Gopal Snacks Limited IPO Subscription & Allotments

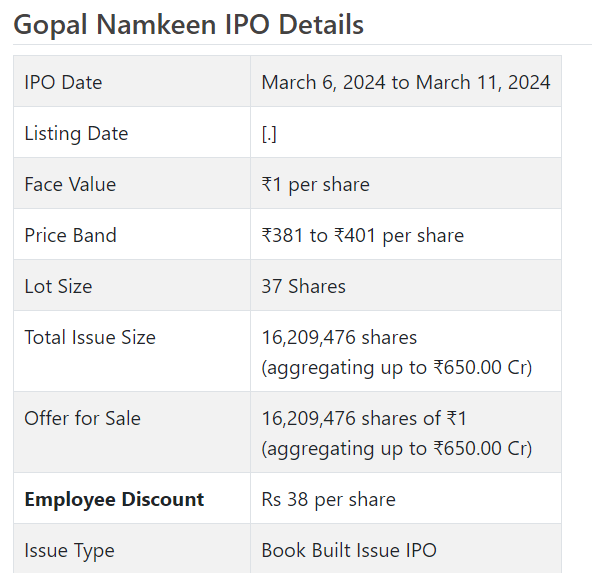

Gopal Namkeen Initial public offering is a book constructed issue of Rs 650.00 crores. The issue is totally a proposal available to be purchased of 1.62 crore shares.

Gopal Namkeen Initial public offering opens for membership on Walk 6, 2024 and closes on Walk 11, 2024. The assignment for the Gopal Namkeen Initial public offering is supposed to be settled on Tuesday, Walk 12, 2024. Gopal Namkeen Initial public offering will list on BSE, NSE with conditional posting date fixed as Thursday, Walk 14, 2024.

Gopal Namkeen Initial public offering cost band is set at ₹381 to ₹401 per share. The base parcel size for an application is 37 Offers. The base measure of speculation expected by retail financial backers is ₹14,837. The base part size venture for sNII is 14 parcels (518 offers), adding up to ₹207,718, and for bNII, it is 68 parts (2,516 offers), adding up to ₹1,008,916.

The issue incorporates a booking of up to 96,419 offers for workers presented at a markdown of Rs 38 to the issue cost.

• GSL is India’s quickest developing, completely coordinated FMCG organization.

• It gets significant income from Gujarat and holds lion piece of the pie in couple of items.

• The organization has posted development in its top and primary concerns for the detailed periods.

• In light of FY24 annualized profit, the issue shows up completely valued.

• Financial backers might stop assets for the medium to long haul rewards.

ABOUT Organization:

Gopal Snacks Ltd. (GSL) is a quick and noticeable customer merchandise organization in India offering ethnic bites, western tidbits and different items under its own image “GOPAL”. It is significantly reliant upon the offer of its items for example namkeen, gathiya and nibble pellets which has been on a normal of 85% of its all out income posting declining patterns. Its income from deals from Gujarat represented around 77% normal for the last three fiscals with increasing patterns.

The limit usage has shown declining patterns for the last three fiscals and raising worries. Notwithstanding, the board is sure of increasing it before very long with its forceful promoting procedure and send off of new items. The organization has gotten not many notification under Food handling and Principles Act 2006, about their bundling, misbranding, deluding ad of its items and so forth. The administration is managing every one of these and is certain that there will be no damage to organization’s picture and the working and they will come clear from such cases/claims.

It is one of India’s quickest developing and completely coordinated quick purchaser merchandise (FMCG) organization. Rajkot based Gopal was laid out in 1999. It was Extruder Bites).

GSL has its assembling plants situated in Rajkot, Nagpur and Modasa. The plants are decisively situated to guarantee simple acquirement of the unrefined substance. The Modasa office area gives advantageous admittance to fundamental unrefined substances like potatoes. Also, concerning the stock of namkeen and nibble pellets, this office being arranged in Gujarat and near Rajasthan – locales where ethnic bites and western nibble pellets are generally consumed. These variables exhaustively improve this office’s invaluable situating.

The Rajkot plant works in three units comprising of a fundamental unit took part in the development of completed merchandise; another for papad, crude nibble pellets, and flavors and flavors fabricating (mostly for hostage utilization, other than papad); and the third unit for chickpea flour/Besan creation (principally for hostage utilization). The plant situated in Nagpur fabricates completed items while the Modasa plant is devoted towards creation of completed products and crude nibble pellets. Nagpur being arranged in the focal district of India empowers the organization to take care of a scope of states like Jharkhand, Chhattisgarh, Uttar Pradesh, Bihar, Telangana, Andhra Pradesh, Madhya Pradesh, and the Vidarbha locale of Maharashtra.

In Financial 2023, as far as deals income through the portions, GSL remained as the second biggest coordinated ethnic namkeen producer in Gujarat, and fourth biggest bundled ethnic namkeen and papad fabricate in India. Further, in Monetary 2023 the organization stands firm on the foothold of being the biggest producer of gathiya (regarding creation volume and deals income) and nibble pellets (concerning creation volume) in India. The substance represents around 20% of the piece of the pie in the ethnic savories, 8% in western bites and 6% in the papad business in Gujarat (counting coordinated and chaotic areas) in Financial 2023. Gujarat is viewed as quite possibly of the most worthwhile market in the tidbits section and thus settled elements like GSL faces furious rivalry from nearby players like Gokul Bites.

