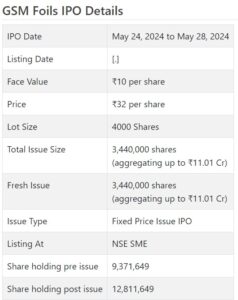

GSM Foils Initial public offering is a decent value issue of Rs 11.01 crores. The issue is totally a new issue of 34.4 lakh shares.

GSM Foils Initial public offering opens for membership on May 24, 2024 and closes on May 28, 2024. The distribution for the GSM Foils Initial public offering is supposed to be concluded on Wednesday, May 29, 2024. GSM Foils Initial public offering will list on NSE SME with a speculative posting date fixed as Friday, May 31, 2024.

GSM Foils Initial public offering cost is ₹32 per share. The base parcel size for an application is 4000 Offers. The base measure of speculation expected by retail financial backers is ₹128,000. The base part size speculation for HNI is 2 parcels (8,000 offers) adding up to ₹256,000.

• The organization is taken part occupied with rankle foils and aluminum pharma foils.

• It is working in an exceptionally cutthroat and divided section.

• The organization has posted irregularity in its top and primary concerns.

• In view of FY24 annualized profit, the issue shows up completely valued.

• Very much educated financial backers might stop moderate assets for the medium to long haul.

ABOUT Organization:

GSM Foils Ltd. (GFL) is taken part occupied with assembling Rankle Foils and Aluminum Pharma Foils (otherwise called “Strip Foils”) which is utilized in pressing of drug prescriptions which incorporates cases and tablets both. This is an essential bundling material which comes in direct contact with the medication, consequently, extreme attention to detail is taken concerning its quality. Throughout recent years, it has obtained positive skill in various kinds of foils utilized in drugs organizations. It offers Aluminum foils in various sizes, shapes and thickness to address assorted issues of clients.

The scope of GFL’s items incorporates plain and printed aluminum thwarts and strip foils alongside alum base foils and it goes from 0.020/0.025/0.030/0.040 micron for covered/ploy overlaid/rankle/strip printed foils. Aluminum Foil or Strip Foils are one of the bundling choices for exceptionally delicate drug items that safeguards the meds from oxygen, dampness, and other ecological impacts. These foils are utilized in bundling of containers which requires really blasting strength as they are greater in size and is utilized to make a push-through conclusion with top film where tablets and cases are safeguarded flawlessly and cleanly.

Rankle Foils are normally utilized as unit-portion bundling for drug tablets. Rankle foils are reasonable for hard pressing of clinical and drug items. It is heat seal covered on the brilliant side and print-treat covered on the matte side, the essential part of rankle packs is produced using “Formable” web, either plastic or aluminum, the shaped hole or pocket contains the item and the “lidding” seals the item in the bundle.

The organization has Dish India presence with customers base in 13 states and 1 Association region for homegrown market in light of deals as of December 31, 2023. As of February 28, 2024 it had 39 workers on its finance.

ISSUE Subtleties/CAPITAL HISTORY:

The organization is emerging with its lady Initial public offering of 3440000 value portions of Rs. 10 each at a proper cost of Rs. 32 for every offer to assemble Rs. 11.01 cr. The issue opens for membership on May 24, 2024, and will close on May 28, 2024. The base application to be made is for 4000 offers and in products subsequently, from there on. Post allocation, offers will be recorded on NSE SME Arise. The issue is 26.85% of the post-Initial public offering settled up capital of the organization. The organization is spending Rs. 0.62 cr. for this Initial public offering process, and from the net returns, it will use Rs. 1.11 cr. for capex towards acquisition of plant and apparatuses, Rs. 7.06 cr. for working capital, and Rs. 2.22cr. for general corporate purposes.

The issue is exclusively lead overseen by Shreni shares Ltd., and Bigshare Administrations Pvt. Ltd. is the enlistment center of the issue. Shreni Offers Ltd. is additionally the market producer for the organization.

