Bank Nifty and Nifty Prediction for Tomorrow, 27 February 2024

ndian financial exchange records shut lower for the second consecutive meeting on Monday. The homegrown business sectors opened somewhat bad following blended worldwide signs and broadened misfortunes. The value benchmarks attempted to eradicate their misfortunes in the final part yet selling strain in IT, Metal, and Banks hauled down the business sectors. Nonetheless, some purchasing was seen in the Energy and Auto counters.

The market broadness was negative. On the NSE 1045 offers rose, while 1552 offers declined at the nearby. The NSE’s unpredictability file “India VIX” hopped 4.19% to 15.60.

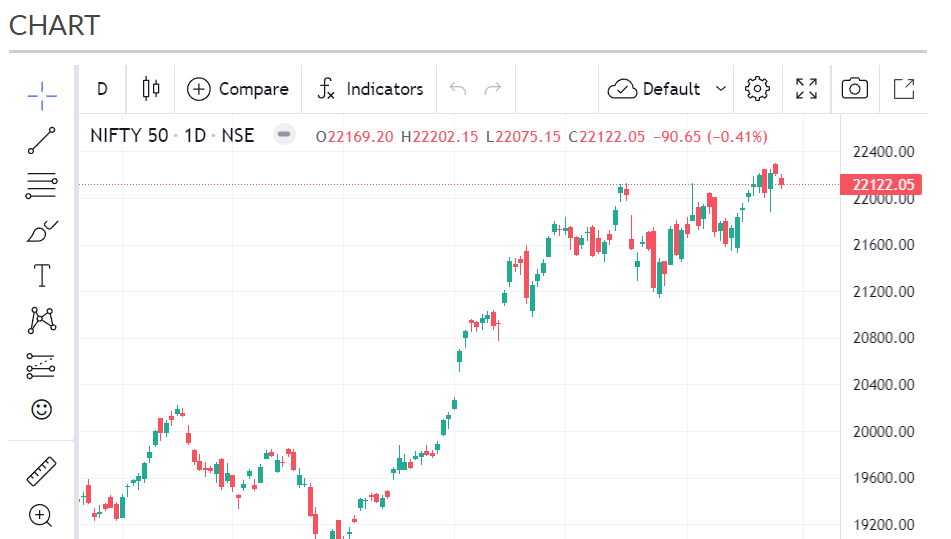

The more extensive business sectors additionally declined practically in accordance with their bigger friends, as Clever mid and smallcap files shut lower by 0.36% and 0.26% separately. Eventually, Sensex was somewhere near 352.66 focuses or 0.48% and shut down at 72790.14, while Clever fell 90.65 places or 0.41% and settled at 22122.05.

Nifty and Bank Nifty Futures Price Movement

The Nifty prospects cost for the February 29 expiry opened at 22195 making a negative opening of 33.85 focuses on Monday. It has contacted an intraday high of 22230.60 and a day’s low of 22088.

The Nifty prospects cost has given an intraday development of 142.6 places. Eventually, the Nifty prospects shut lower by 90.50 focuses or 0.41% at 22138.35 levels.

The Bank Nifty prospects for the February 29 expiry opened at 46694.70. It made a lower opening of 147.95 focuses on Monday. The Bank Nifty prospects contacted an intraday high at 46934.60 and a day’s low at 46526.

During the day, the Bank Nifty prospects have given a development of 408.6 places. Eventually, Bank Nifty Prospects shut lower by 267.65 focuses or 0.57 percent and shut down at 46575 levels.

Nifty Futures Prediction for Tomorrow, 27 Feb 2024

Essential Pattern in Nifty Fates: Positive

Range-Bound Pattern: All up Moves can start benefit Booking @ 22230 though Generally Down Moves can Start Short Covering @ 22020

Assume the Nifty fates move over 22185 and support. Then, at that point, the Clever file can exchange a scope of 22224-22265-22311 levels during the day.

In the event that the Nifty fates share cost moves under 22090 and is supported. Then, at that point, the record prospects can exchange a scope of 22058-22018-21980 levels during the day.

Bank Nifty Futures Prediction for Tomorrow, 27 Feb 2024

Essential Pattern in Bank Nifty Prospects Positive

Range-Bound Pattern of Bank Niftyr Future: All up moves can Start Benefit Booking @ 46950 while Generally down moves can Start Short Covering @ 46400

Assume the Bank Nifty prospects move over 46740 and support, then, at that point, the record can exchange the scope of 46825-46885-46950 levels during the day.

On the off chance that the Bank Nifty prospects move under 46470 and maintain, the record can exchange the scope of 46405-46290-46150 levels during the day.

Global Stock Market Updates

The other Asian financial exchange records generally started the week in a critical mode on Monday because of blurring idealism over China’s recuperation and defer in the US loan cost cut. Financial backers stayed mindful in front of the expansion information from the US, Japan, and Europe in the not so distant future for greater lucidity on loan cost choices.

Nikkei 225 hit a new record high as Dealers in Japan returned in the wake of a difficult end of the week. China’s Shanghai file snapped a 9-day series of wins and shut lower, while Hang Seng likewise finished lower on Monday.

Somewhere else, the Kospi list, Waterways Times, SET Composite, and Jakarta Composite shut bleeding cash, while Taiwan and Australia’s S&P ASX 200 shut marginally higher.

European financial exchange files are exchanging imperceptibly lower on Monday following the negative signals from Asian market peers. The UK’s housebuilding stocks fall on the rear of the test from the Opposition and Markets Authority. Financial backers are looking forward to the expansion information not long from now for greater lucidity on loan fee moves.