The organization has 276 SKUs (as on September 30, 2023) in its portfolio. The organization is committed on giving clients separated esteem through a scope of SKUs at reasonable costs. It is the principal organization to send off gram flour or Besan in Rs.10 SKU. The organization sells its items in 10 Indian states and 2 association regions with north of 617 wholesalers and is one of the quickest developing bite organizations in India. GSL has 263 own calculated vehicles and north of 3300 workers as of September 30, 2023.

Moreover, it connects outsider makers on a need premise to deliver its items, for example, chikki, nachos, noodles, rusk, soan papdi and washing bar.

ISSUE Subtleties/CAPITAL HISTORY:

The organization is emerging with its lady auxiliary book building course Initial public offering of Rs. 650 cr. (16209478 value shares at the upper cap). The organization has declared a value band of Rs. 381 – Rs. 401 for each portion of Re. 1 each. The issue opens for membership on Walk 06, 2024, and will close on Walk 11, 2024. The base application to be made is for 37 offers and in products subsequently, from that point. Post allocation, offers will be recorded on BSE and NSE. The issue is 13% of the post-Initial public offering settled up capital of the organization. This being an unadulterated Proposal available to be purchased (OFS), no assets are going to the organization.

According to the administration, this OFS is being made to meet advertiser’s financing needs to resolve the debate with the split relatives.

The organization has held shares worth Rs. 3.5 cr. for the qualified workers and offering them a markdown of Rs. 38 for each offer. From the rest, it has apportioned note over half for QIBs, at least 15% for HNIs, and at the very least 35% for Retail financial backers.

The joint Book Running Lead Chiefs (BRLMs) to this issue are Concentrated Financial Administrations Pvt. Ltd., Pivot Capital Ltd., and JM Monetary Ltd., while Connection Intime India Pvt. Ltd. is the enlistment center of the issue.

Having given beginning value shares at standard, the organization gave further offers in the value scope of Rs. 10 – Rs. 11 (based on Re. 1 FV) between December 2009 and Walk 2015. It has additionally given extra offers in the proportion of 10 for 1 in January 2023. The typical expense of procurement of offers by the advertisers/selling partners is Rs. 0.35, Rs.0.57, Rs. 158.22, and Rs. Nothing per share.

This being an unadulterated Proposal available to be purchased issue, its settled up value capital of Rs. 12.46 cr. will stay same. In view of the upper cap of the Initial public offering cost band, the organization is searching for a market cap of Rs. 4996.64 cr.

Monetary Execution:

On the monetary execution front, for the last three fiscals, it has posted an all out pay/net benefit of Rs. 1129.84 cr. /Rs. 21.12 cr. (FY21), Rs. 1356.48 cr. /Rs. 41.54 cr. (FY22), and Rs. 1398.54 cr. /Rs. 112.37 cr. (FY23). For H1 of FY24 finished on September 30, 2023, it procured a net benefit of Rs. 55.57 cr. on an all out pay of Rs. 677.97 cr. The abrupt lift in its edges from FY23 onwards causes a commotion. The administration is sure of working on its exhibition with increasing of limit usage with new high edge items.

For the last three fiscals, the organization has revealed a normal EPS of Rs. 5.90 and a normal RoNW of 29.70%. The issue is valued at a P/BV of 14.44 in light of its NAV of Rs. 27.78 as of September 30, 2024, as well as on post-Initial public offering premise.

On the off chance that we trait FY24 annualized income to its post-Initial public offering completely weakened settled up value capital, then, at that point, the asking cost is at a P/E of 44.96. Subsequently the Initial public offering shows up completely evaluated. The organization is working on a lower obligation.

For the announced periods, the organization posted PAT edges of 8.22% (FY21), 7.43% (FY22), 8.06% (FY23),1.87% (H1-FY24), and RoCE edges of 20.83%, 21.43%, 43.08%, 13.48% individually for the alluded periods.

Profit Strategy:

The organization has not proclaimed any profits for the announced times of the deal report. It will take on a reasonable profit strategy post posting based on its monetary execution and future possibilities.

Examination WITH Recorded Friends:

According to the proposition archive, the organization has shown Bikaji Food varieties, and Prataap Snacks as their recorded companions. They are exchanging at a P/E of 68.2 and 42.31 (as of Walk 01, 2024). Be that as it may, they are not equivalent on an apple-to-apple premise.

Trader BANKER’S History:

The three BRLMs related with the issue have taken care of 82 public issues in the beyond three fiscals, out of which 24 issues shut underneath the proposition cost on the posting date.

End/Speculation System

The organization is one of the biggest and unmistakable FMCG organization principally in namkeen and other prepared to eat bundled food sources. It has posted development in its top and primary concerns in spite of declining limit usage, demonstrating its scaling edges with affordable purchaser packs. In light of FY24 annualized profit, the issue shows up full evaluated. Financial backers might stop assets for the medium to long haul rewards.