DCG Cables & Wires Limited IPO Subscription and Allotment’s

DCG Links and Wires’ Initial public offering is a decent value issue of Rs 49.99 crores. The issue is a new issue of 49.99 lakh shares.

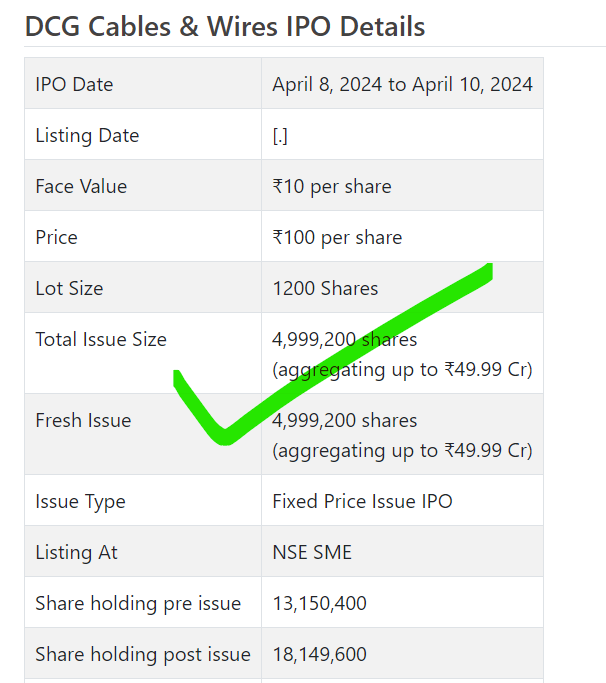

DCG Links and Wires Initial public offering opens for membership on April 8, 2024, and closes on April 10, 2024. The portion for the DCG Links and Wires Initial public offering is supposed to be concluded on Friday, April 12, 2024. DCG Links and Wires Initial public offering will be listed on NSE SME with a provisional posting date fixed as Tuesday, April 16, 2024.

DCG Links and Wires Initial public offering cost is ₹100 per share. The base parcel size for an application is 1200 Offers. The base measure of venture expected by retail financial backers is ₹120,000. The base parcel size speculation for HNI is 2 parts (2,400 offers) adding up to ₹240,000.

• DCWL is occupied with assembling and promoting copper links and other related items with fiber glass covered copper items.

• After normal execution till FY23, it checked bonus gains with high-edge items.

• In light of the FY24 super profit, the issue shows up as completely estimated.

• Very much educated financial backers might stop moderate assets for the medium-term rewards.

ABOUT Organization:

DCG Links and Wires Ltd.(DCWL) is the maker of copper links and wires. It essentially centers around assembling of various kinds of copper links which tracks down applications in Transformers. DCWL’s item portfolio comprises Copper Strips, Paper Covered Copper Strips and Wires (Kraft/Crepe/Nomex/Mica) Uncovered Copper Wires and Strips, Copper Tapes, and Fiber Glass Copper.

The organization offers an extensive variety of copper items. Its items incorporate exposed copper strips, conveyors, and wires, guaranteeing ideal conductivity for different applications. It additionally gives paper-shrouded copper conduits in both rectangular and round shapes, as well as multi-paper-covered copper channels and association links planned explicitly for transformers. For added sturdiness, the organization offers fiberglass-covered copper strips and wires. Also, its copper sub wires and strips are ideal for sub-applications. It additionally supplies twin and triple-packed paper-shrouded copper strips and bundle conveyors.

It significantly supplies items to the transformer-producing organizations in India and DCWL’s principal promoting procedure is to create and keep up with great associations with clients. As on the date of this Outline, the organization has three assembling units – Odhav, Ahmedabad, Kubadthal, Ahmedabad, and Waghodia, Vadodara, with a consolidated introduced limit of 5868 MT for assembling uncovered Copper wire and Strips, 1404 MT for Paper Covered Copper Strips and wire, 1512 MT for Link Wires, 5,760 MT for Copper Poles, 10080 MT for Copper Pads, 972 MT for Submarine Wires and 540 MT for Fiber Glass Covered Copper Strips.

DCWL is right now in the course of setting up another assembling plant at Bhayla, Bavla, Gujarat, to expand its assembling abilities. The land on which the said plant is being developed contains more than 8308 sq. mtrs. region and has been by it on rent from Advertiser Chief for a time of a long time from November 20, 2023. As and when required, the organization is bit by bit wanting to solidify and move each of the three existing assembling offices to this new assembling office for better organization, effectiveness, and cost streamlining.

DCWL is in B2B (Business to Business) Fragment as it were. As of now, it’s over 94.81% of deals come from Gujarat and as of late, it began selling in Maharashtra and Karnataka district, which contributes nearly 5.16% of all out deals for the period finished September 30, 2023. As of February 29, 2024, it had 69 workers on its finances.

