Bank Nifty and Nifty Prediction for Wednesday 25 Oct 2023

Indian value benchmarks finished pointedly lower on Monday in the midst of frail worldwide signals. The homegrown business sectors shut lower for the fourth sequential day because of a spike in US Depository yields and Center East struggles. All the sectoral files finished lower on Monday with media, PSU Bank, and Metal areas falling the most.

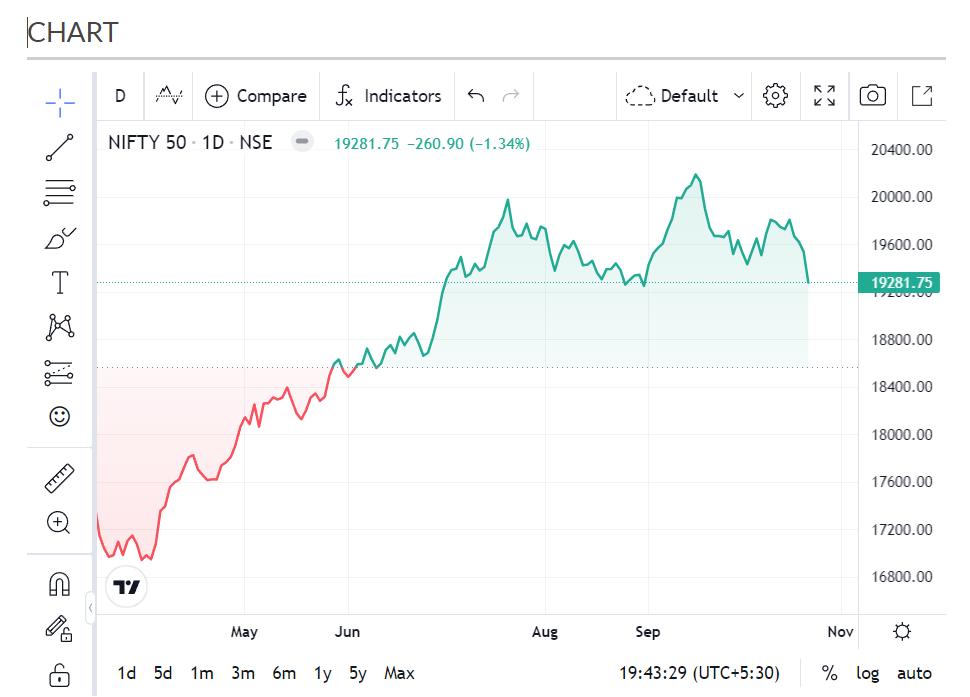

The market expansiveness was negative, on the NSE 297 offers were progressed while 2195 offers declined on Monday. The more extensive business sectors failed to meet expectations the bleeding edge list, as the Nifty mid and smallcap records fell forcefully by 2.66 percent and 3.59 percent individually. At the nearby, Sensex and Nifty declined 1.26 percent and 1.34 percent separately.

Nifty and Nifty Bank Futures Price Movement

On Monday, October 23, the Nifty fates (Oct Series) opened at the 19520 level, it made a negative opening of 7.85 focuses from the past close. It contacted an intraday high at 19543.05 and a day’s low at 19241.15

The Nifty future has made a development of 301.5 focuses on Monday. Eventually, it shut lower by 264.95 focuses or 1.36 percent and finished at 19262.90 levels.

