HMA Agro Industries Limited IPO June 20 To June 23

Consolidated in 2008, HMA Agro Ventures Restricted is a food exchange association for dealt with food and agro items including frozen new deglanded bison meat, ready/frozen normal items, vegetables, and oats in India.

HMA Agro Ventures is one of the biggest exporters of frozen bison meat items from India and records for over 10% of India’s all out commodity of frozen bison meat. The organization’s items are bundled under the brand name “Dark Gold”, “Kamil” and “HMA” and are sent out to more than 40 nations all around the globe.

The organization has four completely coordinated bundled meat handling plants situated at Aligarh, Mohali, Agra, and Parbhani and is currently setting up a fifth completely coordinated claimed meat item handling unit in Haryana. The organization is likewise during the time spent obtaining an extra plant at Unnao by Q2 of FY 2022-23. These would make the all out in-house meat item handling abilities to in excess of 4,00,000 metric tons p.a. spread north of six different possessed plants by Q2 of FY 2022-23.

HMA Agro Ventures likewise claims two extra auxiliary level meat handling units at Jaipur and Manesar.

The offices are supported for product to UAE, Iraq, Saudi Arabia, Oman, Bahrain, Jordan, Algeria, Egypt, Angola, Vietnam, Indonesia, Georgia, Malaysia, Combodia, and other Center East, CIS, and African Nations, and so on. Roughly 90% of the deals of the organization are as commodities.

HMA Gathering has an all out strength of around 25000 representatives and works more than 10 working environments and 5 work spaces in India.

• HAIL is the star trade house for frozen bison meat in worldwide business sectors.

• It has been posting consistent development in its main concerns year over year.

• In light of FY23 profit, the issue shows up sensibly evaluated.

• HAIL sticks to the administrative standards determined for its business.

• All around informed/cash overflow financial backers might stop assets for medium to long haul rewards.

Prelude:

There is a shout for this Initial public offering since it was reported. HAIL is one of the three top exporters of frozen bison meat and this portion is under administrative standards with controllers like APEDA, FSSAI, SGS, QMS, EMS FSMS and so on. While there is a ruckus about this organization’s business on cow meat, the administration explained this and said that they have nothing connected with cows, however they are sending out frozen bison meat in the wake of getting vital confirmations from the administrative bodies. Its complete income has more than 91% of commodities of bison meat and the lay on commodities of agro items.

Since HAIL has acquired ubiquity in worldwide nations for its quality items, the organization has additionally begun sending out Agri items like Basmati and so on, trusting that their clients might choose these items too being the FMCG things of day to day utilization. As the organization is doing trades in Dollar money, it is acquiring expansion to its other pay due to forex unpredictability and supporting tasks. As per the administration, the organization has a piece of the pie of 10% in the complete bison meat sends out from India – the greatest forex worker. As of now, the organization is weakening just around 16% and later on it will think about additional weakening of 9% inside the specified period.

ABOUT Organization:

HMA Agro Enterprises Ltd. (HAIL) is a three-star trade house perceived by the Public authority of India. It’s a leader organization of the HMA bunch which has been in the meat business for more than forty years. HAIL is right now among the biggest exporters of frozen bison meat items from India and it represents over 10% of India’s all out product of frozen bison meat (Source: Brickworks Investigation Report).

Its items are essentially bundled under the brand name “Dark Gold”, “Kamil” and “HMA” and traded to north of 40 nations all around the globe. HAIL bargains in bison meat and unified items. Not at all like hamburger or pork, bison meat is liberated from strict imperatives and enjoys the additional benefit of low fat and cholesterol. The meat delivered for send out is as deboned and deglanded frozen halal bison meat.

HAIL (counting its auxiliaries) claims four completely coordinated bundled meat handling plants which are situated at Aligarh, Mohali, Agra and Parbhani and are currently setting up a fifth completely coordinated possessed meat item handling unit in Haryana. It is likewise in the high level stages to get an extra plant at Unnao and is supposed to be finished this securing by Q2 of FY 2023-24. These would make HAIL’s complete in-house meat item handling limits in excess of 4,00,000 metric tons p.a. spread more than six different claimed plants by FY 2023-24. Further, it likewise claims two extra optional level meat handling units at Jaipur and Manesar. The organization fulfills rigid quality guidelines as characterized by controllers engaged with the cycle and gets affirmed for something very similar.

The acquisition of unrefined substance is finished by the organization and afterward this unrefined substance is shipped off different handling units to deal with the unrefined substance into eventual outcomes and it sends out these marked completed items through its own dispersion channels. The vast majority of these handling units are claimed by its auxiliaries and outsiders own some. These tasks cost HAIL under 1% of its solidified incomes.

To exploit its vigorous commodity business and deeply grounded appropriation channels across 40 nations, the organization has as of late broadened its item portfolio by adding Frozen Fish Items, Basmati Rice and intending to begin Poultry and other Agri items as business verticals. HAIL expects to become one of the most very much perceived food item exporters in India. As of December 31, 2022, it had 926 representatives on its finance.

