity), among Gurgaon and New Delhi. When the organization distinguishes and secures locales, its skill being developed permits it to move quickly from a capital sending stage to an income age stage by making resources functional.

JHL is the lead element for the Saraf Gathering, through responsibility for novel arrangement of extravagance, upper upscale and upscale accommodation resources, situated in profoundly beneficial areas across key areas. As of September 30, 2023, it had an all out 1993 representatives on its finance (counting CHPL gathering of lodgings).

ISSUE Subtleties/CAPITAL HISTORY:

The organization is emerging with a lady book building course Initial public offering worth Rs. 1800 cr. (approx. 50000000 offers at the upper band). The organization has reported a value band of Rs. 342 – Rs. 360 for value portions of Rs.10 each. The issue opens for membership on February 21, m2024, and will close on February 23, 2024. The base application is to be made for xxx offers and in products subsequently, from there on. Post distribution, offers will be recorded on BSE and NSE. The issue comprises 22.47% of the post-Initial public offering settled up capital of the organization. From the net returns of the Initial public offering reserves, it will use Rs. 1500.00 cr. for reimbursement/prepayment of specific borrowings by it and its as of late obtained VHPL and CHHPL, and the rest for general corporate purposes.

The organization has apportioned at the very least 75% for QIBS, not over 15% for HNIs and not over 10% for Retail financial backers.

The three joint Book Running Lead Administrators to this issue are JM Monetary Ltd., CLSA India Pvt. Ltd., and ICICI Protections Ltd., while KFin Innovations Ltd. is the recorder of the issue.

Having given introductory value shares at standard, the organization changed over additional value shares at a decent cost of Rs. 184.51 per share in September 2023. It has additionally given 94500000 extra offers in July 2000. The typical expense of obtaining of offers by the advertisers is Rs. 17.90, Rs. 35.62, and Rs. 184.51 per share.

Post-Initial public offering, JHL’s ongoing settled up value capital of Rs. 172.50 cr. will stand upgraded to Rs. 222.50 cr. In view of the upper band of the Initial public offering value, the organization is searching for a market cap of Rs. 8010.09 cr.

Monetary Execution:

On the monetary execution front, for the last three fiscals, the organization has (on a united premise) posted an all out pay/net benefit/ – (loss) of Rs. 192.85 cr. /Rs. – (199.49) cr. (FY21), Rs. 343.76 cr. /Rs. – (188.03) cr. (FY22), and Rs. 717.29 cr. /Rs. – (1.50) cr. (FY23). De H1 of FY24 finished on September 30, 2023, it posted an overal deficit of Rs. – (26.50) cr. on an all out pay of Rs. 337.43 cr. Consequently it posted misfortune for this large number of announced a long time in the midst of development in its top line.

For the last three fiscals, the organization revealed a normal EPS of Rs. – (6.72), and a typical RoNW of – (23.91) %. The issue is evaluated at a P/BV of xx in light of its NAV of Rs. 59.11 as of September 30, 2023, and at a P/BV of xx in light of its post-Initial public offering NAV of Rs. 119.53 per share (at the upper cap).

The issue is adversely valued as the organization has posted misfortunes for the revealed periods. It is likewise at a negative P/E. Nonetheless, its obligation reimbursement from the Initial public offering supports will bring finance cost saving as it settled on obligation subsidizing that was utilized during the Pandemic to grow at wanted levels.

Profit Strategy:

The organization has not proclaimed any profits for the revealed times of the proposition reports. It has proactively embraced a profit strategy in the long stretch of February 2024, in light of its monetary presentation and future possibilities.

Correlation WITH Recorded Companions:

According to the deal archive, the organization has shown Chalet Lodgings, Lemon Tree, Indian Inns, and EIH Ltd. as their recorded companions. They are exchanging at a P/E of 72.9, 86.0, 65.4, and 45.0 (as of February 16, 2024). In any case, they are not similar on an apple-to-apple premise.

Shipper BANKER’S History:

The three BRLMs related with the issue have taken care of 85 public issues in the beyond three fiscals, out of which 22 issues shut underneath the proposition cost on the posting date.