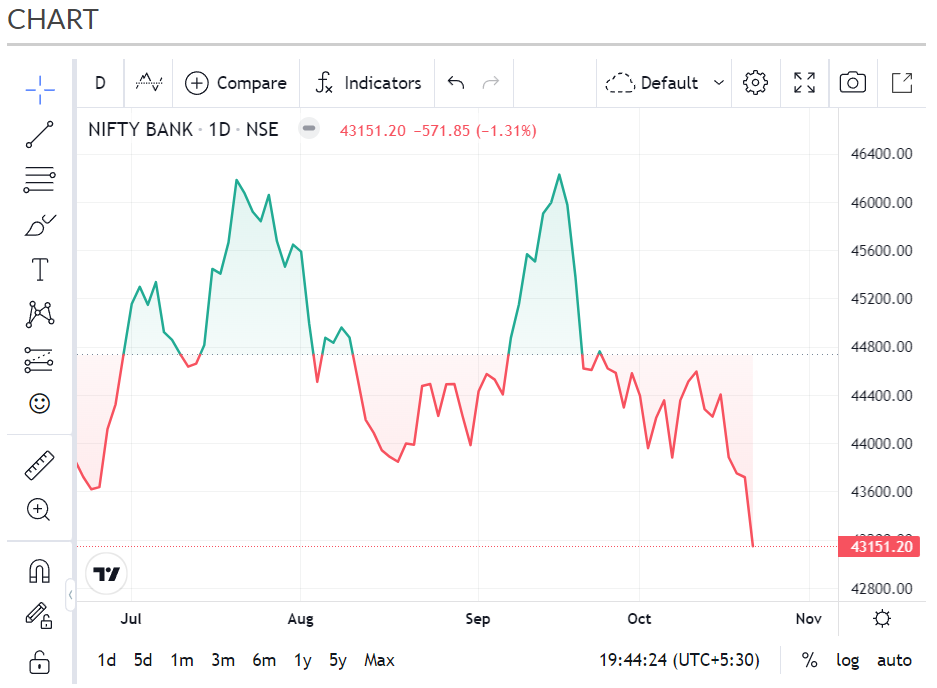

The Bank Nifty fates (Oct Series) opened at 43790 levels on Monday. It made a hole down opening of 51.95 places. It has contacted an intraday high at 43839.80 and a day’s low at 42996.80

On Monday, the Bank Nifty fates gave a development of 843 places. At the nearby, Bank Nifty Future completed lower by 600.45 focuses or 1.37 percent and finished at 43138.30 levels.

Nifty Futures Prediction for Wednesday 25 Oct, 2023

Essential Nifty Pattern in Prospects: Negative

Range-Bound Pattern of Nifty Prospects: All Up Moves can start Benefit Booking @ 19300 though Generally Down Moves can start Short Covering @ 19150.

In the event that the Nifty fates share cost moves over 19330 and supports. Then, at that point, it can contact 19370 during the day with a Stop Deficiency of 19305. During the day it can exchange the scope of 19370-19395-19430.

In the event that the Nifty fates share cost moves under 19230 and is supported. Then, at that point, it can contact 19205 during the day with a Stop Deficiency of 19255 and can exchange the scope of 19205-19180-19154.

Bank Nifty Futures Prediction for Wednesday 25 Oct 2023

Essential Pattern of Bank Nifty Fates: Negative

Range-Bound Pattern of Bank Nifty Future: All Up Moves can start benefit Booking @ 43300, though Generally Down Moves can Start Short Covering @ 42800.

Assume the Bank Nifty fates move over 43320 and maintain, then, at that point, it can contact 43400 with a Stop Deficiency of 43250. During the day it can exchange a scope of 43400-43475-43550.

In the event that the Bank Nifty fates move under 43060 and support, the record can contact 42920 with a Stop Deficiency of 43140. During the day it can exchange the scope of 42920-42825-42740.

Global Stock Market Updates

Asian significant securities exchange lists fell pointedly again on Monday as the circumstance in the Center East heightened and the likelihood of higher loan fees for quite a while likewise hosed the financial backer’s temperament. Securities are additionally under tension as the US-year Depository yields hit above 5% pushing getting costs up across the globe and testing value valuation.

European securities exchanges are exchanging lower as financial backers keep on checking monetary and international vulnerability. Financial backers stay mindful in front of the more corporate profit and European National Bank loan cost choice. The US future records are exchanging lower, showing a negative opening for the US markets on Monday. You can likewise peruse US showcases live updates at 10 p.m. IST.