Having given introductory value capital at standard the organization gave further value shares at a decent cost of Rs. 250 for every offer in February 2024, and has likewise given extra offers in the proportion of 22 for 1 in Walk 2024. The typical expense of securing of offers by the advertisers is Rs. 10.28, and Rs. 10.33 per share.

Post-Initial public offering, organization’s ongoing settled up value capital of Rs. 9.37 cr. will stand improved to Rs. 12.81 cr. In light of the upper Initial public offering cost band, the organization is searching for a market cap of Rs. 41.00 cr.

Monetary Execution:

On the monetary execution front, for the last three fiscals, the organization has posted a complete pay/net benefit of Rs. 35.95 cr. /Rs. 0.34 cr. (FY21), Rs. 71.85 cr. /Rs. 0.64 cr. (FY22), and Rs. 65.89 cr. /Rs. 1.43 cr. (FY23). In this way for FY23 however it checked degrowth for topline, its primary concern flooded and caused a stir. For two broken times of FY24 (3M finished on 30.06.23) + (6M finished on 31.12.23), the organization procured a net benefit of Rs. 1.75 on an all out pay of Rs. 38.10 cr. Hence there is irregularity in its top and main concerns.

For the last three fiscals, it has revealed a normal EPS of Rs. 1.26, and a typical RoNW of 12.74%. The issue is estimated at a P/BV of 1.25 in light of its NAV of Rs. 25.10 as of December 31, 2023, and at a P/BV of 1.93 in view of its post-Initial public offering NAV of Rs. 16.62 per share.

On the off chance that we trait annualized FY24 income to its post-Initial public offering completely weakened settled up capital, then the asking cost is at a P/E of 17.58. Accordingly the issue shows up completely estimated.

For the detailed periods, the organization has posted PAT edges of 0.93% (FY21), 0.89% (FY22), 2.17% (FY23), 4.57% (3M-FY24), 4.59% (+6M-FY24), and RoCE edges of 0.11%, 0.20%, 0.34%, 0.09%, 1.60% separately for the alluded periods.

Profit Strategy:

The organization has not pronounced any profits since fuse. It will embrace a reasonable profit strategy in view of its monetary exhibition and future possibilities.

Examination WITH Recorded Companions:

According to the proposition archive, the organization has shown Synthiko Foils, and MMP Ind., as their recorded companions. They are exchanging at a P/E of 59.6, and 24.8 (as of May 17, 2024). Be that as it may, they are not practically identical on an apple-to-apple premise.

Trader BANKER’S History:

This is the 27th command from Shreni Offers in the last three fiscals (counting the continuous one), out of the last 10 postings, all recorded with expenses going from 7.5%% to 141.94% on the date of posting.

End/Venture Methodology

The organization is working in a profoundly cutthroat fragment that likewise faces unpredictability in ware costs. The organization has posted irregularity in its top and main concerns. In light of FY24 annualized profit, the issue shows up completely estimated. All around informed financial backers might stop moderate assets for the medium to long haul.

Survey By Dilip Davda on May 18, 2024

Audit Creator

DISCLAIMER: No monetary data at all distributed anyplace here ought to be understood as a proposal to trade protections, or as counsel to do as such in any capacity at all. All matter distributed here is only for instructive and data purposes just and by no means ought to be utilized for pursuing speculation choices. My surveys don’t cover GMP market and administrators strategies. Perusers should counsel a certified monetary consultant prior to going with any genuine venture choices, put together the with respect to data distributed here. With passage obstructions, SEBI believes just very much educated financial backers should take part in such offers. With insane postings in the new past, SME Initial public offerings drew the consideration of financial backers no matter how you look at it and lead to diviner frenzy. In any case, as SME issues have section hindrances and proceeded with low inclination from the broking local area, any peruser taking choices in light of any data distributed here does so totally despite the obvious danger ahead. The above data depends on data accessible as of date combined with market discernments. The Creator has no designs to put resources into this proposition.