Italian Edibles Limited IPO February 2 to 7 or Subscription Status

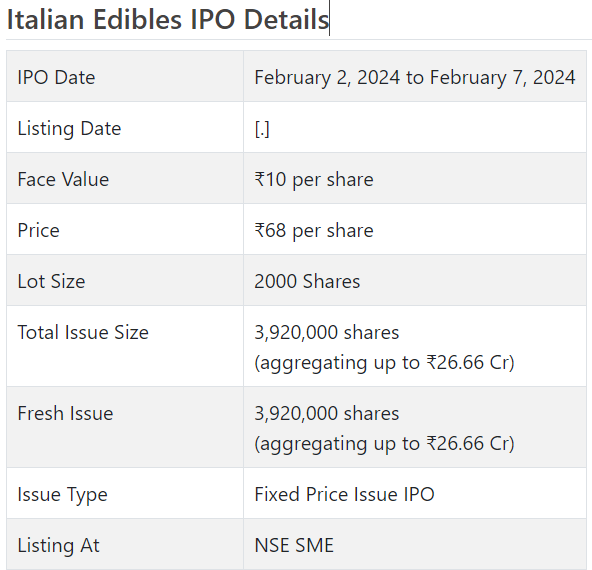

Italian Edibles Initial public offering is a proper value issue of Rs 26.66 crores. The issue is totally a new issue of 39.2 lakh shares.

Italian Edibles Initial public offering opened for membership on February 2, 2024 and will close on February 7, 2024. The portion for the Italian Edibles Initial public offering is supposed to be settled on Thursday, February 8, 2024. Italian Edibles Initial public offering will list on NSE SME with provisional posting date fixed as Monday, February 12, 2024.

Italian Edibles Initial public offering cost is ₹68 per share. The base parcel size for an application is 2000 Offers. The base measure of speculation expected by retail financial backers is ₹136,000. The base part size speculation for HNI is 2 parcels (4,000 offers) adding up to ₹272,000.

• IEL is occupied with sweet shops and other food items.

• The organization sells its items under the brand name “Ofcour’s”.

• It works in an exceptionally serious and divided portion.

• In light of its annualized super profit for FY24, the issue shows up completely valued.

• There is no damage in avoiding this Initial public offering.

ABOUT Organization:

Italian Edibles Ltd. (IEL) is a maker and provider of Sweet shop items. It from a more extensive perspective suggests the conservation of sweet delicacy readiness as confections, caramels, chocolate, handled cocoa and milk and conventional Indian desserts. Remembering the organization’s mantra “Sharing is Everything” and “Wonderful Creation and Endless Happiness”, the organization has been fabricating tasty heavenly dessert shop items throughout the previous 14 years.

Its ice cream parlor items are sold under the brand name of “Ofcour’s” It offers an extensive variety of dessert shop’s, for example, Rabdi [Meethai Sweet], Milk Glue, Chocolate Glue, Candies, Confections, Jam Confections, Multi-Grain Puff Rolls, Organic product Based Items to clients. India being a country with various societies, numerous celebrations and events, festivity with dessert shops assumes a significant part in those exceptional events, celebrations and so on.

IEL’s ice cream parlor items are sold Dish India, significantly in provincial and semi-metropolitan areas of Andhra Pradesh, Assam, Bihar, Chhattisgarh, Delhi, Gujarat, Haryana, Himachal Pradesh, Jammu and Kashmir, Jharkhand, Karnataka, Kerala, Madhya Pradesh, Maharashtra, Odisha, Punjab, Rajasthan, Tamil Nadu, Telangana, Uttar Pradesh, Uttarakhand, West Bengal and through nearby wholesalers and merchants situated around there.

IEL’s buyer fragments generally incorporate teens, youthful grown-ups and kids’ situated in country and semi-metropolitan areas of India. Aside from selling its candy store items inside India, it likewise commodities to different nations like Nigeria, Yemen, Senegal and Sudan.

As of August 31, 2023 its top clients incorporate Chocolate World, Yuvraj Organization, Bakewell Rolls Private Restricted, R. K. Prabhavati Brokers, Mamta Stores, Mama Laxmi Dealers, Suria Merchant and so forth. Likewise, one of its item, i.e., Jam Confections are offered to Dharpal Premchand Ltd (BABA) bunch.

