DEE Development Engineers Limited IPO Full Details

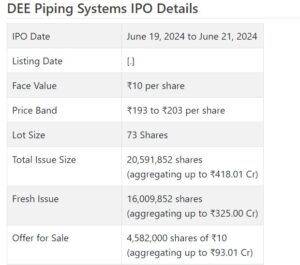

DEE Channeling Frameworks Initial public offering is a book fabricated issue of Rs 418.01 crores. The issue is a mix of new issue of 1.6 crore shares conglomerating to Rs 325.00 crores and make available for purchase of 0.46 crore shares collecting to Rs 93.01 crores.

DEE Channeling Frameworks Initial public offering opens for membership on June 19, 2024 and closes on June 21, 2024. The designation for the DEE Funneling Frameworks Initial public offering is supposed to be finished on Monday, June 24, 2024. DEE Funneling Frameworks Initial public offering will list on BSE, NSE with provisional posting date fixed as Wednesday, June 26, 2024.

DEE Channeling Frameworks Initial public offering cost band is set at ₹193 to ₹203 per share. The base parcel size for an application is 73 Offers. The base measure of speculation expected by retail financial backers is ₹14,819. The base part size speculation for sNII is 14 parcels (1,022 offers), adding up to ₹207,466, and for bNII, it is 68 parts (4,964 offers), adding up to ₹1,007,692.

• DDEL represents considerable authority in process channeling answers for different ventures worldwide.

• It checked consistent development in its top and main concerns post the Pandemic year.

• The organization has a request worth Rs. 828 cr. as of December 31, 2023.

• It has great monetary information with solid basics.

• In light of annualized FY24 profit, the issue shows up forcefully estimated, limiting all close to term up-sides.

• Very much educated financial backers might stop assets for the medium to long haul rewards.

ABOUT Organization:

Dee Advancement Architects Ltd. (DDEL) is a designing organization giving particular cycle channeling answers for enterprises like oil and gas, power (counting atomic), synthetics and other interaction ventures through designing, acquisition and assembling. It has producing experience of more than three and a half many years and have had the option to use its image, decisively found assembling offices and designing capacities to extend business effectively. As a feature of its particular cycle channeling arrangements, the organization likewise makes and supplies funneling items, for example, high-pressure funneling frameworks, funneling spools, high recurrence enlistment pipe twists, Longitudinally Lowered Bend Welding pipes, modern line fittings, pressure vessels, modern stacks, secluded skids and embellishments including, evaporator super radiator curls, de-super warmers and other redid made parts.

The Organization right now is positioned as one of the main cycle pipe arrangement suppliers on the planet, as far as specialized ability to address complex interaction funneling prerequisite emerging from various modern portions. (Source: D&B Report) as of now, it is the biggest player in process channeling arrangements in India, concerning introduced limit. (Source: D&B Report). The organization gives thorough specific cycle channeling arrangements including designing administrations, for example, pre offered designing, essential designing, definite designing and backing designing which incorporates designing of interaction/power funneling frameworks for projects, and pre-manufacture administrations like cutting and angling on regular and CNC machines, welding administrations on self-loader and completely programmed automated welding machines, ordinary and advanced radiography, post weld heat treatment utilizing CNG terminated completely adjusted heaters and acceptance warming interaction, hydro testing, pickling and passivation, coarseness impacting (manual and self-loader) and painting (manual and self-loader). It likewise works in dealing with complex metals, for example, differing grades of carbon steel, tempered steel, very duplex hardened steel, compound steel and different materials incorporating Inconel and hastelloy in its assembling processes. DDEL has seven decisively found Assembling Offices at Palwal in Haryana, Anjar in Gujarat, Barmer in Rajasthan, Numaligarh in Assam and Bangkok in Thailand, with three Assembling Offices situated at Palwal, Haryana. The organization likewise works an impermanent Assembling Office in Barmer, Rajasthan which is a committed office set up to take care of the channeling and erection necessities of the HPCL Rajasthan Processing plant Restricted (the “Barmer Satellite Office”).

Its entirely claimed auxiliary, DFIPL, likewise works a weighty creation office at Anjar, Gujarat (the “Anjar Weighty Manufacture Office”). The organization likewise has a devoted designing office situated at Chennai in Tamil Nadu (the “Chennai Designing Office”). Its seven Assembling Offices, the Anjar Weighty Creation Office and Chennai designing Office together range an area of around 437,453.85 square meters. The organization has started tasks at the New Anjar Office I which has an introduced limit of 3,000 MT for each annum and are currently improving its assembling abilities by setting up another assembling office at the New Anjar Office II with a proposed introduced limit of 9,000 MT for every annum, which will expand the complete introduced creation limit of Anjar offices (barring its weighty manufacture limit) from 3,000 MT for every annum to 15,000 MT for each annum.

It has been centered around mechanizing specific assembling processes and its Assembling Offices are outfitted with hardware, for example, completely robotized mechanical welding frameworks, self-loader shot impacting machines, programmed GMAW welding framework and completely programmed high recurrence acceptance twisting machines having breadth of up to 48 inches. Its Chennai Designing Office is devoted to the plan of sure of items and the advancement of designing cycles. According to the D&B Report, the Organization has solid quality strategies and norms set up, which play had a vital impact in lifting it to an administrative role, in India as well as universally. It likewise fabricates modern line fittings which are enlisted under the Canadian Enrollment Number.

