Exide India Share Full Analysis 16th April 2024

1. Introduction to Exide India

Exide India is one of the leading players in the Indian battery industry, renowned for its quality products and extensive distribution network. With decades of experience, the company has established itself as a household name, catering to diverse sectors ranging from automotive to industrial applications.

2. Overview of Exide India Share Performance

Recent Trends and Movements

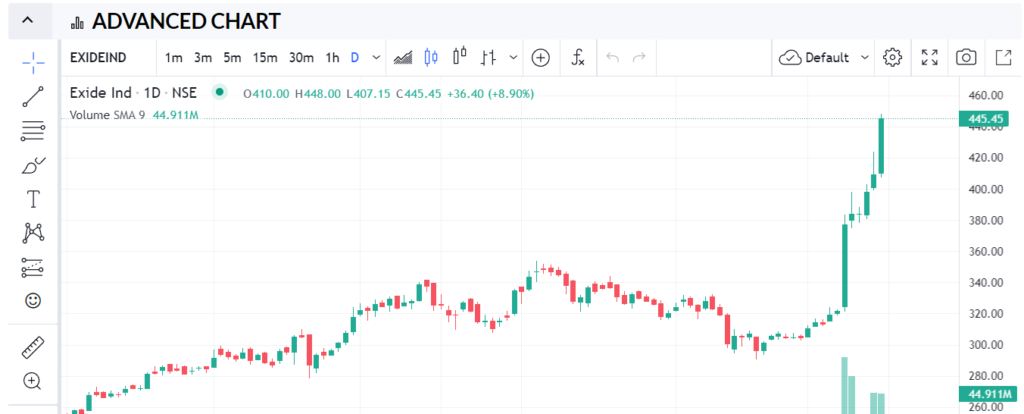

In recent times, Exide India’s share performance has been subject to fluctuations, mirroring broader market sentiments and industry dynamics. Investors have closely monitored its movements amidst evolving economic conditions and competitive pressures.

Factors Influencing Share Price

Several factors influence Exide India’s share price, including market demand for batteries, raw material costs, technological advancements, and regulatory changes. Additionally, macroeconomic indicators and global trends play a significant role in shaping investor sentiment.

3. Financial Analysis

Revenue and Profit Trends

Exide India’s financial performance reflects its market position and operational efficiency. Despite facing challenges, the company has maintained a steady revenue stream, supported by robust demand for its products. Profit margins have demonstrated resilience, highlighting effective cost management strategies.

Debt and Liquidity Position

Analyzing Exide India’s debt and liquidity position provides insights into its financial health and sustainability. By managing debt levels prudently and maintaining adequate liquidity reserves, the company mitigates risks and capitalizes on growth opportunities.

4. Market Position and Competition

Industry Overview

The Indian battery industry is characterized by intense competition and evolving consumer preferences. Exide India operates in a dynamic landscape, marked by technological innovations and regulatory developments. Understanding industry dynamics is crucial for assessing the company’s competitive advantage.

Competitor Analysis

Competitor analysis enables investors to benchmark Exide India against its peers and identify areas for strategic differentiation. By evaluating market share, product offerings, and customer perception, stakeholders gain clarity on the company’s relative positioning and growth potential.

5. Future Prospects and Growth Potential

Expansion Plans

Exide India’s expansion plans signify its commitment to sustained growth and market leadership. By investing in capacity enhancement and geographical diversification, the company aims to capitalize on emerging opportunities and strengthen its competitive position.

Innovation and Technology Adoption

Innovation and technology adoption are integral to Exide India’s future success. By embracing advancements in battery technology and sustainable practices, the company strives to enhance product performance, reduce environmental impact, and meet evolving customer needs.

6. Risks and Challenges

Regulatory Environment

Navigating the regulatory environment poses challenges for Exide India, given the evolving landscape and compliance requirements. Regulatory changes pertaining to environmental norms, taxation, and trade policies can impact the company’s operations and profitability.

Economic Factors

Exide India is susceptible to economic factors such as inflation, currency fluctuations, and GDP growth rates. Economic downturns or geopolitical tensions may affect consumer spending patterns and business confidence, influencing demand for batteries.

7. Investment Outlook

Analyst Recommendations

Analyst recommendations provide valuable insights into Exide India’s investment potential. By assessing factors such as valuation, growth prospects, and industry dynamics, analysts offer guidance to investors seeking to optimize their portfolio allocation.

Potential Returns

Investing in Exide India shares entails potential returns commensurate with associated risks. Long-term investors may benefit from capital appreciation and dividend income, contingent on the company’s ability to execute its strategic initiatives and deliver sustainable growth.

8. Conclusion

In conclusion, Exide India remains a key player in the Indian battery industry, poised for growth amidst evolving market dynamics. By leveraging its strengths in product quality, distribution network, and innovation, the company aims to create long-term value for stakeholders.

FAQs

- Is Exide India a profitable investment?

- While past performance is no guarantee of future returns, Exide India has demonstrated resilience and profitability over the years, making it an attractive investment option for many.

- What are the key challenges facing Exide India?

- Exide India faces challenges related to regulatory compliance, technological advancements, and competitive pressures. Navigating these challenges requires strategic foresight and adaptability.

- Does Exide India have any expansion plans?

- Yes, Exide India has outlined expansion plans aimed at enhancing production capacity and geographical reach. These initiatives underscore the company’s commitment to sustainable growth.

- How does Exide India differentiate itself from competitors?

- Exide India differentiates itself through product quality, brand reputation, and extensive distribution network. Additionally, the company focuses on innovation and customer-centric solutions to maintain its competitive edge.

- What is the long-term outlook for Exide India shares?

- The long-term outlook for Exide India shares depends on various factors, including industry dynamics, economic conditions, and company performance. Investors should conduct thorough research and consult financial experts before making investment decisions.