As of August 31, 2023, it had roughly 450 Providers and wholesalers situated across 22 states in India and have traded items through organization of 5 trader exporters. Its dispersion network inside India and outside India and deep rooted brand has empowered it to really oversee showcasing technique, market infiltration and subsequently increment turnover throughout the long term.

It has two functional assembling unit that is worked by it and are situated in Gram Palda, Indore and Prabhu Cost Kanta, Indore (Madhya Pradesh). IEL sells dessert shop items in retail and discount packs. Candies, Confections, milk sweetmeat items are accessible in Pet Containers, polypacks and

cardboard boxes. As of August 31, 2023, it had 227 workers on its finance.

ISSUE Subtleties/CAPITAL HISTORY:

The organization is emerging with its lady Initial public offering of 3920000 value portions of Rs. 10 each at a decent cost of Rs. 68 for every offer to activate Rs. 26.66 cr. The issue opens for membership on February 02, 2024, and will close on February 07, 2024. The base application to be made is for 2000 offers and in products subsequently, from that point. Post distribution, offers will be recorded on NSE SME Arise. The issue comprises 26.53% of the post-Initial public offering settled up capital of the organization. The organization is spending Rs. 0.80 cr. for this Initial public offering process and from the net returns it will use Rs. 8.00 cr. for setting up of proposed producing unit, Rs. 6.15 cr. for reimbursement of specific borrowings, Rs. 6.00 cr. for working capital and Rs. 5.71 cr. for general corporate purposes.

The issue is exclusively lead overseen by First Abroad Capital Ltd.(FOCL), and Bigshare Administrations Pvt. Ltd. is the recorder of the issue. Nikunj Stock Specialists Ltd.(NSBL) is the market creator for the organization. While FOCL has endorsed the Initial public offering up to 15%, NSBL has guaranteed to the tune of 85%.

Having given starting value capital at standard, it gave further value shares at a decent cost of Rs. 60 for every offer in Spring 2022.The organization has likewise given extra offers in the proportion of 16 for 3 in August 2023. The typical expense of securing of offers by the advertisers/selling partners is Rs. 2.39, and Rs. 2.73 per share.

Post-Initial public offering, organization’s ongoing settled up value capital of Rs. 10.86 cr. will stand upgraded to Rs. 14.78 cr. In view of the upper Initial public offering cost band, the organization is searching for a market cap of Rs. 100.49 cr.

Monetary Execution:

On the monetary execution front, for the last three fiscals, the organization has posted an all out pay/net benefit of Rs. 48.99 cr. /Rs. 0.87 cr. (FY21), Rs. 75.45 cr. /Rs. 0.80 cr. (FY22), and Rs. 63.30 cr. /Rs. 2.64 cr. (FY23). For 5M of FY24 finished on August 31, 2023, it procures a net benefit of Rs. 2.10 cr. on a complete pay of Rs. 30.52 cr. Accordingly its top line has posted degrowth from FY23 onwards, while its main concern is concocted maybe to match the asking cost.

For the last three fiscals, it has revealed a normal EPS of Rs. 1.60, and a typical RONW of 18.00%. The issue is evaluated at a P/BV of 5.73 in light of its NAV of Rs. 11.86 as of August 31, 2023, and at a P/BV of 2.54 in light of its post-Initial public offering NAV of Rs. 26.75 per share (at the upper cap).

On the off chance that we trait annualized FY24 income to its post-Initial public offering completely weakened paid-p capital, then the asking cost is at a P/E of 19.94. Hence the issue shows up completely estimated with supported annualized FY24 income.

For the revealed periods, the organization has posted PAT edges of 1.77% (FY21), 1.06% (FY22), 4.17% (FY23), 6.87% (5M-FY24), and RoCE edges of 9.17%, 12.16% 19.32%, 11.55% separately for the alluded periods.

Profit Strategy:

The organization has not pronounced any profits since consolidation. It will embrace a judicious profit strategy in light of its monetary exhibition and future possibilities.

Correlation WITH Recorded Friends:

According to the deal report, the organization has shown Lotus Chocolate and Tapi Natural product as their recorded companions. They are exchanging at a P/E of NA and 279 (as of January 29, 2024). Be that as it may, they are not equivalent on an apple-to-apple premise.

Trader BANKER’S History:

This is the 25th command from First Abroad in the last three fiscals, out of the last 10 postings, 3 opened at standard and the rest with charges going from 0.04% to 18.68% on the date of posting.