India’s Retail Inflation Dips to 4.75% – Key Takeaways and Market Implications

In a notable development for India’s economic landscape, the latest figures reveal a dip in retail inflation to 4.75%. This shift holds significant implications for both policymakers and market participants, offering valuable insights into the trajectory of the country’s economy.

Analyzing the Data: Understanding the Numbers

India’s retail inflation rate dropping to 4.75% marks a pivotal moment in the economic narrative of the nation. This decline, while seemingly modest, carries profound implications for various sectors and stakeholders. Delving into the intricacies of the data allows us to glean valuable insights into the underlying trends and dynamics driving this phenomenon.

Key Takeaways: Deciphering the Implications

- Economic Stability: The moderation in retail inflation underscores a semblance of economic stability, offering respite amid global uncertainties and domestic challenges. This trend bodes well for consumer sentiment and business confidence, laying the groundwork for sustained economic growth.

- Monetary Policy Outlook: The retail inflation data serves as a crucial input for monetary policymakers, guiding their decisions on interest rates and liquidity management. The decline in inflationary pressures may provide leeway for accommodative monetary measures aimed at fostering economic recovery.

- Consumer Spending Dynamics: Lower inflation rates have the potential to bolster consumer spending power, as reduced price pressures translate into increased purchasing capacity. This, in turn, could stimulate demand across various sectors, contributing to overall economic revitalization.

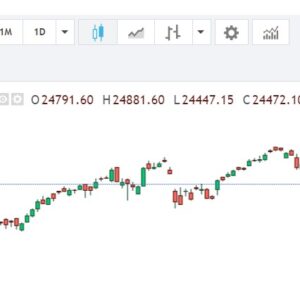

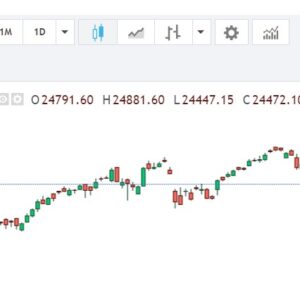

- Market Sentiment: The retail inflation data exerts a significant influence on market sentiment and investor behavior. A decline in inflationary pressures may instill confidence among investors, driving positive sentiment and bolstering asset prices.

Market Implications: Navigating Opportunities

- Equity Markets: The news of declining retail inflation could serve as a catalyst for equity markets, with investors eyeing sectors poised to benefit from increased consumer spending and favorable economic conditions.

- Fixed Income Markets: In the realm of fixed income, the implications of lower inflation rates extend to bond yields and interest rate expectations. Investors may recalibrate their fixed income portfolios in response to evolving inflation dynamics, seeking optimal risk-adjusted returns.

- Currency Markets: Currency markets are not immune to the influence of retail inflation data, as shifts in inflationary expectations can impact exchange rates and currency valuations. Market participants may monitor currency pairs closely for signs of volatility and trend reversals.

Navigating the Road Ahead: Strategic Imperatives

In light of the evolving economic landscape, stakeholders must remain vigilant and proactive in navigating the road ahead. Strategic imperatives for policymakers, businesses, and investors include:

- Policy Agility: Policymakers must maintain a nimble approach, adapting monetary and fiscal policies to changing economic conditions while prioritizing long-term sustainability and stability.

- Business Resilience: Businesses should focus on enhancing resilience and agility, leveraging technological advancements and strategic partnerships to capitalize on emerging opportunities and mitigate risks.

- Investor Prudence: Investors are urged to exercise prudence and diligence in portfolio management, conducting thorough research and diversifying across asset classes to mitigate risks and seize opportunities.

In conclusion, the dip in India’s retail inflation to 4.75% heralds a promising development for the country’s economic trajectory. While the implications are manifold, stakeholders across sectors have the opportunity to leverage this shift to their advantage, fostering growth, resilience, and prosperity.