Grill Splendour Services Limited IPO Subscription and Allotments

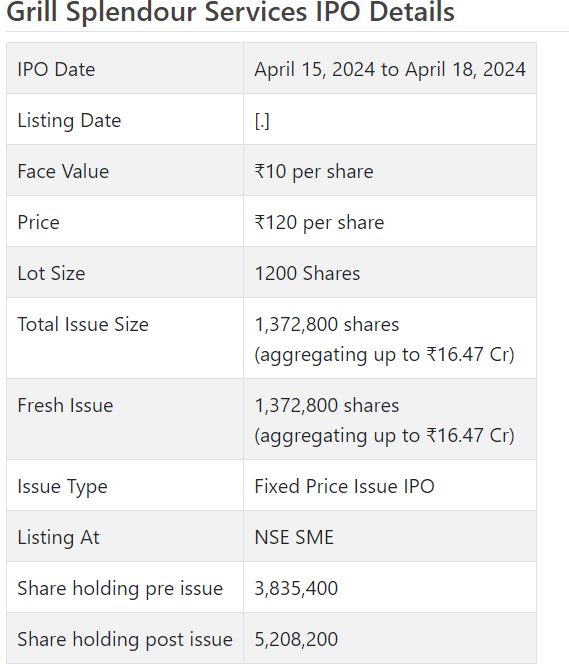

Barbecue Wonder Administrations Initial public offering is a proper value issue of Rs 16.47 crores. The issue is totally a new issue of 13.73 lakh shares.

Barbecue Wonder Administrations Initial public offering opens for membership on April 15, 2024 and closes on April 18, 2024. The allocation for the Barbecue Quality Administrations Initial public offering is supposed to be concluded on Friday, April 19, 2024. Barbecue Wonder Administrations Initial public offering will list on NSE SME with speculative posting date fixed as Tuesday, April 23, 2024.

Barbecue Wonder Administrations Initial public offering cost is ₹120 per share. The base parcel size for an application is 1200 Offers. The base measure of venture expected by retail financial backers is ₹144,000. The base parcel size venture for HNI is 2 parts (2,400 offers) adding up to ₹288,000.

• The organization is participated in the chain of foodies in and around Mumbai.

• Right now it works out of 17 retail locations and a brought together creation office.

• It posted a normal monetary execution with a supported benefit from FY23 onwards.

• Higher income have all the earmarks of being a manufactured information to make ready for extravagant valuations.

• In view of annualized super profit for FY24, the issue shows up forcefully evaluated.

• There is no damage in skirting this expensive bet.

ABOUT Organization:

Barbecue Wonder Administrations Ltd. (GSSL) is a chain of connoisseur Bread kitchen and Patisserie spread across Mumbai through 17 retail locations, a brought together creation office and numerous corporate clients. Out of these 17 retail locations, 5 stores are running under the franchisee model (franchisee claimed, and organization worked) and rest 12 stores are possessed by it.

It offers new food items from customary to ‘specially made’ as expected by the Clients. Barbecue Wonder Administrations Private Ltd. was consolidated in November 2019 as a cordiality organization to get the bread shop and confectionary business alongside brand Birdy’s Pastry kitchen and Patisserie from WAH Eateries Private Restricted. The obtaining was done by means of a Business Move and Licensed innovation Task Understanding dated December 27, 2019 (Securing Arrangement). After that the organization continued to put resources into the business and develop the brand and spread presence.

The brand Birdy’s was initially set up as “Birdy’s by Taj”. Over a period, it was offered to WAH Eateries Private Restricted and from them the equivalent was gained by GSSL vide above alluded Securing Understanding. The essential focal point of the Organization was to bring back the quality and sheen of the brand. It is participated in the offer of general classes of items: for example Cakes and Baked goods, Food Deal, Refreshments, and Desert Deals.

The Organization after securing of Birdy’s image has remodeled the greater part the shops. These shops presently gloat of seating, music atmosphere, table assistance, free library and newly made food and drinks. These bistros draw in another classification of clients called feast in which was missing before.