It works two biomass power age plants in Abohar and Muktsar, Punjab, with a contracted yearly limit of 8 MW and 6 MW, separately, which together range an area of roughly 347,511.15 square meters. The Muktsar Biomass Power Plant is worked by its entirely possessed auxiliary, MPPL. Further, it makes wind turbine towers through entirely possessed auxiliary, DFIPL, at Anjar Weighty Creation Office. DFIPL is likewise engaged with the assembling of modern stacks. DDEL as of late extended its business by entering another business vertical of configuration, designing, creation and assembling of pilot plants. The organization means to give a one stop answer for pilot plant necessities of clients which will go from conceptualization to charging of a pilot plant, and will incorporate three dimensional displaying, process recreation, control designing, plan, creation and development of a pilot plant, trailed by establishment of the pilot plant at the site indicated by the client. It means to foster pilot plants which take care of the innovative work needs of organizations in the oil and gas, petrochemicals, treatment facilities, specialty synthetics, drugs and atomic areas, as need might arise of instructive exploration establishments.

Certain tasks by government possessed organizations, in the pilot plant area are granted based on cutthroat offering, wherein sellers are assessed entomb alia on their specialized abilities and framework set up to execute such undertakings. DDEL is meeting these standards which forecasts well for its commercial center. As of December 31, 2023, it had a request book worth Rs. 828.70 cr. what’s more, as of Walk 31, 2024, it had 1061 representatives on its finance.

ISSUE Subtleties/CAPITAL HISTORY:

The organization is emerging with its combo lady Initial public offering of new value shares issue worth Rs. 325 cr. (approx. 16009849 offers at the upper cost band), and a Proposal available to be purchased (OFS) of 4582000 value shares (worth Rs. 93.01 cr. at the upper cap). Subsequently the general size of the Initial public offering is for 20591849 offers worth Rs. 418.01 cr. at the upper cap. The organization has declared a value band of Rs. 193 – Rs. 203 for each portion of Rs. 10 each. The issue opens for membership on June 19, 2024, and will close on June 21, 2024. The base application to be made is for 73 offers and in products consequently, from that point. Post allocation, offers will be recorded on BSE and NSE.

The issue comprises 29.82% of the post-Initial public offering settled up value capital of the organization. From the net returns of the new value issue, the organization will use Rs. 75 cr. for working capital, Rs. 175 cr. for reimbursement/prepayment of specific borrowings, and the rest for general corporate purposes.

The organization has saved 5% of the Initial public offering for its qualified workers and offering them a rebate of Rs. 19 for every offer. From the rest, it has distributed not over half for QIBs, at the very least 15% for HNIs and at the very least 35% for Retail financial backers.

The joint Book Running Lead Administrators to this issue are SBI Capital Business sectors Ltd. furthermore, Equirus Capital Pvt. Ltd., while Connection Intime India Pvt. Ltd. is the enlistment center to the issue.

Having given/changed over starting value shares at standard, the organization gave/changed over additional value partakes in the value scope of Rs. 100 – Rs. 555.67 between February 2011 and August 2015. It has likewise given extra offers in the proportion of 8 for 1 in January 1996, 1 for 3 in Walk 2003, 9 for 2 in May 2008, and 4 for 1 in September 2023. The typical expense of procurement of offers by the advertisers/selling partners is Rs. 0.27, Rs. 0.37, and Rs. 0.83 per share.

Post-Initial public offering, organization’s ongoing settled up value capital of Rs. 53.04 cr. will stand upgraded to Rs. 69.05 cr. In view of the upper cap of the Initial public offering cost band, the organization is searching for a market cap of Rs. 1401.69 cr.

Monetary Execution:

On the monetary execution front, for the last three fiscals, the organization has (on a united premise) posted a complete pay/net benefit of Rs. 513.03 cr. /Rs. 14.21 cr. (FY21), Rs. 470.84 cr. /Rs. 8.20 cr. (FY22), and Rs. 614.32 cr. /Rs. 12.97 cr. (FY23). For the 9M of FY24 finished on December 31, 2023, it procured a net benefit of Rs. 14.34 cr. on a complete pay of Rs. 557.86 cr. While it languished a difficulty over FY22 following the Pandemic effect, it stamped lower net for FY23.

For the last three fiscals, it has posted a normal EPS of Rs. 2.14, and a typical RoNW of 2.78%. The issue is evaluated at a P/BV of 2.46 in light of its NAV of Rs. 82.59 as of December 31, 2023, and at a P/BV of xx in view of its post-Initial public offering NAV of Rs. 109.07 per share (at the upper cap).

On the off chance that we trait annualized FY24 income on post-Initial public offering completely weakened settled up value capital, then, at that point, the asking cost is at a P/E of 73.29. Subsequently the issue shows up forcefully valued. Yet, in light of the latest things, it is ready for splendid possibilities ahead.

For the announced periods, the organization has posted PAT edges of 2.87% (FY21), 1.78% (FY22), 2.18% (FY23), 2.63% (9M-FY24), and RoCE edges of 2.47%, 3.99%, 3.91%, 3.91% individually for the r