Creative Graphics Solutions India Limited IPO Subscription and Allotments

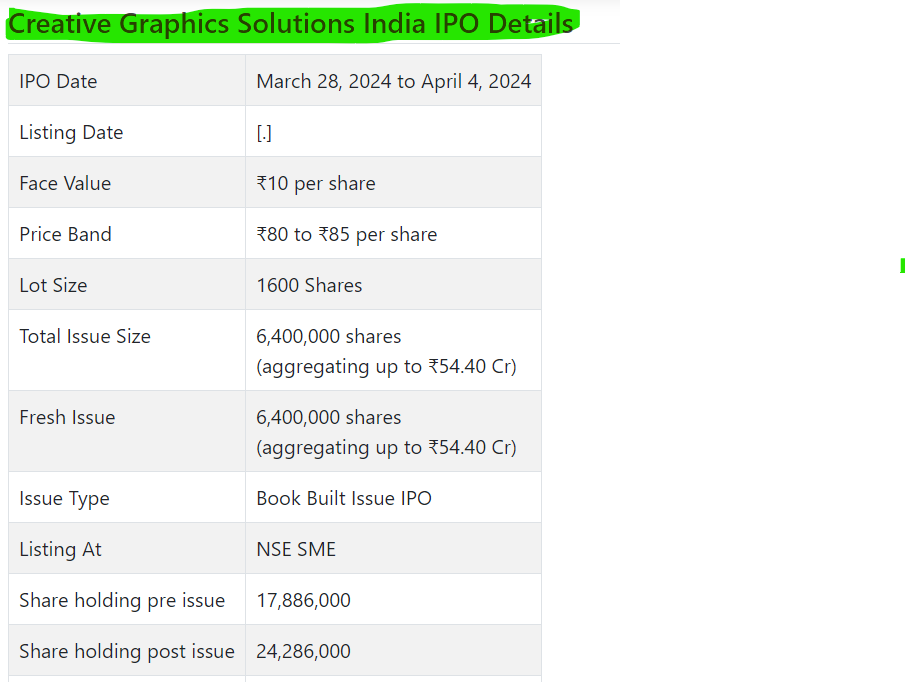

Inventive Designs Arrangements India Initial public offering is a book fabricated issue of Rs 54.40 crores. The issue is completely a new issue of 64 lakh shares.

Inventive Designs Arrangements India Initial public offering opened for membership on Walk 28, 2024 and will close on April 4, 2024. The distribution for the Imaginative Illustrations Arrangements India Initial public offering is supposed to be settled on Friday, April 5, 2024. Inventive Designs Arrangements India Initial public offering will list on NSE SME with conditional posting date fixed as Tuesday, April 9, 2024.

Inventive Designs Arrangements India Initial public offering cost band is set at ₹80 to ₹85 per share. The base part size for an application is 1600 Offers. The base measure of venture expected by retail financial backers is ₹136,000. The base parcel size venture for HNI is 2 parts (3,200 offers) adding up to ₹272,000.

Corporate Capitalventures Pvt Ltd is the book running lead administrator of the Innovative Illustrations Arrangements India Initial public offering, while Bigshare Administrations Pvt Ltd is the recorder for the issue. The market creator for Inventive Illustrations Arrangements India Initial public offering is Ss Corporate Protections.

• The organization is taken part in a pre-press matters with most recent flexo innovation.

• The organization posted development in its top and primary concerns for the revealed periods.

• The ascent in main concerns from FY23 onwards cause a stir.

• In light of FY24 annualized super profit, the issue shows up completely valued.

• Financial backers might stop assets for the medium to long haul rewards.

ABOUT Organization:

Innovative Illustrations Arrangements India Ltd. (CGSIL) is a pre-press organization, took part in the assembling of flexographic printing plates including Computerized Flexo Plates, Customary Flexo Printing Plates, Letter Press Plates, Metal Back Plates, and Covering Plates. The organization is serving the clients across India as well as outside India in particular African Nations, Thailand, Qatar, Kuwait and Nepal.

