Bank Nifty and Nifty Prediction for Tomorrow Sept 15, 2023

Indian value benchmarks finished the unpredictable meeting with minor additions on Thursday. The homegrown market opinions stay positive following additions from Asian business sectors. In the mean time, the new information delivered on Thursday showed that India’s WPI expansion remained under no on a yearly reason for the fifth time in succession.

Among the areas, Clever PSU Bank, Metal, and Realty areas acquired the most while the Media and FMCG areas were feeling the squeeze. The market expansiveness was major areas of strength for very. On the NSE, 1502 offers were progressed while 537 offers declined at the nearby. The NSE unpredictability record “India VIX” slipped 4.31 percent to the 11.32 level.

At the nearby, Sensex progressed 52.01 focuses or 0.08 percent and finished at 67519 levels while Clever acquired 33.10 places or 0.16 percent and settled at 20103.10 levels. The more extensive business sectors beat the benchmarks, as Clever mid and smallcap lists bounced 1.17 percent and 1.31 percent separately.

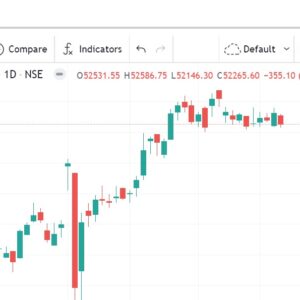

Nifty50 chart

Nifty and Bank Nifty Futures Price Movement

The Nifty fates cost opened at 20150, making a positive opening of 24.85 focuses on Thursday. It has contacted an intraday high of 20204.95 and a day’s low of 20095

The Nidty fates cost has given a development of 109.95 focuses during the day. Eventually, it shut higher by 61.45 focuses or 0.31 percent and finished at 20186.60 levels.

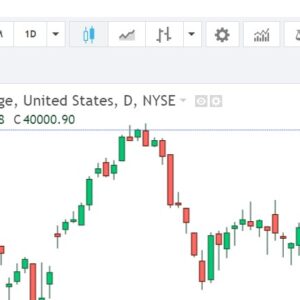

The Bank Clever fates opened at 46041.95. It made a positive opening of 40.01 places. The Bank Nifty fates contacted an intraday high at 46210 and a day’s low at 45874.

During the day, the Bank Nifty prospects have given a development of 336 places. Eventually, it shut higher by 96.15 focuses or 0.21 percent and shut down at 46098 levels.

Nifty Futures Prediction for Tomorrow Sept 15, 2023

Essential Pattern in Nifty Fates: Positive

Range-Bound Pattern of Nifty Fates: All up Moves can start benefit Booking @ 20250 though Generally Down Moves can Start Short Covering @ 20130

Assuming Nifty fates for the Sept series move over 20207 and support. Then Nifty prospects can contact 20235 during the day with a Stop Deficiency of 20185. In a day it could exchange a scope of 20235-20260-20285 levels.

In the event that the Clever prospects (Sept Series) share value Moves Under 20158 and is maintained. Then Nifty prospects can contact 20132 levels for the day with a Stop Deficiency of 20170. In a day it could exchange for the objective of 20132-20100 – 20070 level.

Bank Nifty Futures Prediction for Tomorrow Sept 15, 2023

Essential Pattern in Bank Nifty Fates Positive

Range-Bound Pattern of Bank Nifty Future: All up Moves can Start Benefit Booking @ 46350 though Generally Down Moves can Start Short Covering @ 45900

Assume the Sept series Bank Clever fates move over 46235 and support, then, at that point, Banknifty can contact 46330 levels during the day with a Stop Deficiency of 45160. During the day Bank Nifty fates could exchange the scope of 46330-46415-46520 levels.

In the event that the Bank Nifty prospects (Sept Series) move under 46020 and maintain, Banknifty can contact 45930 levels in a day with a Stop Deficiency of 46090. During the day Bank Nifty fates could exchange the scope of 45930-45850-45760 levels.

BANK NIFTY CHART

Global Stock Market Updates

The other Asian financial exchanges finished higher on Thursday, even after the US expansion rate came surprisingly high in August, as financial backers expected that the Central bank would leave loan costs unaltered in the following week’s gathering. In the interim, the EU test into Chinese state appropriations for its electric vehicle producers littly affected China’s business sectors, China’s auto file fell pointedly yet later pared the greater part of its initial misfortunes.

Individuals’ Bank of China (PBOC) has declared to cut the hold necessity proportion (RRR) for all banks by 25 premise focuses from Sept.15. The news came after the market hours on Thursday.

Japan’s Nikkei made a sharp convention in front of the Bank of Japan strategy meeting one week from now. South Korea’s Kospi broadened its initial gains and finished on areas of strength for a. Australia’s S&P/ASX 200 finished higher, as the joblessness rate delivered on Thursday was according to examiner’s evaluations.

Hang Seng acquired as of now, while the Shanghai record finished simply over the level line. Somewhere else, Waterways Times, SET Composite, Jakarta, and Taiwan likewise finished higher on Thursday.

European financial exchange records are exchanging higher in front of the European National Bank loan fee choice later in the day. Auto stocks are exchanging lower, as starting hopefulness over an EU Test into Chinese electric vehicle sponsorships soured over fears of retaliatory activity.

The US future lists, Dow and Nasdaq fates are exchanging higher demonstrating a higher opening for the US showcases today. In the US, the Maker Cost and Retail Deals information will be delivered today. You can likewise follow our US markets Report at 10 PM IST.