JNK India Limited IPO Full Details

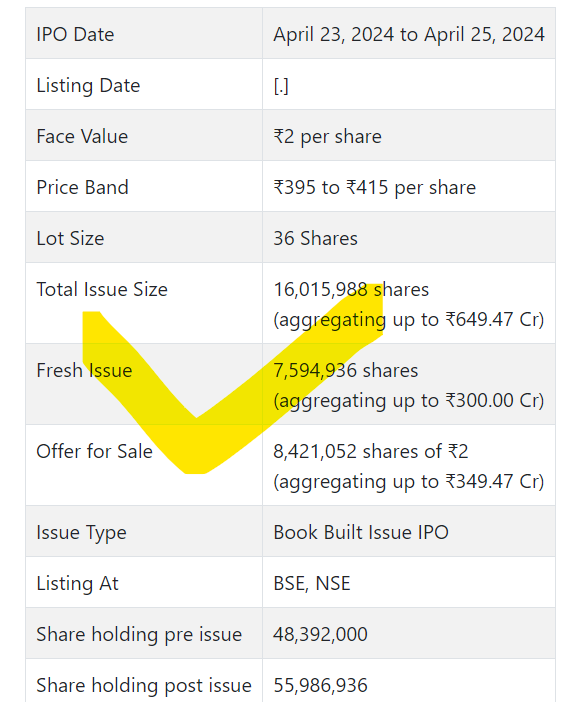

JNK India Initial public offering is a book fabricated issue of Rs 649.47 crores. The issue is a mix of new issue of 0.76 crore shares conglomerating to Rs 300.00 crores and make available for purchase of 0.84 crore shares collecting to Rs 349.47 crores.

JNK India Initial public offering opens for membership on April 23, 2024 and closes on April 25, 2024. The portion for the JNK India Initial public offering is supposed to be settled on Friday, April 26, 2024. JNK India Initial public offering will list on BSE, NSE with provisional posting date fixed as Tuesday, April 30, 2024.

JNK India Initial public offering cost band is set at ₹395 to ₹415 per share. The base part size for an application is 36 Offers. The base measure of venture expected by retail financial backers is ₹14,940. The base parcel size speculation for sNII is 14 parts (504 offers), adding up to ₹209,160, and for bNII, it is 67 parcels (2,412 offers), adding up to ₹1,000,980.

• The organization is a specialty player in Warming Gear section.

• It stamped consistent development in its top and main concerns for the detailed periods.

• The organization has orders available worth Rs. 845 cr. as of December 31, 2023.

• In light of annualized FY24 profit, the issue shows up sensibly evaluated.

• Financial backers might stop assets for the medium to long haul rewards.

ABOUT Organization:

JNK India Ltd. (JIL) is occupied with assembling the cycle terminated warmers, reformers and breaking heaters (together, the “Warming Hardware”) that are expected in process enterprises, for example, for oil and gas treatment facilities, petrochemical and compost ventures. It has abilities in warm planning, designing, producing, providing, introducing and charging Warming Hardware and take special care of both homegrown and abroad market.

The Indian warming gear market is firmly contended among seven organizations with the Organization and Thermax Restricted being the most conspicuous and equivalent players. (Source: F&S Report). Throughout the long term JIL has broadened into flares and incinerator frameworks and have been creating capacities in the sustainable area with green hydrogen. An interaction terminated warmer is a sort of modern radiator used to warm liquids or gases straight by consuming a fuel source like gaseous petrol or propane. Reformers are gadgets used to change over hydrocarbons, like petroleum gas or naphtha, into combination gas or syngas, which is a combination of hydrogen and carbon monoxide. Further, breaking heaters are utilized to separate enormous hydrocarbon particles into more modest ones, which can then be utilized to deliver various items, including energizes, synthetic compounds, and plastics.

The most common way of separating hydrocarbons is known as breaking, and it regularly includes warming the hydrocarbon feedstock within the sight of an impetus. (Source: F&S Report) The Warming Hardware are expected in process ventures, for example, oil and gas treatment facilities, petrochemicals, composts, hydrogen and methanol plants and so on. In India, JIL has finished projects in, among others, Andhra Pradesh, Assam, Bihar, Karnataka, Kerala, Maharashtra, Tamil Nadu, West Bengal and around the world have finished projects in Nigeria and Mexico. Further, it has continuous activities in Gujarat, Odisha, Haryana, Rajasthan in India and universally in Oman, Algeria, and Lithuania.

Further, it has effectively finished projects which were situated in broad areas, which remembered its undertakings for India at Numaligarh, Assam; Kochi, Kerala; Barauni, Bihar; and abroad at Lagos, Nigeria. Further, in Walk 2022, JIL were perceived for its wellbeing consistence by one of the confidential processing plant organizations of a global modern combination from Nigeria.

