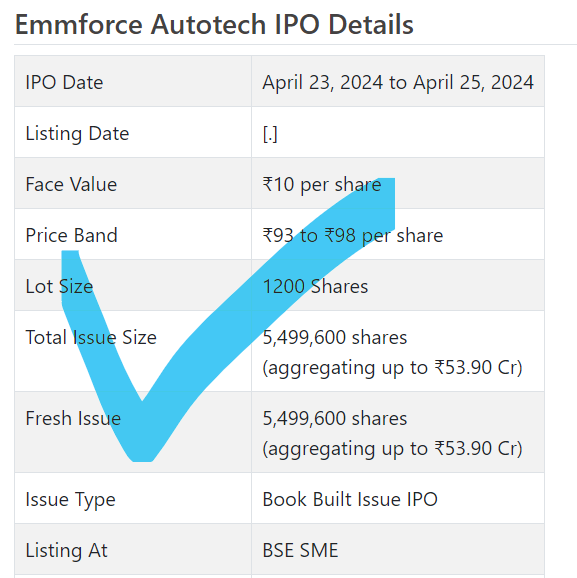

Emmforce Autotech IPO is a book built issue of Rs 53.90 crores. The issue is entirely a fresh issue of 55 lakh shares.

Emmforce Autotech IPO opens for subscription on April 23, 2024 and closes on April 25, 2024. The allotment for the Emmforce Autotech IPO is expected to be finalized on Friday, April 26, 2024. Emmforce Autotech IPO will list on BSE SME with tentative listing date fixed as Tuesday, April 30, 2024.

Emmforce Autotech IPO price band is set at ₹93 to ₹98 per share. The minimum lot size for an application is 1200 Shares. The minimum amount of investment required by retail investors is ₹117,600. The minimum lot size investment for HNI is 2 lots (2,400 shares) amounting to ₹235,200.

• The organization is participated occupied with assembling specialty car drivetrain parts.

• It posted development in its top and main concerns for FY21 and FY22.

• The organization stamped degrowth in top and main concerns for FY23.

• From 7M-FY24 execution it gives off an impression of being in the groove again.

• In light of FY24 annualized profit, the issue shows up completely estimated.

• All around informed financial backers might stop assets for the medium to long haul rewards.

ABOUT Organization:

Emmforce Autotech Ltd. (EAL) is participated occupied with assembling specialty auto drivetrain parts like Differential Lodgings, Differential Storage spaces, Differential Covers, all wheel drive Locking Centers, Axles, Axles and Shafts, Stuff Shifters, Burdens, Differential Spools, Differential Apparatuses and different differential produced/cast parts principally for 4-wheel Drive and execution hustling vehicles. The organization has been participated in sends out since its commencement. It has laid down a good foundation for itself as a maker of Drivetrain Parts in India and is all in one resource for quality expense serious drivetrain parts and giving out-of-the-case answers for its clients through planning and improvement of complex/exceptional parts.

Colossal stock of tooling for producing and machining, dances and installations for machining, additional emphasis on designing gives Emmforce an edge over the opposition to foster new parts in a lot quicker time than contest. The organization assists with speeding up execution and further developing benefit through quicker item improvement, more limited lead time, on time conveyance, exhaustive item range and serious valuing.

EAL offers completely incorporated designing arrangements from conceptualization, advancement and approval to execution and assembling of items. The conceptualization stage includes gaining market insight, evaluating client necessity and forming altered system for individual clients. The advancement stage incorporates item planning, material acquisition and handling. This is trailed by the approval stage, which includes prototyping, testing and plausibility investigation. Its in-house assembling and execution abilities incorporate fashioning, machining, manufactures, heat treatment, surface completion, strategies, quality and testing, plan and approval. As of October 31, 2023, it had 128 representatives on its finance.

ISSUE Subtleties/CAPITAL HISTORY:

The organization is emerging with its lady book building course Initial public offering of 5499600 value portions of Rs. 10 each to assemble Rs. 53.90 cr. at the upper cap. It has declared a value band of Rs. 93 – Rs. 98 for each offer. The issue opens for membership on April 23, 2024, and will close on Aril 25, 2024. The base application to be made is for 1200 offers and in products consequently, from that point. Post allocation, offers will be recorded on BSE SME. The issue comprises 26.83% of the post-Initial public offering settled up capital of the organization. From the net returns of the Initial public offering, it will use Rs. 10.00 cr. for interest in auxiliary – Emmforce Versatility Arrangements Pvt. Ltd., Rs. 27.00 cr. for working capital, and the rest for general corporate purposes.

