Blue Jet Healthcare Limited IPO

Blue Stream Medical services Initial public offering is a book fabricated issue of Rs 840.27 crores. The issue is completely a proposal available to be purchased of 2.43 crore shares.

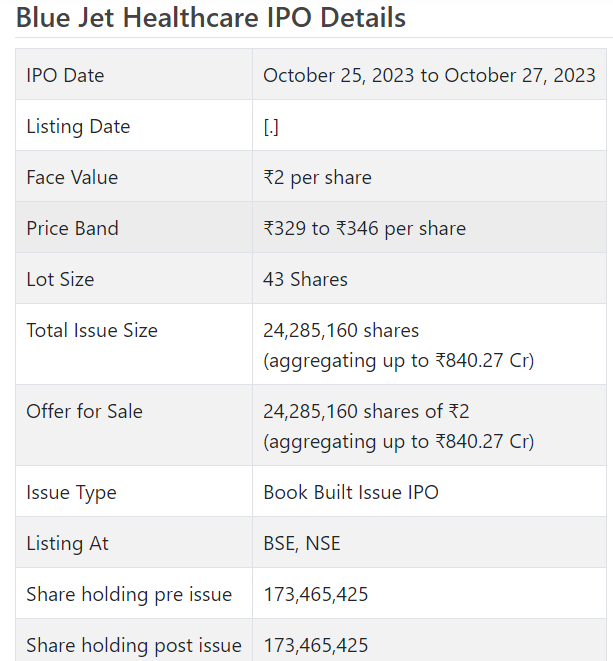

Blue Stream Medical services Initial public offering opens for membership on October 25, 2023 and closes on October 27, 2023. The apportioning for the Blue Fly Medical care Initial public offering is supposed to be concluded on Wednesday, November 1, 2023. Blue Fly Medical services Initial public offering will list on BSE, NSE with provisional posting date fixed as Monday, November 6, 2023.

Blue Fly Medical care Initial public offering cost band is set at ₹329 to ₹346 per share. The base part size for an application is 43 Offers. The base measure of speculation expected by retail financial backers is ₹14,878. The base part size speculation for SNII is 14 parcels (602 offers), adding up to ₹208,292, and for BNII, it is 68 parcels (2,924 offers), adding up to ₹1,011,704.

• BJHL is having specialty items with long haul relationship with prime clients.

• The issue is simply an optional proposition and it is searching for posting gains.

• However its top line posted development, its primary concern stamped irregularity in the midst of variances in the unrefined substance costs.

• In light of FY24 annualized profit, at first sight the issue shows up completely estimated.

• Post posting, it might bring first mover extravagant among financial backers in all cases.

• Financial backers might stop supports in this lengthy race horse for medium to long haul rewards.

ABOUT Organization:

Blue Fly Medical services Ltd. (BJHL) is a specialty drug and medical care fixings and intermediates organization, offering specialty items designated toward trend-setter drug organizations and worldwide conventional drug organizations. Since its fuse in 1968, it had laid out an agreement improvement and assembling association (“CDMO”) plan of action with particular science capacities conversely, media intermediates and extreme focus sugars, on the rear of vital and early interests in innovative work (“Research and development”) and assembling framework.

The organization has skills and assembling capacities interestingly, media intermediates and extreme focus sugars, including saccharin and its salts. It fabricates a scope of items in-house, including the vital beginning middle of the road and high level intermediates, which permits it to control creation process for reliable quality and cost viability. In the beyond three Monetary Years and the three months finished June 30, 2023, the organization invoiced a sum of in excess of 400 clients in 39 nations. It has constructed a drawn out client base with trailblazer drug organizations and worldwide nonexclusive drug organizations, upheld by committed long term agreements of as long as five years.

BJHL’s activities are principally coordinated in three item classifications: (I) contrast media intermediates, (ii) focused energy sugars, and (iii) pharma intermediates and dynamic drug fixings (“APIs”). Saccharin is fundamentally utilized in table-top sugars, oral consideration items like toothpastes and mouthwashes, refreshments (essentially soda pops), confectionary items (like mints, confections, and bread kitchen items), drug items, food enhancements and creature takes care of. (Source: IQVIA Report). The oral consideration market is sensibly thought, with the main five players (Colgate, Delegate and Bet, Johnson and Johnson, Unilever and Glaxo-Smith Kline) telling almost 60% of the market in total. (Source: IQVIA Report).

