Brisk Technovision Limited IPO subscription status

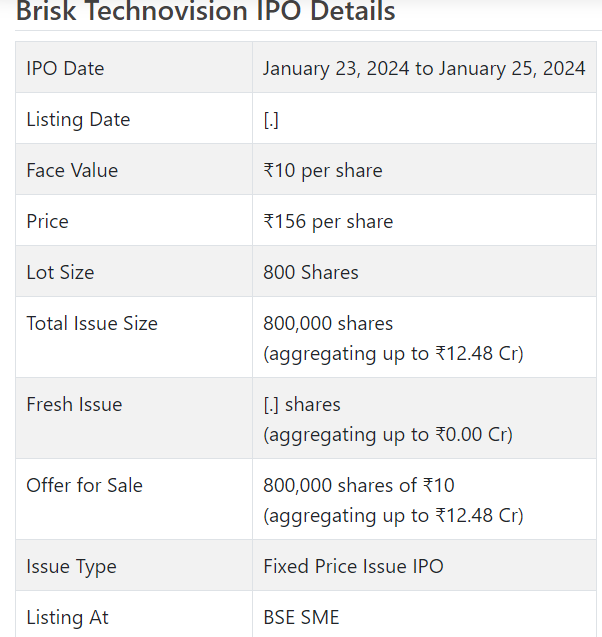

Energetic Technovision Initial public offering is a proper value issue of Rs 12.48 crores. The issue involves new issue of Rs 0.00 crore and make available for purchase of 8 lakh shares.

Energetic Technovision Initial public offering opens for membership on January 23, 2024 and closes on January 25, 2024. The assignment for the Energetic Technovision Initial public offering is supposed to be concluded on Monday, January 29, 2024. Energetic Technovision Initial public offering will list on BSE SME with conditional posting date fixed as Wednesday, January 31, 2024.

Energetic Technovision Initial public offering cost is ₹156 per share. The base part size for an application is 800 Offers. The base measure of speculation expected by retail financial backers is ₹124,800. The base part size speculation for HNI is 2 parcels (1,600 offers) adding up to ₹249,600.

• BTL is occupied with giving IT answers for its clients.

• It is working in an exceptionally cutthroat and divided section.

• The organization has posted irregularity in its top line for the revealed periods.

• The unexpected lift in primary concerns throughout the previous year and a half’s raises worry over its maintainability.

• There is no damage in skirting this expensive OFS.

ABOUT Organization:

Energetic Technovision Ltd. (BTL) is participated occupied with giving data innovation answers for corporate clients. The essential business of the Organization is (a) to give different outsider equipment items, for example, servers, work areas, PCs and PCs as well as (b) outsider programming to Indian corporate clients.

It likewise offers other assistance contributions, which incorporates administrations connecting with configuration, supply and establishment of server farms, undertaking organizing the board, email the executives, framework mix and yearly upkeep contract (AMC) for equipment and framework support, checking and oversaw administrations. In the last three monetary years, it has started to zero in on offering a greater amount of administration contributions. As of now, predominately its business (the two Deals of Products and Deals of Administrations) is in province of Maharashtra. As of November 30, 2023, it had 119 workers on its finance.

ISSUE Subtleties/CAPITAL HISTORY:

The organization is emerging with a lady optional Initial public offering of 800000 value portions of Rs. 10 each at a decent cost of Rs. 156 for every offer to activate Rs. 12.48 cr. The issue opens for membership on January 22, 2024, and will close on January 24, 2024. The base application to be made is for 800 offers and in products subsequently, from there on. Post apportioning, offers will be recorded on BSE SME. The issue is 40% of the post-Initial public offering settled up capital of the organization. It is spending Rs. 2.35 cr. (18.86%) for this Initial public offering process. This being an unadulterated Proposal available to be purchased (OFS) issue, no assets will organization. The issue is being made to give halfway exit to advertisers and to open posting benefits. Higher spending shows completely organized method of this Initial public offering.

The issue is exclusively lead overseen by Sun Capital Warning Administrations Pvt. Ltd. what’s more, KFin Advancements Ltd. is the recorder of the issue. NNM Protections Pvt. Ltd. is the market producer for the organization.

The organization has given whole value capital at standard worth up until this point. It has additionally given extra offers in the proportion of 199 for 1 in Walk 2022. The typical expense of obtaining of offers by the advertisers/selling partners is Rs. 0.05 per share.

This being an unadulterated optional issue, its settled up capital will stay same at 2.00 cr. In view of the Initial public offering estimating, the organization is searching for a market cap of Rs. 31.20 cr.

Monetary Execution:

On the monetary execution front, for the last three fiscals, the organization has posted an all out pay/net benefits of Rs. 16.91 cr. /Rs. 0.15 cr. (FY21), Rs. 22.08 cr. /Rs. 1.10 cr. (FY22), and Rs. 18.40 cr. /Rs. 1.99 cr. (FY23). For H1 of FY24 finished on September 30, 2023, it procured a net benefit of Rs. 1.53 cr. on a complete pay of Rs. 15.77 cr. In this way while its top line checked vacillations, its primary concern posted development and specifically help in H1 of FY24 for top and primary concerns cause a stir and the worry over the supportability proceeding.

For the last three fiscals, the organization has revealed a normal EPS of Rs. 6.92 and a normal RoNW of 33.87%. The issue is estimated at a P/BV of 4.95 in light of its NAV of Rs. 31.55 as of September 30, 2023 as well as on the post-Initial public offering premise.

On the off chance that we characteristic annualized super income for FY24 to the post-Initial public offering settled up capital of the organization, then, at that point, the asking cost is at a P/E of 10.23 and in view of FY23 income, P/E remains at 15.68. Subsequently the issue seems is completely estimated.

The organization has posted PAT edges of 0.86% (FY21), 4.97% (FY22), 10.86% (FY23), 9.73% (H1-FY24), and RoCE edges of 15.64%,47.77%, 54.71%, 32.32% separately for the alluded periods.

Profit Strategy:

The organization announced 14% break profit for FY23. It has previously taken on a profit strategy in light of its monetary exhibition and future possibilities, in September 2022.

Examination WITH Recorded Companions:

According to the proposition record, the organization has no recorded companions to contrast and.

Trader BANKER’S History:

This is the second command from Sun Capital in the last two fiscals. The main posting that occurred so far was at a higher cost than expected of 5% on the posting date.