As of December 31, 2023, it served 21 Clients in India and 8 Clients abroad. Further, 7 out of the 12 oil refining organizations in India, are its Clients and the organization has provided or are currently providing Warming Gear to 11 of the 24 working petroleum processing plants across India. (Source: F&S Report). A portion of its homegrown Clients incorporate Indian Oil Company Restricted, Goodbye Ventures Restricted, Rashtriya Synthetic substances and Composts Restricted and Numaligarh Treatment facility Restricted. Further it has taken special care of abroad Clients, for example, a main designing, obtainment and development (“EPC”) organization in Europe, a main oil and gas investigation and creation organization in Oman and a center east arm of European EPC organization in oil and gas. Likewise JIL has appreciated recurrent orders from specific huge homegrown Clients like Rashtriya Synthetic and Manures Restricted, Goodbye Tasks Restricted, Numaligarh Treatment facility Restricted and Indian Oil Partnership Restricted.

In like manner, JIL has executed 17 activities for JNK Worldwide taking care of their Clients in the abroad business sectors. JNK Worldwide has likewise introduced process terminated warmers for its client in Lagos, Nigeria, where quite possibly of the greatest treatment facility on the planet (Dangote Processing plant) is worked, having a limit of 32.7 million metric tons for each annum. (Source: F&S Report).

The organization is additionally chipping away at building abilities in sustainable area with green hydrogen. It is building capacities in sustainable area with on location hydrogen creation, hydrogen fuel stations and sun oriented photovoltaic – EPC (“Sun powered PV-EPC”) which structures some portion of green hydrogen esteem chain. JIL works

as a worldwide joint designing and carrying out band together with JNK Worldwide as one of the Contracting Clients. As of December 31, 2023, it had 235 workers on its finance.

ISSUE Subtleties/CAPITAL HISTORY:

The organization is emerging with its lady book building course combo Initial public offering of 15649960 offers (at the upper cap) to prepare Rs. 649.47 cr. The issue comprises new value issue (approx. 7228908 offers at the upper cap) worth Rs. 300.00 cr. what’s more, a proposal available to be purchased (OFS) of 8421052 offers (worth Rs. 349.47 cr. at the upper cap). The organization has reported a value band of Rs. 395 – Rs.415 per portion of Rs. 2 (FV) each. The Initial public offering opens for membership on April 23, 2024, and will close on April 25, 2024. The base application to be made is for 36 offers and in products subsequently, from there on. Post distribution, offers will be recorded on BSE and NSE. The issue comprises 28.14% of the post-Initial public offering settled up value capital of the organization. From the net returns of the new value issue, it will use Rs. 262.69 cr. for working capital, and the rest for general corporate purposes. The organization has designated not over half for QIBs, at the very least 15% for HNIs and at least 35% for Retail financial backers.

The joint Book Running Lead Administrators to this issue are IIFL Protections Ltd., and ICICI Protections Ltd., while Connection Intime India Pvt. Ltd. is the recorder to the issue.

Having given whole value capital at standard worth (in light of Rs. 2 FV), it additionally gave extra offers in the proportion of 15 for 1 in November 2021. The typical expense of obtaining of offers by the advertisers/selling partners is Rs. NA. Rs. 0.13, Rs. 0.19, and Rs. 4.38 per share.

Post-Initial public offering, organization’s ongoing settled up value capital of Rs. 9.68 cr. will stand improved to Rs. 11.12 cr. In light of the upper band of the Initial public offering, the organization is searching for a market cap of Rs. 2308.27 cr.

Monetary Execution:

On the monetary execution front, for the last three fiscals, the organization has (on a merged premise) posted an all out pay/net benefit of Rs. 138.45 cr. /Rs. 16.48 cr. (FY21), Rs. 297.14 cr. /Rs. 35.98 cr. (FY22), and Rs. 411.55 cr. /Rs. 46.36 cr. (FY23). For 9M of FY24 finished on December 31, 2023, it procured a net benefit of Rs. 46.21 cr. on a complete pay of Rs. 256.76 cr. The organization stamped improvement in its edges year-over-year with developing top lines. As of December 31, 2023, the organization had a request book worth Rs. 845.03 cr.

For the last three fiscals, the organization has detailed a normal EPS of Rs.7.83, and a typical RoNW of 55.36%. The issue is valued at a P/BV of 11.91 in view of its NAV of Rs. 34.84 as of December 31, 2023, and at a P/BV of 5.47 in view of its post-Initial public offering NAV of Rs. 75.90 per share (at the upper band).

On the off chance that we characteristic FY24 annualized income to organization’s post-Initial public offering settled up value capital, then, at that point, the asking cost is at a P/E of 37.46. Hence the issue shows up sensibly valued on the new monetary exhibitions.

For the detailed periods, the organization has posted PAT edges of 11.96% (FY21), 12.14% (FY22), 11.38% (FY23), and 18.24% (9M-FY24), and RoCE edges of 71.90%, 83.25%, 57.17%, and 34.73% individually for the alluded periods.

Profit Strategy:

The organization has pronounced profits of 100 percent (FY21 and FY22), 15% for FY23 and 9M of FY24. It has embraced a profit strategy in June 2023, in light of its monetary exhibition and future possibilities.

Examination WITH Recorded Friends:

According to the proposition archive, the organization has shown Thermax Ltd., and BHEL as their recorded friends. They are exchanging at a P/E of 104.0, and NA (as of April 18, 2024). Nonetheless, they are not practically identical on an apple-to-apple premise.

Shipper BANKER’S History:

The two BRLMs related with this deal have taken care of 56 public issues in the beyond three fiscals, out of which 17 issues shut beneath the proposition cost on the posting date.