CGSIL conveys quality flexo plates with its best in class innovation and supplies which meet the necessities of present day flexo printing processes. It has remained organization’s consistent undertaking to surpass clients’ assumptions with ideal conveyances of hand crafted flexo plates, with quality confirmation. As of August 31, 2023, it had 420 workers on its finance.

ISSUE Subtleties/CAPITAL HISTORY:

The organization is emerging with its lady book building course Initial public offering of 6400000 value portions of Rs. 10 each to activate Rs. 54.40 cr. at the upper cap. It has declared a value band of Rs. 80 – Rs. 85 for each offer. The issue opens for membership on Walk 28, 2024, and will close on April 04, 2024. The base application to be made is for 1600 offers and in products consequently, from there on. Post assignment, offers will be recorded on NSE SME Arise. The issue is 26.35% of the post-Initial public offering settled up capital of the organization. From the net returns of the Initial public offering, it will use Rs. 15.00 cr. for working capital, Rs. 11.00 cr. for reimbursement/prepayment of specific getting, Rs. 10.00 cr. for capex, Rs. 5.00 cr. for inorganic development, and the rest for general corporate purposes.

The issue is exclusively lead overseen by Corporate Capitalventures Pvt. Ltd., and Bigshare Administrations Pvt. Ltd. is the enlistment center of the issue. SS Corporate Protections Ltd. is the market producer for the organization.

Having given/changed over starting value shares at standard, the organization gave further value shares at a proper cost of Rs. 600 each in October 2023. It has additionally given extra offers in the proportion of 1 for 1 in May 2023, and 10 for 1 in October 2023. The typical expense of obtaining of offers by the advertisers is Rs. 0.21, and Rs. 0.45 per share.

Post-Initial public offering, organization’s ongoing settled up value capital of Rs. 17.89 cr. will stand improved to Rs. 24.29 cr. In light of the upper Initial public offering cost band, the organization is searching for a market cap of Rs. 206.43 cr.

Monetary Execution:

On the monetary execution front, for the last three fiscals, the organization has (on a combined premise) posted a complete pay/net benefit of Rs. 48.04 cr. /Rs. 2.28 cr. (FY21), Rs. 68.68 cr. /Rs. 4.65 cr. (FY22), and Rs. 91.78 cr. /Rs. 8.64 cr. (FY23). For H1 of FY24 finished on September 30, 2023, it procured a net benefit of Rs. 7.24 cr. on an all out pay of Rs. 48.46 cr.

For the last three fiscals, it has revealed a normal EPS of Rs. 83.16, and a typical RONW of 45.42%. The issue is estimated at a P/BV of 0.50 in view of its NAV of Rs. 170.06 as of September 30, 2023, and at a P/BV of 2.58 in light of its post-Initial public offering NAV of Rs. 32.90 per share (at the upper cap).

On the off chance that we characteristic annualized FY24 income to its post-Initial public offering completely weakened paid-p capital, then, at that point, the asking cost is at a P/E of 14.26. Subsequently the issue shows up completely evaluated in view of its super annualized profit of FY24.

For the detailed periods, the organization has posted PAT edges of 4.79% (FY21), 6.81% (FY22), 9.59% (FY23), 15.06% (H1-FY24), and RoCE edges of 39.77%, 57.80%, 42.71%, 24.99% separately for the alluded periods.

Profit Strategy:

The organization has announced 10% profit for FY23. It will embrace a judicious profit strategy in view of its monetary presentation and future possibilities.

Correlation WITH Recorded Friends:

According to the deal archive, the organization has no recorded companions to contrast and.

Vendor BANKER’S History:

This is the fourteenth order from Corporate Capitalventures in the last three fiscals, out of the last 11 postings, 1 opened at markdown and the rest with expenses going from 17.65% to 245.23% upon the arrival of posting.

End/Venture Technique

The organization appreciates virtual syndication in pre-press flexo process. It checked development in its top and main concerns for the detailed periods. In view of FY24 annualized super profit, the issue shows up completely evaluated. Taking into account rising inclination for flexo process pre-press work, this organization is ready for brilliant possibilities ahead. Financial backers might stop assets for the medium to long haul rewards.