For the abrupt lift in its primary concerns for 11M-FY24, the administration expressed that because of its expense control and significant spotlight on a high edge item portfolio, it oversaw twofold digit development in the net benefits. It has pushed for such high-edge items proceeding and will want to keep up with the patterns. Higher spending by the Public authority of India on energy forecasts well for the organization, which is banding together with many blue-chip organizations for specialty parts and other related materials.

ISSUE Subtleties/CAPITAL HISTORY:

The organization is emerging with its lady Initial public offering of 4999200 value portions of Rs. 10 each at a decent cost of Rs. 100 for every offer to assemble Rs. 49.99 cr. The issue opens for membership on April 08, 2024, and will close on April 10, 2024. The base application to be made is for 1200 offers and in products subsequently, from there on. Post portion, offers will be recorded on NSE SME Arise. The issue comprises 27.54% of the post-initial public offering settled up capital of the organization. The organization is spending Rs. 2.70 cr. for this Initial public offering process, and from the net returns, it will use Rs. 5.36 cr. for building development, Rs. 33.20 cr. for working capital, and Rs. 8.73 cr. for general corporate purposes.

The issue is exclusively led overseen by Intelligent Monetary Administrations Ltd., and Bigshare Administrations Pvt. Ltd. is the enlistment center of the issue. Nikunj Stock Intermediaries Ltd. is the market producer for the organization.

The organization has given whole value capital at standard up until this point. The typical expense of securing offers by the advertisers is Rs. 10 for each offer.

Post-initial public offering, the organization’s ongoing settled up value capital of Rs. 13.15 cr. will stand improved to Rs. 18.15cr. In light of the upper Initial public offering cost band, the organization is searching for a market cap of Rs. 181.50 cr.

Monetary Execution:

On the monetary execution front, for the last financial, the organization has (on a merged premise) posted a complete income/net benefit of Rs. 54.55 cr. /Rs. 1.72 cr. (FY23). For 11M of FY24 finished on February 29, 2024, it procured a net benefit of Rs. 8.47 cr. on an all-out income of Rs. 76.39 cr.

On an independent premise, for the last three fiscals, the organization has posted an all-out income/net benefit/ – (loss) of Rs. 14.63 cr. /Rs. 0.10 cr. (FY21), Rs. 27.70 cr. /Rs. 0.37 cr. (FY22), Rs. 54.55 cr. /Rs. 1.72 cr. (FY23), and for 11M of FY24 finished on February 29, 2024, it procured a net benefit of Rs. 8.47 cr. on a complete income of Rs. 76.39 cr. The super benefit for 11M-FY24 notwithstanding paying the most elevated at any point finance cost of Rs. 2.67 cr. cause a stir. In any case, as explained by the administration, because of facilitated metal costs, pre-booked orders at higher edges brought about higher profit, and the inflow of orders because of higher spending by the Public authority of India on energy area foreshadows well for the organization, it is certain of keeping up with the patterns showed by late execution.

For the last three fiscals, it has revealed a normal EPS of Rs. 19.47 and a typical RONW of 21.54%. The issue is estimated at a P/BV of 5.57 given its NAV of Rs. 17.94 as of February 29, 2024, and at a P/BV of 2.47 in light of its post-initial public offering NAV of Rs. 40.54 per share.

On the off chance that we characteristic annualized FY24 super income to its post-initial public offering completely weakened settled-up capital, then the asking cost is at a P/E of 19.65. In view of FY23 income, the issue is valued at a P/E of 105.26. Along these lines issue shows up completely valued.

For the revealed periods, the organization has posted PAT edges of 0.70% (FY21), 1.34% (FY22), 3.15% (FY23), 11.09% (11M-FY24), and RoCE edges of 78.79%, 8.38%, 11.22%, 59.10% individually for the alluded periods.

Profit Strategy:

The organization has not pronounced any profits since joining. It will embrace a reasonable profit strategy in light of its monetary presentation and future possibilities.

Correlation WITH Recorded Friends:

According to the proposition record, the organization has shown Lines Link, and All inclusive Links as their recorded companions. They are exchanging at a P/E of 25.8 and 17.0 (as of April 05, 2024). Nonetheless, they are not similar on an apple-to-apple premise.

Vendor BANKER’S History:

This is the sixteenth order from Intelligent Monetary in the last four fiscals, out of the last 10 postings, 2 opened at rebate, 2 at standard and the rest with charges going from 1.46% to 20.74% upon the arrival of posting.

End/Speculation System

The organization is participated occupied with assembling and promoting of copper links and other related items like fiber glass covered copper items. Higher spending by the Public authority of India on energy area forecasts well for the organization. As educated by the administration, its attention on high edge items procured great prizes with quantum hop in the main concerns and it desires to proceed with similar patterns going ahead. In light of its FY24 super profit, the issue shows up completely estimated. All around informed financial backers might stop moderate assets for the medium to long haul rewards.