Because of the reliable nature of extreme focus sugars, BJHL has become piece of the select provider base of a few global organizations in the oral consideration and non-cocktail markets, like Colgate Palmolive (India) Restricted, Unilever, Primeval US LLC, and MMAG Co. Ltd, and numerous other global and homegrown clients across all finished result classes. The organization presently work three assembling offices, which are situated in Shahad (Unit I), Abernathy (Unit II) and Mahad (Unit III) in the territory of Maharashtra, India, with a yearly introduced limit of 200.60 KL, 607.30 KL and 213.00 KL, separately, as of June 30, 2023. As of the said date, it had 407 representatives on its finance.

As per the administration, their top line has 85% worldwide income and 15% homegrown, post development, this proportion will be to a great extent kept up with a significant push for trades. Its arrangements for de-bottlenecking of limit usages is a continuous cycle. Unrefined substance costs changes caused ups and down for primary concerns, yet the administration is sure of keeping up with the patterns going ahead with high edge item blend.

ISSUE Subtleties/CAPITAL HISTORY:

The organization is emerging with its lady auxiliary proposal of 24285160 value portions of Rs. 2 each via Offer for Sale(OFS). The organization has declared a value band of Rs. 329 – Rs. 346 for each offer and ponders preparing Rs. 840.27 cr. at the upper cap. The issue opens for membership on October 25, 2023, and will close on October 27, 2023. The base application to be made is for 43 offers and in products subsequently, from that point. Post apportioning, offers will be recorded on BSE and NSE. The issue comprises 14.00% of the post-Initial public offering settled up capital of the organization. This being an unadulterated OFS no assets are gotten by the organization. The object of the OFS is to give exit to a portion of its partners and open the posting gains.

The organization has distributed note over half for QIBs, at the very least 15% for HNIs and at the very least 35% for Retail financial backers.

The joint Book Running Lead Directors (BRLMs) to this issue are Kotak Mahindra Capital Co. Ltd., ICICI Protections Ltd., and J. P. Morgan India Pvt. Ltd. while Connection Intime India Pvt. Ltd. is the recorder of the issue.

Having given introductory value shares at standard, the organization gave further value shares at Rs. 10 (in view of FV of Rs. 2 for every offer) in February 2012. It has likewise given extra offers in the proportion of 5 for 2 in February 2022. The typical expense of securing of offers by the advertisers/selling partners is Rs. Nothing, Rs. 0.03, and Rs. 1.91 per share.

As this is an optional deal, the post-Initial public offering settled up capital of the organization will stay same at Rs. 34.69 cr. In view of the upper cap of Initial public offering cost band, the organization is searching for a market cap of Rs. 6001.90 cr.

Monetary Execution:

On the monetary execution front, for the last three fiscals, BJHL has posted all out pay/net benefit of Rs. 507.81 cr. /Rs. 135.79 cr. (FT21), Rs. 702.88 cr. /Rs. 181.59 cr. (FY22), Rs. 744.94 cr. /Rs. 160.03 cr. (FY23). For Q1 of FY24 finished on June 30, 2023, it procured a net benefit of Rs. 44.12 cr. on an all out pay of Rs. 184.60 cr.

For the last three fiscals, the organization has revealed a normal EPS of Rs. 9.44 and a normal RoNW of 30.01%. The issue is evaluated at a P/BV of 8.27 in light of its NAV of Rs. 41.83 as of June 30, 2023, as well as on post-Initial public offering premise.

On the off chance that we quality annualized income for FY24 on the post-Initial public offering value capital, then the asking cost is at a P/E of 34.02.

For the detailed periods, the organization has posted PAT edges of 27.22% (FY21), 26.57% (FY22), 22.20% (FY23), and 24.57% (Q1-FY24), and RoCE of 7.97%, 6.67%, 31.91%, and 49.70% for the relating past periods. This demonstrates a tension on its PAT edges for FY21 to FY23, which is credited to wild variances in its natural substance costs. Things have begun settling and the organization is sure of keeping up with the development as shown by Q1 of FY24.

Profit Strategy:

For FY21 to FY23 it delivered a profit of 0.10% on inclination shares yet there was no profit on the value shares for the revealed times of the proposition record. It has supported a conventional profit strategy in light of its monetary exhibition and future possibilities in June 2022.

Correlation WITH Recorded Friends:

According to the deal report, the organization has no recorded companions to contrast and.

Dealer BANKER’S History:

The three BRLMs related with this issue have taken care of 61 Initial public offerings over the most recent three years out of which 20 Initial public offerings shut beneath the issue cost on the posting day.