ISSUE Subtleties/CAPITAL HISTORY:

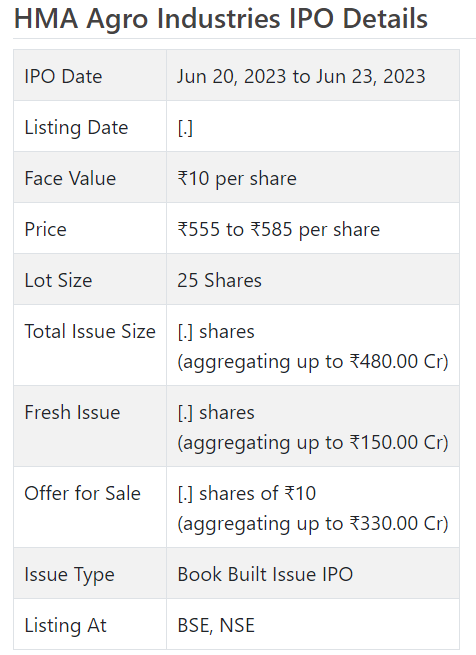

The organization is emerging with a combo book-building Initial public offering of a new value issue worth Rs. 150 cr. (Approx. 2564100 offers at the upper cap) and a proposal available to be purchased (OFS) of Rs. 330 cr. (approx. 5641025 offers at the upper cap) to assemble Rs. 480.00 cr. (approx. 8205125 offers at the upper cap). It has declared a value band of Rs. 555 – Rs. 585 for each portion of Rs. 10 each. The issue opens for membership on June 20, 2023, and will close on June 23, 2023. The base application is to be made for 25 offers and in products consequently, from there on. Post distribution, offers will be recorded on BSE and NSE. The issue comprises 16.39% of the post-Initial public offering settled up capital of the organization. From the net returns of the new value issue, the organization will use Rs. 135.00 cr. for working capital and the rest for general corporate purposes.

Aryaman Monetary Administrations Ltd. is the sole Book Running Lead Administrator (BRLM) and Bigshare Administrations Pvt. Ltd. is the recorder of the issue.

Having given starting value shares at standard, the organization gave further value partakes in the value scope of Rs. 50.00 – Rs. 100.00 between August 2010 and July 2011. It likewise gave extra offers in the proportion of 325 for 100 in July 2021 and 2 for 1 in October 2021. The typical expense of securing of offers by the advertisers/selling partners is Rs. 0.65, Rs. 0.78, Rs. 1.13, Rs. 1.29, Rs.1.45, and Rs. 1.56 per share.

Post-Initial public offering, HAIL’s ongoing settled up value capital of Rs. 47.51 cr. will stand upgraded to Rs. 50.08 cr. In view of the upper cap of Initial public offering estimating, the organization is searching for a market cap of Rs. 2929.50 cr.

Monetary Execution:

On the monetary execution part, for the last three fiscals, HAIL has (on a merged premise) posted a turnover/net benefit of Rs. 2416.61 cr. /Rs. 45.90 cr. (FY20), Rs. 1720.40 cr. /Rs. 71.60 cr. (FY21), and Rs. 3138.98 cr. /Rs. 117.62 cr. (FY22). For 9M of FY23, it procured a net benefit of Rs. 113.24 cr. on a turnover of Rs. 2417.82 cr. However the organization experienced a minor misfortune in top line during the pandemic year, it posted better edges. With another completely coordinated plant and hardware, it is planning to keep up with development in its edges going ahead.

For the last three fiscals, HAIL has revealed a normal EPS of Rs. 18.83 and a normal RoNW of 28.78%. The issue is valued at a P/BV of 6.14 in view of its NAV of Rs. 95.33 as of December 31, 2022, and at a P/BV of 4.86 in view of its post-Initial public offering NAV of Rs. 120.41 per share. (at the upper band).

HAIL’s EBIDTA edges have expanded from 3.25 % in FY 2020 to more than 5.60 % in FY 2022. If we annualize FY23 income and characteristic it to post-Initial public offering completely weakened settled up value capital, then, at that point, and asking cost is at a P/E of 19.40. The issue shows up sensibly estimated.

Profit Strategy:

The organization has delivered a profit of 7% for FY20 and in the wake of skipping for FY21 and FY22, it delivered a profit of 20% for FY23 till the recording of this proposition reports. It will embrace a reasonable profit strategy post-posting, in light of its monetary exhibition and future possibilities.

Correlation WITH Recorded Companions:

According to the deal archive, there are no recorded friends for HAIL.

Trader BANKER’S History:

This is the eighteenth command from Aryaman Monetary in the last four fiscals (counting the continuous one). Out of the last 10 postings, 1 opened at a rebate, 2 at standard and the rest with charges going from 0.22% to 27.18% on the posting day.

End/Venture System

Almost certainly, there is commotion against this Initial public offering from some financial backer local area. Yet, their fear about cow meat is absolutely deceptive. This organization is participated in frozen bison meat commodities and it is rising year over year in the midst of control of numerous administrative bodies including APEDA. In light of its FY23 annualized profit, the Initial public offering shows up sensibly evaluated. All around informed/cash overflow financial backers might consider stopping of assets for the medium to long haul rewards.

Survey By Dilip Davda on Jun 13, 2023

Audit Creator

DISCLAIMER: No monetary data at all distributed anyplace here ought to be understood as a proposal to trade protections, or as exhortation to do as such in any capacity at all. All matter distributed here is only for instructive and data purposes just and by no means ought to be utilized for pursuing speculation choices. Perusers should counsel a certified monetary guide prior to pursuing any real venture choices, in view of the data distributed here. My audits don’t cover GMP market and administrators strategies. Any peruser taking choices in light of any data distributed here does so completely notwithstanding copious advice to the contrary. Financial backers ought to remember that any interest in securities exchanges is dependent upon flighty market-related chances. The above data depends on RHP and different archives accessible as of date combined with market insight. The creator has no designs to put resources into this proposition.