The issue is exclusively lead overseen by Shortcut Capital Guides Pvt. Ltd., and Connection Intime India Pvt. Ltd. is the enlistment center of the issue. Direct path gathering’s Spread X Protections Pvt. Ltd. is the market creator for the organization. The deal record is quiet on endorsing data.

The organization has given/changed over whole value capital at standard worth up until this point. The typical expense of procurement of offers by the advertisers is Rs. 10.00 per share.

Post-Initial public offering, organization’s ongoing settled up value capital of Rs. 15.00 cr. will stand upgraded to Rs. 20.50 cr. In view of the upper Initial public offering cost band, the organization is searching for a market cap of Rs. 200.90 cr.

Monetary Execution:

On the monetary execution front, for the last three fiscals, the organization has posted an all out pay/net benefit of Rs. 51.85 cr. /Rs. 5.09 cr. (FY21), Rs. 71.38 cr. /Rs. 7.33 cr. (FY22), and Rs. 48.75 cr. /Rs. 4.39 cr. (FY23). Clubbing the two broken periods execution for 7M of FY24 finished on October 31, 2023, it procured a net benefit of Rs. 5.12 cr. on an all out pay of Rs. 47.90 cr. The organization has posted degrowth in its top and primary concerns for FY23. It seems, by all accounts, to be in the groove again with its FY24 – initial seven months’ presentation for FY24.

As indicated by the administration, the organization gets more than 98% income from sends out. Because of more appeal and mass stock buys by worldwide clients, it checked development in top and primary concerns for FY21 and FY22, notwithstanding, because of stacked up stock, FY23 stamped minor misfortune. The circumstance has turned for the ongoing year as demonstrated by its presentation for 7M-FY24, and the executives is sure of keeping up with the patterns before very long with in reverse coordination and high edge items. It appreciates specialty place in all wheel drive locking center point supplies which offers more than 45% in absolute turnover.

For the last three fiscals, it has detailed a normal EPS of Rs. 3.66, and a typical RONW of 26.39%. The issue is valued at a P/BV of 9.52 in light of its NAV of Rs. 10.29 as of October 31, 2023, and at a P/BV of 2.90 in light of its post-Initial public offering NAV of Rs. 33.82 per share (at the upper cap).

On the off chance that we trait annualized FY24 income to its post-Initial public offering completely weakened paid-p capital, then, at that point, the asking cost is at a P/E of 22.90. Along these lines this Initial public offering shows up completely estimated in view of its new monetary exhibition.

For the revealed periods, the organization has posted PAT edges of 10.09% (FY21), 10.61% (FY22), 9.60% (FY23), 8.42% (7M-FY24), yet the proposition archive is missing RoCE information in the KPI table.

Profit Strategy:

The organization has not announced any profits since consolidation. It will take on a reasonable profit strategy in view of its monetary exhibition and future possibilities.

Correlation WITH Recorded Friends:

According to the deal report, the organization has shown Divgi Torq as their recorded companion. It is exchanging at a P/E of 55.9 (as of April 19, 2024). Nonetheless, they are not similar on an apple-to-apple premise.

Dealer BANKER’S History:

While by and large last three fiscals order history is absent in the proposition report (the LM is requesting to allude their site for this information), however according to Chittorgarh.com web, this is the 36th command from Direct route Capital Guides Pvt. Ltd. in the last three fiscals (counting the continuous one) and out of last 10 postings, all recorded with charges going from 5.88% to 200% on the date of posting.

Мы компания SEO-специалистов, занимающихся увеличением трафика и улучшением рейтинга вашего сайта в поисковых системах.

Наша команда получили признание за свою работу и предлагаем вам воспользоваться нашим опытом и знаниями.

Какие преимущества вы получите:

• [url=https://seo-prodvizhenie-ulyanovsk1.ru/]продвижение сайта[/url]

• Тщательный анализ вашего сайта и разработка персональной стратегии продвижения.

• Усовершенствование контента и технических особенностей вашего сайта для достижения максимальной производительности.

• Регулярное отслеживание и анализ результатов, с целью постоянного улучшения вашего онлайн-присутствия.

Подробнее [url=https://seo-prodvizhenie-ulyanovsk1.ru/]https://seo-prodvizhenie-ulyanovsk1.ru/[/url]

Уже много клиентов оценили результаты: рост посещаемости, улучшение рейтинга в поисковых запросах и, конечно, увеличение прибыли. У нас вы можете получить бесплатную консультацию, чтобы обсудить ваши потребности и помочь вам разработать стратегию продвижения, соответствующую вашим целям и бюджету.

Не упустите возможность улучшить свой бизнес в онлайн-мире. Обратитесь к нам немедленно.