The organization that was fundamentally in B2C portion has entered in B2B section from FY23. As of February 29, 2024, it had 77 representatives on its finance.

ISSUE Subtleties/CAPITAL HISTORY:

The organization is emerging with its lady Initial public offering of 1372800 value portions of Rs. 10 each at a proper cost of Rs. 120 for each offer to activate Rs. 16.47 cr. The issue opens for membership on April 15, 2024, and will close on April 18, 2024. The base application to be made is for 1200 offers and in products subsequently, from there on. Post assignment, offers will be recorded on NSE SME Arise. The issue is 26.34% of the post-Initial public offering settled up capital of the organization. The organization is spending Rs. 0.37 cr. for this Initial public offering process and from the net returns of the Initial public offering, it will use Rs. 1.00 cr. for working capital, Rs. 11.15 cr. for reimbursement/prepayment of specific borrowings, and Rs. 3.95 cr. for general corporate purposes. The organization might have picked a market parcel of 1000 offers according to SEBI’s cost band equation for SME Initial public offerings.

The issue is exclusively lead overseen by Inventure Trader Broker Administrations Pvt. Ltd., and Bigshare Administrations Pvt. Ltd. is the recorder of the issue. Rikhav Protections Ltd. is the market creator for the organization. While Inventure has endorsed this Initial public offering to the tune of 94.93%, Rikhav has guaranteed for 5.07%.

The organization has given whole value capital at standard up until this point and has likewise given extra offers in the proportion of 150 for 1 in May 2023. The typical expense of securing of offers by the advertisers is Rs. 4.50 and Rs. 10.00 per share.

Post-Initial public offering, organization’s ongoing settled up value capital of Rs. 3.84 cr. will stand improved to Rs. 5.21 cr. In light of the upper Initial public offering cost band, the organization is searching for a market cap of Rs. 62.50 cr.

Monetary Execution:

On the monetary execution front, for the last three fiscals, the organization has posted a complete income/net benefit/ – (loss) of Rs. 8.25 cr. /Rs. – (0.04) cr. (FY21), Rs. 11.52 cr. /Rs. 0.04 cr. (FY22), and Rs. 15.32 cr. /Rs. 1.99 cr. (FY23). For 8M of FY24 finished on November 30, 2023, it procured a net benefit of Rs. 0.62 cr. on an all out income of Rs. 8.86 cr. The abrupt lift in its primary concerns in pre-Initial public offering year raise worries over its supportability proceeding.

For the last three fiscals, it has revealed a normal EPS of Rs. 6.63, and a typical RONW of 117.82%. The issue is evaluated at a P/BV of 9.02 in view of its NAV of Rs. 13.30 as of Walk 31, 2023, and at a P/BV of 2.81 in light of its post-Initial public offering NAV of Rs. 42.65 per share. The proposition report is feeling the loss of its NAV as of November 30, 2023.

On the off chance that we trait annualized FY24 income to its post-Initial public offering completely weakened paid-p capital, then, at that point, the asking cost is at a P/E of 67.42. Accordingly the Initial public offering shows up forcefully evaluated.

For the revealed periods, the organization has posted PAT edges of – (0.44) % (FY21), 0.30% (FY22), 13.00% (FY23), 6.96% (8M-FY24). The KPI information is missing RoCE edges data in the proposition report.

Profit Strategy:

The organization has not announced any profits for the revealed times of the deal archive. It will embrace a judicious profit strategy in light of its monetary presentation and future possibilities.

Examination WITH Recorded Companions:

According to the proposition archive, the organization has shown Westlife Food, Sapphire Food varieties, and Euphoric Food as their recorded friends. They are exchanging at a P/E of 145.0, 52.2, and 135.0 (as of April 09, 2024). Nonetheless, they are not tantamount on an apple-to-apple premise. This look at is showing up as an eyewash.

Shipper BANKER’S History:

This is the ninth command from Inventure Trader in the last four fiscals including the continuous one. Out of the last 8 postings, 3 opened at a markdown, 2 at standard and the rest with expenses going from 0.05% to 57.14% on the posting day.